🔴 Foreclosure rate in the United States from 2005 to 2022. The culprit is a lack of housing supply 🚨 Inventory Watch

- The culprit is a lack of housing supply

- Why the Silicon Valley housing market is extra hot right now

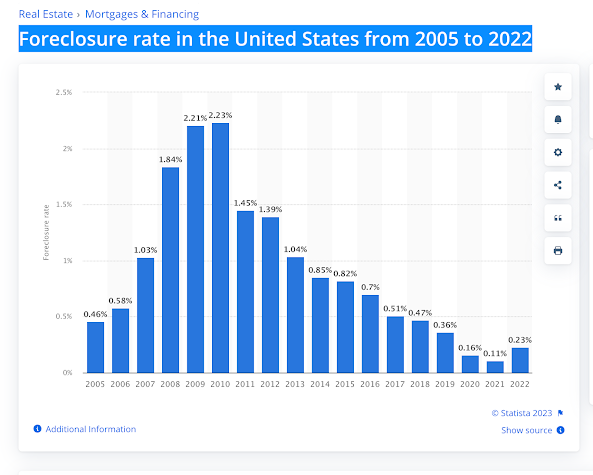

- Foreclosure rate in the United States from 2005 to 2022

- Inventory Watch

https://www.onereal.com/vito-scarnecchia-1/refer

What you get for $1MM Santa Clara County https://search.mlslistings.com/Matrix/Public/Portal.aspx?ID=0-998483112-00&agt=1&L=1

5 things you need to know about Title Theft. Cyber Crime https://youtu.be/X1is7wVyeAA

start your home search here: https://www.onereal.com/vito-scarnecchia-1

🔴 Foreclosure rate in the United States from 2005 to 2022. The culprit is a lack of housing supply 🚨 Inventory Watch

Three things you need to know living in Silicon Valley. One supply is the culprit. That's what we talked about. Why is the Silicon Valley market housing market extra hot? And two or three, number three foreclosure rate in the United States,, from 2005 to 2022. Nothing too alarming, but you're going to hear a lot of like salacious attacks and crash bros talking about this.

So let's just talk about what the numbers really mean. First and foremost, let's do... Why is the housing inventory so low? The housing shortage. Couple things, right? We have corporate America buying up housing. We're making it, we had historically low interest rates for the longest time and made it so people are lifelong owners of that house.

The culprit is a lack of housing supply

They're less likely to move. Are they going to move? Yes. Other reason, death, divorce relocation, any number of reasons. But also the housing market, new home builders are not building right now. They're just not building as many as we need. And that's the problem. There's the trifecta of problems.

We have low rates. We have corporate America buying. And we have no houses being built to match the people that are being born. We have population exploding all across the world and it's not just a US thing. Our problem is the three things make it really different. Problem, right? So there you go.

That's why, is that going to happen? Is it going to end anytime soon? yOu have the crash pros talking about this stuff all the time, right? Oh, we have this thing going to be the Airbnb. I don't know if that's going to be a problem or not because. Just our boomers dying off.

When somebody dies off, we have to sell those houses. It's not an explosive amount of people that, or houses that are going to come to the market right away. So I think you're going to see the prices stay the same for quite a long time. Now that's not to say that. In certain areas like Cape Coral, which we'll get into in a minute, uh, we'll see prices come down

to a wild frenzy of foreclosures and maybe a good time for seeing, for see, to see prices collapse, but economically speaking, we're in an area, Silicon Valley is in an area where. There will always be a ton of jobs. There will be always be a lack of inventory. And right now we're very low compared to where we should be, but that's okay.

Why the Silicon Valley housing market is extra hot right now

And that's exactly what's going on in here too. So I just explained to you what this article is all about too. It's super expensive to, to buy a house right now, right? I just looked at a bunch of houses right here. These are the list price reductions, right? Not too many people can afford it two or three or five or ten or six million dollar house There's one over here.

