Is Now a Good Time to Buy a House

Is Now a Good Time to Buy a House

Video https://youtu.be/Dlmmfj3shW0

Podcast https://anchor.fm/siliconvalleyliving/episodes/Is-Now-a-Good-Time-to-Buy-a-House-e1r42ea

Blog http://blog.abitano.com/2022/11/is-now-good-time-to-buy-house.html

Is Now a Good Time to Buy a House

All right, so a lot of people are asking me, is this a good time to buy? And it depends on your circumstances, and mostly it's, yes, everybody's freaking out because the rates are going so high and houses are staying on the market for so long, and it's a fact. We're headed into a recession. People tend to forget the fact that in recessions house prices actually continue to move upwards or in an upward trajectory, and it could be a half a percent, it could be even more.

The last time we went into a massive recession or depression was the Great Depression or whatever it's called, 2008, 2009, 2010. So it means buyers are still out there. There's still a lot of buyers. As a matter of fact, there's more buyers on the fence today than there were six months ago. Seven months ago, in April, there were 17 offers for every house on the market, and now there's 17 houses for every buyer.

So buyers can be picky, right? What's gonna happen when the market comes back? Then you hit 17 buyers. House again and the competition comes back. What we're seeing right now is unprecedented, especially here in Silicon Valley. I'm gonna go look at my sheet real quick so I can do it When the market collapses and guys, I talk about this stuff in my live videos all the time.

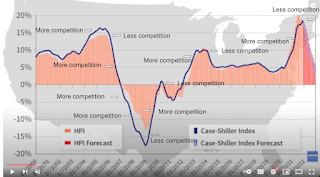

I bring this chart amazing, like so many times that it's almost redundant for me to bring it up. But I think it's important that we have this discussion because at the end of the day, when you are looking at buying a house, You're a renter right now, it's, your thoughts are, I can't afford a 7% mortgage.

I just, it's, I can't, it doesn't make sense. But understand that rents are gonna continue to go up. You might be sheltered in your little place, but what happens if your landlord says, Hey, I'm selling a house. You need to move out. This is where it's actually a good time for you, because there's less buyers in the market.

17 houses per by. That's an erroneous number. Actually, a factual number. There's more competition when the market's hot or when the market's going crazy down. But right now we're at a peak or a plateau saying, Hey, the market's just sitting here. We're sitting on the market not really knowing what's going on.

So I tell my people, yes, this is a great time to buy and you're not gonna get the best price when the market crashes or if the market ever crashes. , right? But you're gonna be able to do a lot of different things, a lot of different concessions, a lot. You're gonna be able to ask for a lower sales price or concessions, and we'll go into that in a minute.

But you look at this graph, and frankly, when the market is hot, there's so much competition that you're paying three, four, $500,000 over list price, which people got tired of, and they were just, With the whole market. I've seen people just walk away or they just continue to do it and then they're like, you know what?

I'm gonna take a break cause I'm exhausted. I'm gonna wait for the market to change. Well, the market's changed and those buyers are still sitting on the fence because the interest rates are going high and prices haven't really come down and I don't see the prices coming down so much. But you're like veto what?

Ha. The market's already contracted a little bit. I agree. And if you look at this Fred Median sales price house sold for the United States, right there on the back, on the far. Part of the slide, you see the market value price, just shoot right up. And that's an unnatural shooting up because we had unnaturally low interest rates for a long time.

We had the great refinance boom of our history, and people made a ton of money. Lenders made a ton of money. We made a ton of money. Buyers bought in and they saw their values go up. Guess what? The equilibrium is gonna come back down to normal. Which is about 15, 16% depending on where you are. In San Jose, it was 22% for a while, including the uptick.

So that's not a natural number. When you see what's going on right now, rates are going higher because short term money is being taxed so that we can tackle inflation. It's the same thing that's happening in the real estate market. There's still a ton of houses out there. We have so many houses on the market, right?

They're just sitting there. Sellers are getting frustrated or they're just gonna take it off, but they're not gonna go down any further in their head. Those are called Wish price sellers. They want their April, 2022 price, which the times have changed. Markets changed like the wind does when you're sailing.

You just have to be able to read it and work with it. Your house may have been worth $2 million in April, but now it's worth 1.7 to one point. And it could go a little bit lower. I don't see that being a crash in the market. I think that's an equalization of the natural inflation of real estate. So that unnatural bump that you saw in that chart, you're gonna see that those values come back down a little bit to get back to that.

Red line, and it could be 20%, right? If we went to 20%, you're gonna be around right about here, but you're not gonna get the April 22 numbers until five, 10 years down the road. So keep that in mind. All right. So I wanted to talk to you about this little story. One of another agent just sent out this story, and I wanna read it to you.

I'm gonna paraphrase it because. Horrible reader. So a buyer came up to an agent and said, Hey, let's go buy a house. I'm looking for about $3 million time for price range, which in Vegas, that's $600,000 in Florida, that million, it's crazy. And it's, I wanna say Willow Glen. Almaden Los Gatos. Those are 3 million homes today.

That's kind of where it is, but even there, we're seeing my prices stabilize and houses stay on the market, and this agent goes, yeah, let's go out and find you a great deal. The Bay Area, there's 3,700 active homes. I've been on the market for over 60 days and 23 active homes that have been on market over 90 days and 1,430.

Homes that have been on market over 120 days and just this month we've had 1500 listings expire and withdraw, which means, and I've been telling you this in my life, a whole bunch, right? I, if you watch my lives, you're gonna see this. I do lives every Wednesday at noon. Pst, which goes to show the market has slowed down a bit.

