🔴 How much it could cost to (buy a house in the U.S. by 2030)

- how much it could cost to buy a house in the U.S. by 2030

- Los Gatos Homes for sale

- Foreclosure Activity Increases

- Tuesday Highs & Lows

🔴[LIVE] 🚨 how much it could cost to buy a house in the U.S. by 2030 | Los Gatos Homes for sale

Home Value Tool https://hmbt.co/bT7qRJ

HOME SEARCH https://www.onereal.com/vito-scarnecchia-1

Foreclosure Activity Increases

Other Articles:

How much could it cost you to buy a house by 2030? We'll also talk about Los Gatos homes for sale. And there's another thing that I want to go into going back to that whole, how much could it cost to buy a house? And then we'll also go through the highs and lows of Santa Clara County. For this last week.

Let's get into it.

Discussion on Mortgage Rates

So Real quick, I want to talk about mortgage rates. It's up a little bit over last week, 6. 87, but that doesn't mean it's you're stuck at 6. 87. You can buy it down. I just wrote an offer for three, probably not going to get it, but three and a half percent towards closing costs and points, which means it'll bring it way down.

So there's a lot of room for negotiation when it comes to. Working with experienced buying agents. Gas is three 65. I lost it. Let's see if we can find it. Three 65. It is right here. Premium gas on Washington Street, right by the Rose accretion. Look at that. Three 65, three 65.

Let's see where there you go. It's crepes beast. No, it's this one right here. Hello. Anyway, it's right by that Burger King. You can go see it. Three 65. I might go fill it up over there because where I usually fill up at my Costco, it is 3. 89. I'm not going to drive all the way out there for a couple bucks.

But anyway, 3. 65. It's coming down. Election year.

Predicting House Prices by 2030

how much it could cost to buy a house in the U.S. by 2030

This is how much it would cost to buy a house in the U. S. by 2030. And tips on how we're not going to talk about savings because that's a whole nother subject. We have financial intelligence for that and we can go into that a little bit more. But I wanted to point out that the average home value in Nashville will reach 539 New York City will be 964.

Houston will see 309. I think that's the median sales price now across the United States. Back in 1996. It was 112, 112, 000. That's about when I bought my first house. I bought it for 225 and it was way below the median. It was a starter house, with nothing to it. I think at that time it was in Santa Clara County.

The median sales price was like I wanna say 3, 2 75, and then in September 2006, it was two 15, and then in 2016 it was 2 24, and then in 2021, which is when it jumped way up. Remember, that was the firestorm that we had. That was 3 43 and it still continues to go up 3 81. We actually had it all the way up to four 16 at one time, June last year, I believe.

April, a year ago, then it's different, right? So I took the liberty of taking this and plugging it into this and assuming that nothing. Different goes up and we see about an 11 percent increase every year. I just did averages. The average price by 2030 could be 475, not saying it's going to be, but plus or minus, it'll be about 475, right?

We could see another firestorm like we did in 2021, where it jumped up crazy. But probably not. If you follow this line, it's a complete trajectory, and you'll probably be paying the median price for a house in the U. S. by 2030. It'll probably be 475, 000. This article never really says anything about what they think it's going to be.

It just goes into, I don't know, just how you should start saving. There's no real guess. That's a crystal ball. It's not a guess. I would call that a wag or a wild bleep guess. Leave it at that.

The Cost of Not Buying a House

Now This chart right here is a fun little chart because over the last five years, I want to demonstrate to home buyers that they're missing out on a huge amount of equity over the last five years.

So how do you break it down? By the year and how much do you lose per day or not per day?

You're losing 320, about 335 medians, 377 per day. If you took that number and rounded it up to 30 days, it would be 11, 000 a day you're walking away from. That's the average by renting and giving somebody else your mortgage or paying off their mortgage by renting somebody else's house or apartment.

You're paying a huge amount of money. And look, I'm not saying that this is going to be continued trends or what have you, but over the last. For five years, every month you walked away from 11, 000 on average if you're living in Santa Clara County. Now I broke it down for you in San Jose, just for a couple different numbers.

And guys, this is just averages, right? If you bought in the lower threshold, you're probably looking at something a little bit less. Probably like 6, 000 a month loss on top of your 2, 500, 3, 500 a month rent. So it's a powerful thing to see when you're, how much you're losing when you put it nuts and bolts again, this might not happen.

Continue this way, right? Because 2021 was a crazy time. And a lot of people opted to not buy a house. This is just San Jose. This is the same thing in Cupertino. If you bought something in Cupertino, it would have been a lot crazier. Why?

Oh, I know what I did. I had there 50, almost 16, 000 a day that you're walking away from. Los Gatos is 10, 000

and Yeah. Yeah. The averages come out the same and in Mountain View, you're walking from away from, so it's roughly 10, 000 a month. You're walking away from equity build. That's why this is a powerful thing. Just to put it into perspective, you're losing money every day, 300, almost 400 a day by not owning a house.

I'm not saying that's the exact number, right? If you're a home buyer, you're renting and you're a home buyer and you can't afford it. There are certain things that you could do. You could buy into a townhouse. Now your equity gain on a townhouse or a condo is not going to be as great as a single-family house.

This is just single-family houses, but at least you're in the market. You're stepping into the market. And I'm telling you not to, right? I'm just telling you, you're doing this by not owning a house. I had a conversation with a friend of mine a couple of weeks ago when I did this. And he was speechless and he's a renter and he's been renting for 30 years.

So imagine how much equity you could have if you pay off your house. And on top of that, get that equity built.

