Time to get your DEAL!!! Rates coming down, Are buyers coming back to buy?

Time to get your DEAL!!! Rates coming down, Are buyers coming back to buy?

Happy Wednesday. Happy almost last day of November. Can you believe how quickly this this year went by? I, it was like, it just has been a flash. It's been just a crazy year of fast forward watching the market kind. Take on a different world of itself or a different life of itself. And yeah, so a lot of reflection to, to come in the next month because next month we're gonna be talking about, going back and appreciating all the appreciation we've seen over the last half decade because it's been hectic and that's really what the whole point is today.

https://youtu.be/MOvXGjpjsso?sub_confirmation=1

blog http://blog.abitano.com/2022/11/time-to-get-your-deal-rates-coming-down.html

I saw a TikTok the other day and what it said was 45% of the homes, oh, before I do that, let me prelude what it is. He said, the market probably won't crash in 2023, and here's the reasons why. And then he gave us four reasons. I actually have a fifth reason for California in case you're looking.

Time to buy?

Or you're thinking about making a move or you're thinking about what have you. But the four reasons was one 45% of the homes don't have a loan on it. They're like free and clear. There's no lie on the property whatsoever. So we had that same thing back in 2008, but what happens next is number two.

97% of the homes that do have loans on it are fixed rate. They're not the toxic. Pick a poll. Pick a pick a pay. That's what was called pick a pay, was option arm where you got to pay interest only fully amortized neg AM or something else. I can't remember. It was so long ago. And, Of those homes that have loans on them are actually their rate, the interest rate's about 3% People, if they're in trouble, they can afford to actually rent it out, do a long term rental.

They can do all sorts of different things with that house. It would be foolish for them to do it because number four. Number four, which is really eye opening, is the average equity in all of those homes. It's about $300,000. That's average right here in California. You'll probably have a little bit more.

You go out in St. Louis or Utah, it's probably a little bit less, but at the same time, you have equity built into that home versus in 2008, right? And number five, which was the bonus thing. Now I'm bringing in, I actually did a TikTok talking about this as well, the. There's 40 million Californians in right now, and there's not enough houses to house everybody.

1 in 5 can afford

It's not because of the house homeless situation, it's the housing affordability situation. One out of five people can't afford to buy a house right now. It makes it really difficult. Makes it really difficult for other people to be able to buy the house. But those one, that 20% they can afford to buy houses, and that's who's buying houses right now.

They're engineers, professionals, executives, those types of people. There's contractors, people that are in the trades. They work hard. They get into, supervisory roles. They can afford to do that. They can buy into the house. What I've been telling everybody over the last week, and that's another segue into this, is the housing market's kind of picking up

You're like, Fido, you just told me to wait. No, I never told you to wait. I never told you. I said, if you could buy, you should buy, because when the market comes back, the buyers are gonna come back in. Drove. And of the last four or five offers that I've written, there's been multiple offers on that house.

And when you're a seller and you only have one house, you have zero leverage. When you have two or more offers on your house, then you have leverage, which is something that we use to help negotiate higher prices, better terms for you as a seller now that the market is coming back. Sellers are back in the control, not every house, right?

So let me open this up real quick.

62% of the offers in Santa Clara County are non-contingent

This right here, this is just last week. On average, it's 62% of the offers in Santa Clara County are non-contingent. Contingent. It means appraisal, loan, property condition, need to sell your house. Those are wave. And they're coming in and buying houses non-contingent. Now, a majority of those I'm sure are homes over on the west side, Cupertino, Palo Alto, Saratoga, Los Gatos.

Those people really don't care because they don't have the, have a problem with rates. So the question is, are the prices leveling off or softening Still? My thoughts are rates came down just a tad bit, six and 6.65 for a conforming rate that's conforming, that's less than what it was, like 800,000 or change whatever.

FHA rules just went up over a million dollars for conforming. And that certain areas, it's still coming out. We're learning those guidelines. So if it's less than a million dollars, it's gonna be about 6.65. We're assume the feds are gonna testify in the next week or so. I don't know when, but their assumption is that we're gonna go up another half, a percentage or a half a basis point 50 basis points, which will increase the rates again up to, over 7%.

As a matter of fact, we're gonna go and talk about this housing prediction market prediction in a minute, but prices might be leveling off. But I think that here in the Silicon Valley, especially Bay Area and metropolitan areas that are financially sound, they're gonna continue to bolster and at least stay at the pricing that we're.

