🚨 🔴🎧 Citizens Bank becomes the fifth US bank to fail in 2023 | $540,000,000 Winfall for Class Action Lawyer State of the Market SAN JOSE 40DOM. 🦅 🌎 ⚓️

PODCAST HERE

- #REWTF of the Week

- Fraud on the rise http://blog.abitano.com/2023/08/title-theft-is-on-rise-what-is-it-how.html

- Buying a House With Friends

- Federal Reserve leaves its key rate unchanged

- Citizens Bank becomes the fifth US bank to fail in 2023

- $540,000,000 Winfall for Class Action Lawyer

- Financial Intelligence https://docs.google.com/forms/d/e/1FAIpQLSc0R5pjHIAPguZ5GDEB-fTbGJXKpWK3coK9Khymv_GTWkMnyQ/viewform?usp=send_form

- https://bit.ly/AbitanoHomeValuation

- NAR.Realtor Stats. https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales

- https://www.onereal.com/vito-scarnecchia-1

🚨 🔴🎧 Citizens Bank becomes the fifth US bank to fail in 2023 | $540,000,000 Winfall for Class Action Lawyer State of the Market SAN JOSE 40DOM. 🦅 🌎 ⚓️

Happy November 8th election day. Today we're talking about three things, three, three things you need to know about living in Silicon Valley. Today is election day. That's not one of them, but okay, we'll get into that in a second. The feds are keeping the rates the same, buying a house with the same, with a friend and citizen bank collapses.

Let's get moving. All right. First, I want to talk about election day. Go out and vote. Our wonderful republic has not besieged me with its election data. I have no clue what the hell is going on. There wasn't a whole lot of talk about it. I don't know. Did you get anything? I didn't get anything. I didn't get any information about what's going on in our local voting.

So probably not a big deal, but happy election day. R E W T F of the week. Let's get this thing over here. Look at that. Beautiful. Hey, look, recycle. reuse Repurpose god bless this person. All right what do you I mean, how can you either I don't

What do you say to that? Sure. I surely hope I'm recording. So yesterday, by the way, I did the exact same three news articles that we're going to talk about today, but for some reason, my Video didn't record. So you get to hear me talk about the same stuff over and over again. By the way, we're talking about the NAR lawsuit.

So stand by there.

Federal Reserve leaves its key rate unchanged

Federal Reserve leaves the rate unchanged.

I talked a little bit yesterday about the value of having rates high because the supply is just not low enough, high enough to meet demand and pricing is remaining the same. Especially here in Silicon Valley, there are certain areas in the United States in Canada that are seeing slumps and oversupply, like tomorrow we're going to talk about Cape Coral in Austin and Las Vegas.

Those are the canary in the coal mines that we're looking at to make sure that there's no major flat coming our way, but for the most part, Silicon Valley is doing great. People are still buying houses. I have two listings and people are not even on the market right now and people are begging to buy them, holding them off with a stick.

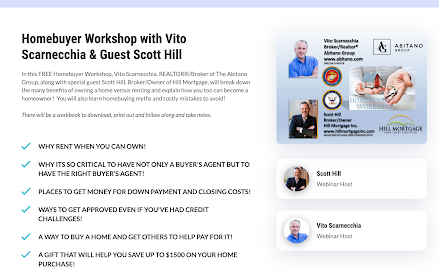

So is this a good thing? Yeah, it's a good thing. We need to keep rates high. Okay. Homebuyers workshop. Sign up if you want.

Citizens Bank becomes the fifth US bank to fail in 2023

Citizens Bank becomes the fifth us bank to fail in 2023. I said it last night. I'll tell you again, do yourself a favor, pull out six months' worth of money, six months, whatever it takes for you to live off of a month.

Multiply it by six because there could be a fiasco and why not have in your bed mattress instead of a bed? You have access to it, etc. I don't know why people are crying that they can't make their mortgage payments because the systems are shutting down. Banks are going to go through a huge change I think of how we're doing business.

It's good. It's actually good. Just like the NAR lawsuit, I think it's really good that's happening in Silicon Valley living

Fraud on the rise http://blog.abitano.com/2023/08/title-theft-is-on-rise-what-is-it-how.html

Title theft is on the ride rise, guys. I talk about this all the time Will it be that somebody comes up and says hey somebody stole my type and still stole my home This type of stuff is happening all the time, especially with elder parents protect yourself protect your friends protect your family watch this video It's 10 minutes It's not that big of a deal to watch it.

It'll help you save some other people. Share it, please.

Buying a House With Friends

Buying a house with friends. You can read this article all the way through. I'll just tell you a quick story about what happened to us. We bought a store before we had kids. A long time ago. Before we had kids. We bought a cabin up in Tahoe with another family.

Thought it was a great idea up until things started happening. We were having fun. We were going up there. We started renting it out. We did VRBO because Airbnb wasn't around at the time. And the first time we rented it out, they stole the renters, the tenants, the whatever short-term tenants stole the VCR.