Houses are still. Guys houses are still selling. And I tell my agents, go do open houses on the west side of Silicon Valley. People over there have a whole lot more money than people over here where we're, I'm not saying we're blue collar, but we're more blue collar. We can't afford to spend $3 million on a house.

So go and work that area over there and find a couple deals and you're gonna be quite pleasantly happy. So they're talking about this one house they went and saw it's been on market. For 14 days listed at $3 million and the client was saying, Hey, let's go. I want to come back down on price. And this listing, the selling agent was like, yeah, no problem, let's do that.

So they went in at 18 days at 2.75. So two and three cores, $250,000 less. Than the less price. And because it is on market a lot longer than normal, the market's slowing down. Some people say it's shifted, but I've always said it was corrected. It's in a correction. We're definitely in a correction. So the sellers counted at 3.35.

So 350,000 over at the original list price, which counterintuitive the client countered at 2.85, so they went up a hundred thousand dollars, crack it, come back in, and sellers came back at 3.25. So they came down to a hundred thousand and then he said, let's sit. On this for a little while. Let's see what happens.

You don't, you're not in a hurry to buy, are you? The rates are going up. We can work with that too. Don't worry about that. That's, let's talk that out of the way. So they come back like a week or a week and a half later and they say, okay, you know what my, my sellers are willing to go at the list price.

They're like, Nope, we're okay. Thank you very much. So the seller came down from what their expected mindset, which was April pricing at 3.35 all the way down. Within two weeks of having an offer down to 3 million, the actual list price, that's $350,000 offer their perceived value. The week after that, they said the seller came back to the agent and said, Hey, what about three?

Five your counter . They're like, no, you know what? It's been over a week. We were working with you. We were willing to do it a week ago, but that was a two day offer submitted, and you let that go. So now we're back at 2.7 point seller. Begrudgingly said the sellers, the listing agent said, okay, send us the counter, and we'll set that up.

So they sent out a counter and put a two hour timeframe on it, and the sellers accepted it. Not every seller is going to be willing to do that. Remember, we just said 1500 homes have been expired over the last month. Which is crazy, right? But that's Bay area wide, right? My numbers that I look at on the live are a lot less, cause we're just focused in San Jose proper single family homes, three bedrooms or more, and 2 million and less.

And that just happens to be my numbers that I'm looking at, kept it that way. That's my baseline so that we understand where we are, what the market. So now it's closed, everything's going on. Some other things you can actually add into this is all the rates gone up. You made me wait another week, the rates went up, another half a percent.

I'm not gonna be willing to pay for that. So I want you to pay me back some points to bring that back down to my rate that I have in my, that's called buying the rate down with points. And you can do that. If it's a $2 million, $2 million loan, then you go in at $20,000. That's a point. And yes, that hurts because it goes from your net, goes down $20,000 as a seller.

So buyers are definitely in control. Deals are being had like this all. I go through and talk about the highs and lows I show you in my lives. I show you that we have these different things that are happening. We have the ability to negotiate. Now. Buyers are in the driver's seat. This is a great time to buy.

If you are in that mode, if you need to wait, if you go back to the chart, the orange chart, it goes up and down. If you go back to that up and down, you're gonna wait until the market starts crashing. Guess what? You're gonna be competing with people. You're not gonna get the $250,000 off of a 3 million listing, whatever that ratio is, don't expect that because every seller is different.

Every deal's different. Right? But that's what we're doing today. That's what we're doing to negotiate. We have a listing in Morgan Hill that we're negotiating with right now, and we're going back and forth. We're playing the game. That's how it works, right? When the market crashes, rates come. Values come down, there's gonna be more competition.

So you go from one buyer for 17 houses to 17 buyers for each house. And when the seller has multiple operas, the seller has leverage. Buyers are no longer in the driver's seat. Think about this from a 10 term, you buy a million dollar house Today, I'm not saying this is a future guaranteed or a fortune telling or crystal ball looking, but typically if you look at that 20.

15% increase, your million dollars will double in time, right? Could be 10 years, could be 12 years, could be eight years. Really depend. So keep that in mind today. If your ego says, I have to buy at the rock bottom of the market, good luck on timing that. Because I can't tell you when the bottom of the market's gonna hit.

.jpg)

It could be today, it could be yesterday, it could be 10 months from now. We don't know. Is our prices gonna continue to come down? Yes. But as prices come down, velocity of that price comes down, and when the starts coming down more and more, You have more competition, so keep that in mind. All right. Should you buy a house?

Guys, that's completely up to you. If I'm looking to buy, investment, investors are buying properties right now because they know that this is a great time. The rate right now is just a temporary rate. They know that the values are, the rates are gonna go down eventually, let's say four, 5% eventually. So if they buy today, Five months or even five years down, the road comes down and hey, it goes from 7% down to four and a half.

You're making more money then too, so keep that in mind. If you're thinking about buying a house or selling a house, gimme a call. My name is Vitos Carneia. My number's 4 0 8 7 0 5 6 8 1 7. We'll see out there.

Vito Scarnecchia

Realtor®, Broker, Veteran, Dad

DRE#: 01407676

Website: abitano.com

If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents!

Book appointments here: https://calendly.com/abitano/15min

IG https://www.instagram.com/abitanogroup/

Video Marketing Course for Realtors

.jpg)

Comments

Post a Comment