Because we did lose a little bit of money, a little bit of equity depending on where you are. But I think we're gonna see that's going to start staunch or leveling off. , right? I think in March we're gonna see prices, or when I say prices, I pricing for rates, I think we're gonna see five and a half percent.

Rates will end up at 7-7.5

I think we're gonna end up with a year at seven, seven point a half percent, and I think by March time we're gonna see it 5%. By the way, if you're buying a jumbo loan, you're gonna see it come down to as low as five and a half percent. You might have to buy a point, so get it down to five and a half, but that become, Livable and that's what a lot of people are doing.

That's what those people are doing, right? We had how many closings did we have? We had 37 closes last week. Which is not a lot, but we're seeing things come back. Can buyers still qualify? That's the big question. Sometimes it's the buyer thinking, I might not have a job tomorrow.

My job might disappear. But also because rates went up so high, it became less affordable for them to buy that same house that they were looking at back in April. So those buyers are out of the market. We can still work with different programs and buy down rate and make it equitable for you as well as the seller depending on the house.

Our appraisals coming in haven't heard a lot of stories of appraisals not coming in, but there are those situations that are coming in right now. And don't listen to the headlines. Talk to your profess. Even if you don't talk to me, talk to the person you're aware of and that's your realtor, talk to them about what's really going on in the industry, especially in your area.

Your area is a microcosm of the entire housing market, right? So I can tell you straight up Silicon Valley we're doing fairly well when we have 62% offers coming in non-con contingent. So really quick I haven't really digested this. I just saw it. I should have opened it up, but this just came out today.

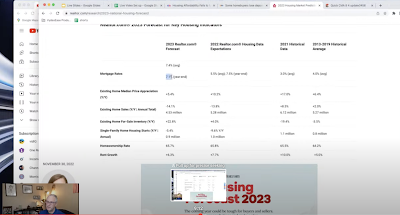

So we're, again, we're seeing 7.4 nonconforming, right? We're seeing 7.1 by the end of the year. So again, we're gonna see the prices spike up again. We saw the prices go up to seven and three, 7.4. Now we're gonna see come back down. But at the end of the day, I think in March timeframe, which is our buying season, March, April, may, we're gonna see you come back down to 5%.

Five and a half. That's the expectation. That's what housing data expectations were throughout the year. But again, you're gonna see jumbos be about five and a half percent. All right. The other thing here, buying power is on the decline. Because the mortgage payment went up about 28%, it made it less affordable for people to be able to buy houses, right?

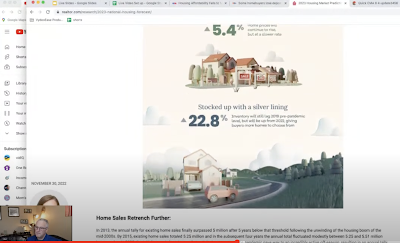

Mortgage rates remained elevated. That's 7.4. That was the average that we're seeing for conforming loans. Not for jumbo still growing, but slow. Home prices will continue to rise, but not at the crazy rates that we were seeing. Inventory is our problem, especially here in California.

There are houses that are staying on market a lot longer, right? I'll show you. 90 days. We haven't had 178 homes on market. 90 days since I started watching this thing. These numbers are still dwindling around 439. Now these aren't every house in San Jose, right? It's residential, three plus bedrooms, less than $2 million, that kind of thing.

Values are holding

And it's not all of San Jose. I thought it was, but it wasn't. It's. And if you look at houses that are active right now, oh wait, this is multiple counties, right? Alameda, Monterey, San Mateo. So this is multiple counties right here. So if you look at San Jose, 346 homes per sale, that's 1.9 homes per square mile.

That includes parks, but at the same time, this is just a way to give us a baseline so you can compare these numbers to other cities and towns. For every thousand people, there's one third of a house, so you need. 3000 people buying for a house, but that's not active. Homeowners looking to buy houses, those are home.

These are residents, of all ages. So overall, we're doing okay. Last year we had 107 closes. This week we only had 37. And going back a month ago, you remember a month ago, rates were. 7.1, 6.88, 7.1. So that related to less home buyers.

Now that rates are coming down, people are like, I'm gonna buy it. I'm gonna buy it now. And then they might not be doing 7.77%, they're probably doing 6%. And then now they're like, holy cow, I could get it for five and a half. Maybe I should refinance. Probably not. Let's see. We're gonna come through all this.

I'm not gonna spend a whole lot of time on this today. Home buyers. Oh yeah, this one pissed me off. This right here. New home buyers are holding new home sellers. The developments are holding buyers. Feet to the fire to say, you have to buy this house or else you're gonna lose your deposit. I've always had problems with new homes.