Willow Glen's five most expensive homes https://youtu.be/3A_E2ck0ePg

And that was even when BCRs were going out of style. What are you going to do? There was broken glass, stolen forks all sorts of stuff. And then we started going to the cabin on our vacation and it became a to-do honey-do list type of thing where I would go and wake up and I would be working on the cabin.

And that wasn't fun. It was fun for a while. It replaced a deck, hard work is fun. But not on your vacation, you should be drinking margaritas and hanging out and swimming and getting suntan and going hiking. It's a different situation. We bought it for the idea that we could offset the payments, have some people rent it out, and then we would have a cabin.

Huber set in and allowed us to realize that you know what, we don't really want to have a second home. We don't need a second home. So we decided we're going to sell it. We had a semi-exit plan. We didn't have a solid, this is exactly every step, of how it was going to happen. There were a lot of assumptions and a lot of pointing fingers and a lot of this and a lot of grudges that were made because we didn't understand how to exit out of a program.

We didn't realize that we would have to fix things and we were out of pocket a lot on this cabin. And that wasn't really the problem. The problem is who's going to fix it? Am I the one that's always going to fix it? Or is the other husband always going to fix it? Or how are we going to do this?

And, for the most part, we did, we got along famously, but if you're buying a house with friends, you got to understand that stuff's going to break and there's going to be maintenance and chores. And especially if you're young, there's going to be grudges that you didn't do the dishes or you didn't take out the garbage.

Whatever. So write things out, and have a concrete plan. Our exit plan was we were going to sell in five years. We didn't talk about who's going to pay what, how much it's going to cost, blah, blah, blah. So there was a lot of misconception. I was in real estate. At the time we decided that we were gonna sell and get our equity out.

And I didn't realize that there are certain costs when you sell a house and this and that. So I had a little bit of, regarded feelings about that. What got over it, there's a lot of things that can happen. Buying with a girlfriend, boyfriend, or a non-spouse. It's just as bad as if you were going to buy it with a husband or a wife if you get divorced.

It's the same thing. The same friends are a little bit different because you can have grudges with them. And at the end of the day, I should make this a little bit easier for you to watch. There you go. Or read. Yeah, you can buy more houses. You can qualify for more of a mortgage. You can build equity quickly.

We did take a lot of equity out of that house, which was nice. We had a big down payment. So that was fine. The negative thing is we didn't really talk about what was going on. What happens if. The other thing, sorry, the other thing that happened was we rented it to a semi-long-term renter for three months or four months over the winter.

So he rented it out, which is great because he paid for the mortgage, but then we couldn't use it to go skiing because he had it the entire winter. Good things, bad things, just how life moved along. just have things concretely written out. And what I would highly suggest is if you're going to do something like that, talk to a lawyer.

I want to see this. Okay.

$540,000,000 Winfall for Class Action Lawyer

Congratulations to the lawsuit, NAR lawsuit, congratulations, especially to the law firm. It's 1. 8 billion. Now they don't get it yet because of NAR and Keller Williams. Are contesting it. They're going to the applet. They're appealing the decision, right?

But let's say that it settles out and let's just assume that the law firm gets 30 It could be 20 could be whatever we'll go through this in a minute, right?

The lawyer gets 540 million dollars good for him. I am so elated for him. That is awesome let's just say it was 20 because I don't know it's not disclosed by the way. It's not disclosed Part of the lawsuit is we should be telling people how much we're making when we're a buyer's agent. Even if it's 20%, it was 360, 000.

Even if it's 5%, that's 90, 000, 000. You could buy a whole lot of money with that stuff, right? So let's just go back to this whole thing. Assuming it's 30%, the sellers get a whopping $1.226 billion. That's a lot of money. But when you divide it by the number of PTI plaintiffs, they get a whopping $4,800.

Compared to that 540 million. I think he did. I think it's a smart look. I don't have anything against this lawsuit. I think it's good that we straighten our ties and figure out a better way to go to business because are we taking advantage? I don't know. I don't know. I'm not, I'm an agent. I've been doing this for 20 years.

I've done it the same way and I enjoy the lifestyle. I enjoy representing people. I enjoy the negotiation. I enjoy the marketing. I enjoy the process of helping get the house ready to sell. But at the end of the day, Am I doing it the right way? That's up to the court and lawyers and a few philosophers to decide what's going on.

I know that there's a lot of hate going on of realtors saying that we make too much money, but we don't get a salary.

So yeah, we do get a commission. And in sales sky's the limit. And I know that there are a lot of realtors out there across this country that make a ton of money. three, five, 20 million a year, and they make a lot of money. And yeah, but you know what? So does corporate America, right? So does corporate America.

And if you're high-end in corporate America making two, five, 10, 15, 20 million a year. It's the same thing. You're a high-performing asset to that company. So I see both sides I'm i'm eager to see how this thing fans out and what we could do better to better serve our clients I'll let that go but at the same time congratulations to that lawyer for a 540 million dollar windfall Good for him.

Good for, or that firm or whatever. All right, let's take a look at quick numbers just in the Bay Area. We have 611. Actually, that number changed a little bit. Days on mark homes that are on the market longer than 40 days, but this is multiple counties, right? In the 10 counties that we track in San Jose, we have 265 homes available for sale on a realtor, but the actual MLS fee shows three 25 uh, closes last week was a big 68 transactions were down or actually up.