That's right here. It's thirty two million dollars ridiculous That's a hundred acre lot hundred acre lot, but same time, it's Not tenable for a huge population of us. Now, a lot of people think that the 880 17 Freeway is the separator of high cost homes and not it's actually 87 Let me open this up so you can see this one

That's right here. It's thirty two million dollars ridiculous That's a hundred acre lot hundred acre lot, but same time, it's Not tenable for a huge population of us. Now, a lot of people think that the 880 17 Freeway is the separator of high cost homes and not it's actually 87 Let me open this up so you can see this one

there. So it's a little bit better. So 87 so anything over here, you're gonna see 1. 6 to 5 million dollar homes Right in Willow Glen, Cambrian, depending on the condition, but then you go over here and you're looking at houses that are three, four, six, ten, ten million dollars, right? That's just not tenable for a lot of people, and I get that.

I tend to want to sell houses over here, obviously, because that's where... You make more money, but I saw a lot of houses down here and where I live and down to Morgan Hill and Gilroy. And you look over here and there's nothing really wrong with any of these houses here, right? They're just sitting on market for a little bit longer and the market's contracted.

Maybe they overpriced it. So there's a nice little ranch house. Ooh.

Oh, look at that. Imagine that. I have to come back to that. I have a client that's actually interested in that house who had an offer on that house. They said they had an offer and now look, it decreased in price. Let's take a quick look at it.

Foreclosure rate in the United States from 2005 to 2022

It's been on market almost a month, 27 days. Original list price was One six now, it's one five. Yay. All right, so I'll probably do a live from this house Just so you know, okay foreclosure rate in the United States now I've timed out of that which is okay. I'm completely okay with that because I copied it On my blog, I sourced it.

So don't think that I'm stealing this. Meaning that if you want to see this source, go to the blog and I have it right there in the title of this part of the article, people are saying that foreclosures are up 2 million to 2 million units or what have you. Percentage wise, it's nothing. Percentage wise, it's a, it's doubling of what it was last year.

https://www.statista.com/statistics/798766/foreclosure-rate-usa/

And last year we had a moratorium. So it's a natural attrition or natural buildup of last year, because we couldn't do foreclosures last year, the year before, because of COVID, there was a moratorium on foreclosures, just like there's a moratorium on evicting bad tenants. So that is a bump up. And I think you'll see next year or this year, you're going to see it pop down a little bit.

Or it's probably going to pop up a little bit and then 24, 25, it'll come down even more, but that's not even a quarter of a percent of the entire population of homes with mortgages on it. I don't think it's a problem. So you see a crash bro, or tick tocks, people saying, Oh, the market's going to crash because the foreclosure rates are going up.

Probably. Maybe slight chance there's probably a 0. 23 chance percent of a chance that we'll see that actually crash. So we'll see.

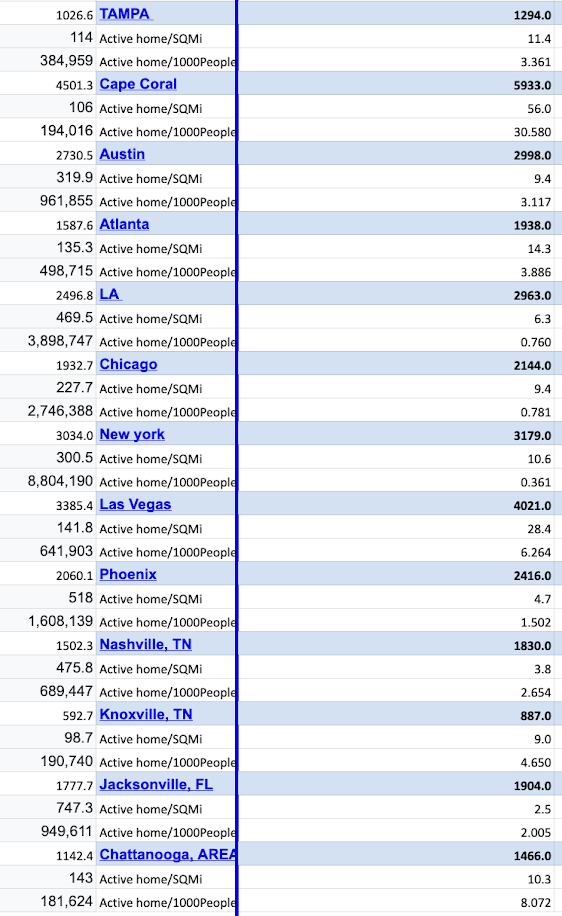

Inventory Watch

Let's get into the numbers. San Jose on realtor. com is 272 actual is actually went up a little bit. Let me show you the number real quick. 333. Let's see if that number changed. Now I'm going to hit this again, hit the criteria for these. 333 actual numbers. 333. When I did it earlier this morning, before I went to the gym, it was 325.