New Home sellers are screwing buyers

They're just, a lot of their practices are not regulated and they can do whatever they want. They have their own separate purchase contracts, which favor the seller, not the buyer. And, Like in this situation right here this couple right here, put a down payment on a new house, and now that rates went up so high, they can't qualify anymore.

And so the home seller's ah, too bad. We're keeping the deposit.

And I don't know if they have liquidated damages. I don't know that if there's an arbitration clause or what have you, that's why you wanna use a realtor. Cause we have a process to help protect the buyers no matter what. And new host. This is the Home Builders Association saying that they're their market's sucking too.

But if you look at all the national builders right now, they're all hurting. They're giving back options to buy land. All social different things are happening. And this is it right here too, right? It's not because of people don't wanna buy houses, it's just that housing. The affordability's gone.

Sales Volume Down

So 2020 2 21, we saw 6.2 million houses on average. We're seeing about 6 million houses go. There's an estimation that as of year to date is 5 million. We're gonna see a drop in home. Overall. Matter of fact, it says it right here.

Okay? So this is all local market predictions, right? 23 sales growth. This is in volume, the number of units sold versus price growth, right? So we'll go down to San Jose area real quick, minus 28. In volume next year, excuse me, minus 28% in volume. And we're gonna see a little bit of appreciation based on what we saw this year, but if you recall the numbers that we saw right here, were actually back down to about here on average.

This is median across the United States, but if you look at the same chart for just Santa Clara County, it did come back down a little bit. It's very similar to this. So we're at that price point right there. So we did see a contraction mostly on the east side of 1787, but that was expected because. When you have free money for that long, that makes it really hard, right?

By the numbers

For people to look at it. Alright let's go by the numbers. Hang on, let do that real quick.

By the numbers closes last week, 37. Last year is a hundred and. Crazy. So we're at 34% of what we were, our transactions are way down from last year. But that's also cuz supply is drying up. And if you look up here, we still have homeowners that are refusing to acknowledge that the market's come down a little bit, especially if your house is in poor condition, especially if you're overpriced for what the market's.

It's just gonna sit on market. I am still seeing houses sell. I hosted a, an open house last two weekends ago and had 17 buyers or sets of people come through. It was busy. It was busy the entire time. I barely had time to eat my sandwich. It's been crazy. Market's back houses are being. So don't think that it's not happening.

I'm not gonna go through all this other stuff. There's 36 pending transactions last week. These numbers are dwindling down, but their buyers are still out there, right? There might be not big buying here. They might be borrow buying in Morgan Hill. Tampa and one other one. Nashville are the only.

Cities that saw a net increase from last week in supply, everything else is down in supply. But again, this is the holiday season where it is natural progression for us to see a reduction in supply. Because typically what happens, they wait until March, April, may to sell their houses. The sellers will hold off until that timeframe.

Different areas have d. Selling seasons like in San Francisco. I think it's August, September, October is their season. Ours happens to be and always has been. March, April, may. So houses are coming. The supplies coming down. Rates are coming down. Houses are still selling though, right? I'm gonna estimate that it's all about the same numbers here.

So if there's any questions you have. That's probably all I'm gonna talk about today because I've got stuff to do. Let's see. Yeah, so I'm Vito Scarnecchia with Group, powered by Compass. If you have any questions about buying, selling, what have you, we have financial intelligence program coming up.

It's a seminar to help people understand finances from small business to home ownership, to being, like home economics, like learning how to live within your means. If you're interested in that, let us know. We'll see you out there.

Vito Scarnecchia

Realtor®, Broker, Veteran, Dad

DRE#: 01407676

Website: abitano.com

If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents!

Book appointments here: https://calendly.com/abitano/15min

IG https://www.instagram.com/abitanogroup/

FB https://www.facebook.com/vito.scarnecchia/

LI https://www.linkedin.com/in/vito-scarnecchia/

POD https://spotifyanchor-web.app.link/e/oxdH1Hwfcvb

Professional Photography by Kim E https://photosbykime.com/

Compass site: https://www.compass.com/agents/vito-scarnecchia/

VydeoEase.com- Post production service for business marketers.

Video Marketing Course for Realtors

housing market today,housing market crash 2023,housing market update california,housing market update today,housing market update 2022,home prices 2023,housing market 2023,buying a house in 2023,mortgage rates today,housing market forecast next 5 years,home prices dropping 2022,buying a house with high interest rates,housing bubble 2022,huntington beach state park sc,buying a house for the first time 2022,first time home buyers tips and advice 2022

Comments

Post a Comment