MARKET SNAPSHOT

113 from last year. Our last year's average sales price was 1. 5. This year's sales price was 1. 58, but on average we're still 41, 000 from the averages of last year.

The medium price is 1. 485. The list price-to-sales price ratio is 103. 65 versus last year's 101. High was at 130. The lowest 87 percent of the list price. And we have 53%, which is a good cut week two weeks ago, we had 55 and it bounced up to 79. Now we're down to 52, but overall we're at 61. So roughly two-thirds of the homes that are listed are at.

Or above this price. Now, Ryan Lundquist, my favorite appraiser in California works in Santa Clara, Santa, sorry, Sacramento. Never met him. We've spoken a few times. He has access to all my data. We talk regularly. He has helped us raise the bar of data. Understanding the data and showing data. So all those charts that I send out on Facebook, et cetera, they come from him.

And I just plug in the Santa Clara County data. So kudos to Ryan l Lundquist, uh, as a body, as a whole, what we tend to do, not everybody does this, but we wanna list our house, our houses a little bit lower than sales than what the market will. If we say your house is worth about a million dollars, we're going to suggest that we sell it.

We list it at 1. 5 to I'm sorry if it's worth a million dollars, we suggest we sell it from 900 to 950 to bring in more people and show more people. Let me show you a quick thing real quick there. So if we go 5%, Below the list price. We're going to get a whole lot more buyers that are out there because the culture of what we're doing here, not necessarily in Sacramento is we know we're going to have to bid up a little bit and a good buyers agent will give you comps specific to that house and give you a value of where we think it will land and then go with a strategy from there.

Now, if you overmarket it, you're only going to see 5 percent of the eyeballs. On your house and people are just gonna pass it by and you're gonna get crickets. If you're at the market, you're gonna get 25, you're gonna get a couple house viewings, and a very dismal open house. But if you're 5%, if you're 10%, which is why I save, 900, 2 5, 9 50 for a million dollar house, you're gonna get a whole lot more buyers.

Now, the fear is what happens if the market. doesn't present itself. What happens if it will, here's a little quick secret about what's going on in the world of real estate. I don't determine the sales price. The buyer's agent doesn't determine the sales price. The seller doesn't determine the sales price.

The buyers do. And when it's a firestorm of a market and buyers are competing and they get pissed off because they've lost 27 offers, they tend to overpay for the property. It's the buyers that determine the market. You don't as a seller, we can't do that. So part of our guidance is let's list a little bit lower, bringing as many eyeballs as possible onto your listing and as many feet onto your house and get as many offers as we can so that we can negotiate up for you.

And see where the market is. And I tend to, when I sell houses I like to break buyers. I call it breaking the buyers because I push them as high as they can go. And if I have two or more buyers on the hook, I push them until they break. And that's just my job. It's my job. This is what you hired me to do.

So I get the highest price. So there you go. We've had 27 tfts or back on markets. We've had 57 decreases and

These are the prices 169

of them have had price reductions. These are all active, right? So pending list price decrease is actually 57. That's cumulative, but that's based on a certain formula, not all of the listings. The actual number is 169 and you could take any random one. Let's take a look at Futrell 2. 2. million dollars started off at 2.

5 Because they listed it too high for the market again It's the fear of the market is that oh I'm not going to get what the house is worth Yeah, you will, and if you market it right and allow us to price it, right? We're going to bring in as many people as we can To sell that house as quickly as possible for the most amount of money.

And we go into tempo and negotiation and buzz and all this other stuff. It's a system that works and it works really well when you listen. And when you don't listen and operate from fear and scarcity, you tend to get this.

You tend to get houses to sit on the market for a very long time. And then they have to reduce the price. Now let's see 27 days on the market. The original was 1. 9. These people are biting their arms off one inch at a time. What they should have done is listed at 1. 6, 1. 7, and let the market come to them instead of trying to find the market.

Hope that makes sense. If you have ideas or thoughts about this, please let me know because that's really. The way best way we market houses and through learning through falling through failing and through success, we found a formula that really works very well here in Santa Clara County and we tend to sell houses a lot faster that way.

All right, so today we talked about the feds keeping the rates the right at the right price Should you sell yourself and buy a house with your friend? 540 million dollar windfall for the lawyer now again, that's an assumption I don't know if that's true or not then citizens bank another bank crashing sucks, but it is what it is And that's it.

I'm Vito with Abitano.

Financial Intelligence https://docs.google.com/forms/d/e/1FAIpQLSc0R5pjHIAPguZ5GDEB-fTbGJXKpWK3coK9Khymv_GTWkMnyQ/viewform?usp=send_form

Campbell, San Jose, Silicon Valley, retirement, empty nest, Financial Intelligence, Best Realtor Santa Clara County, Google Jobs, apple careers, Apple Jobs, meta jobs, Hewlett Packard, Oracle, Intel, Cisco, Facebook, Broadcom, Adobe, eBay,

Comments

Post a Comment