So the number fluctuates all the time, right? And the difference between realtor. com and this is really coming soon. You can actually have coming soon as available to you with a real estate agent. It's one of the values that we offer. Cupertino 20 up one Las Gatos, 84 down six Saratoga. So you look at these numbers and they're not, there's nothing really spiking unless you look at Cape Coral.

Cape Coral 6, 000 and a month ago it was 5, 500. And how long ago was this? Sorry. I know I'm getting you dizzy here. I apologize. August,

August it was 46. So that's 15, 1400, 1300 more active. Is that a dangerous thing? Cape Coral is an anomaly where in the winters, the snowbirds come down and that's when houses go up for sale. Is it over, it's over abundance, probably. Cape Coral isn't that big. If you look at it, it's 50 it's 106 square miles compared to, I don't know, San Jose, which is 181, which is 1.

5 houses for listed active for sale per square mile. Or for every thousand people, every 4, 000 people, there's about one house for sale. Cape Coral. There's. 30 houses for sale for thousand people. And for every square mile, there's 56 homes for sale. Crazy, right? Our price is going down, going crazy down. I think they're maintaining.

You can get, where is this? There we go. Now this is all over. So let's take a look down here and see what's available. 1. 5 million. So no prices have not come down.

yOu can get a nice house. That's not on a channel for three 50, but if you're on a channel and you're close to the river, that'll take you to uh, the Gulf, then yeah, you have some more money to spend.

Austin. So nothing's really popping up other than Vegas is up, but I haven't seen it spike in the last couple of days. All right guys, there you go. Today we talked about foreclosure why the supply, especially here in Silicon Valley is so high. And what else,

why the market is extra hot right here. Jobs. We have too many jobs, too many people coming into a very isolated part of an isolated area. It's hard for us to spread out. So it makes it very difficult for people to. Commute, whether you're up in Pleasanton or Morgan Hill or Hollister or wherever, you're adding two hours of commute time each way every day.

So people are going to spend the money to buy here. There you go. All right. I'm Beto with Abitano. Have a fantastic week weekend. And if you're a Marine, happy birthday tomorrow because I'm not coming on tomorrow. I hope you have a fantastic weekend. We'll see you out there.

Vito Scarnecchia

Realtor®, Broker, Veteran, Dad

DRE#: 01407676

408-705-6817

Vito@abitano.com

Website: abitano.com https://www.onereal.com/vito-scarnecchia-1

update your home value: https://hmbt.co/bT7qRJ

FREE DESKTOP APPRAISAL https://www.propertyrate.com/agent/vitoscarnecchia

If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents!

Book appointments here: https://calendly.com/abitano/15min

IG https://www.instagram.com/abitanogroup/

FB https://www.facebook.com/vito.scarnecchia/

LI https://www.linkedin.com/in/vito-scarnecchia/

Blog http://blog.abitano.com/

POD https://spotifyanchor-web.app.link/e/oxdH1Hwfcvb

Professional Photography by Kim E https://photosbykime.com /

VydeoEase.com- video post-production service for business marketers. VITO50 for discount

Video Marketing Course for Realtors https://karincarr.samcart.com/referral/O0FGKRS3/0orWK4vK5bAYBD6E

Try Melon video streaming https://melonapp.com?ref=vitoscarnecchia

santa clara county property tax, aalto, Expired, Canceled, Withdrawn Listings, ALC,CCC,MRN,MTY,NPA,SFC,SMC,SCC,SZC,SOL,SON, NAR Lawsuit

Comments

Post a Comment