The Importance of Homeownership

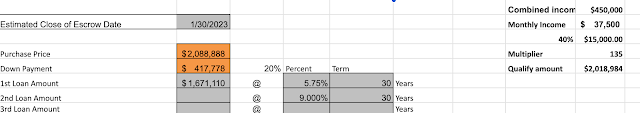

That's why it's important to be a homeowner. Now, this is where it comes into crazy, right? To buy a. And a median-priced house, right? We know what the median price house is because 288 or this is the average sales price is 2000 or 2, 000, 088.

So 2, 000, 088. If you have a 20 percent down payment, you need to have four, 400, 000 down, which I get, believe me. Let me see if I can make this bigger for you. You need to have 400, 000 down. And at 5. 75, your monthly payment would be 500, 000. Okay. Okay. This is just a guess, right? How much do you need to make to own, to be able to buy a 2 million house?

The going conservative income-to-loan ratio is 40%. If you make this thing, this is where it comes in. So I just did a quick. So here's the thing here. 450, 000 a year combined income. Your monthly income would be 37, 000 37 or 40 percent of that would be 15%. See, and then the multiplier I just did the income the loan amount divided by the monthly payment, the PITI principal interest taxes, and insurance.

right? You have to talk to a lender to get it. So you qualify for that much. Now this can go up and down, right? You can go all the way up to 65%. I don't like people to do that, but when you're in a situation, there you go. Now my house isn't worth 2 million. I can tell you that right now. I can tell you that I bought my house when it was worth 690, 000, right?

20-something years ago. And if I lived in Los Gatos, my house would have been worth a whole lot more. If I bought it in Mountain View, it would have been worth a whole lot more. I couldn't afford that kind of a house. So I bought it in San Jose, South San Jose. And it's a great neighborhood. So don't get me wrong.

What I'm missing out on is the equity bill that I could have had in Mountain View or Cupertino or something just couldn't afford it at that time. Now, can you afford, if you're making 200, 000 combined income, you can buy a house for about a million dollars, right? Plus or minus. Or 1. 25. And there are different ways of working around that. So don't give up, buy a house, and get into a house right away. If you're interested in learning more, Call me, and I'll get you qualified.

I'll get you approved and we'll go through an entire process. I actually have a home buyers course. It's in my blog. You can check it out. It's free. I don't bug you. I don't have this annoying call you every 15 times a day. When you're ready to sign up and work with me, I'm full press. At your footsteps, ready to help you, but I don't do the naggy, buggy thing.

I'm here to help you, not to bug you. Okay, enough of that.

Understanding the Housing Market

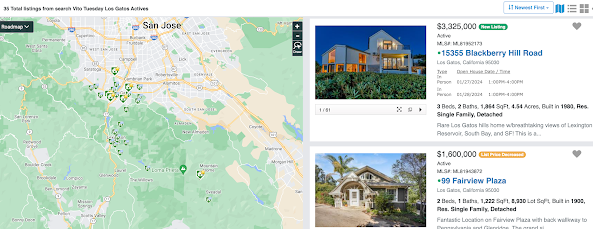

Los Gatos House of the Week. I think we looked at this last week. I'm pretty sure. Fairview Plaza. This is a two bedroom, one bath. House Los Gatos, 1222 square feet. It's a little rough. It's a little rough. It's original everything. Now that looks like it's been updated, but that side of the kitchen has not been.

So I'm not sure what's going on there. It looks old, feels old, and probably smells old. And it is old. It was built in the 1900s and is 123 years old, 124 years old now. So there's been some updates, a little cramp, but it's. a Los Gatos property and it's downtown, it's walking distance to all the fine restaurants in Los Gatos.

It's 123 years old. It's been on the market for 112 days and they just recently reduced it from 2 million down to 1. 6. So there you go. That's a great buy. If you're looking at buying a house, on Maccabee Road, what is this? Oh,, that is a median-priced house. That's actively for sale right now. It's been on the market for 13 days, with four bedrooms through the bath.

So going back to the whole buy thing, right? Okay. So we're going to talk about the highs and lows of Santa Clara County this last week. The first one is the tollgate. These are not my listings, by the way, it's been on the market. It was on the market for 46 days. The original list price was 6. 3 sold for 6. 0 3 8 5 bedroom 6 bath, 4700 square feet.

It's 1. 3 acres. This is a, this is an awesome house too. I think I looked through this once. Now, this is in the Saratoga Hills, right? This is Monte Sereno.

So you're up in the hills a little bit. Open that up for you. So Las Gatos, Monteserino, Saratoga, Cupertino's right here. I just went hiking back here last weekend. So this is a preeminent Saratoga house and it was sold for six million dollars. Gorgeous. Gorgeous house pool, rustic old world. Look at the charm tray, ceiling, lots of light, beautiful house. Congratulations to the buyers. This is the lowest-priced house in San Jose or in Santa Clara County. And this is an older house too. This is, this looks like an older craftsman style,

but it looks and feels old, right? Nothing updated. So for 600, 000, now they were smart. They underpriced it. So that listed at four, 500, 000. They had a bunch of bids and it sold for 20 percent over the list price, 10 days on the market. They didn't have to worry about it. This is a two bedroom, one bath, 949 square foot.

And it's close to the freeway. So they were smart to list it low on this one. This is the highest list price-to-sales price ratio. Eden Ave in Sunnyvale. Now look at this. So Rinconada, Eichler.

Painful, painfully old, nothing updated.

And it sold for 1. 7 million. The lowest list price to sales price ratio is in Los Gatos up in the Los Gatos mountains.

So even though it's past Lexington, this is downtown Los Gatos. So you're still driving 15, 20 minutes after you get to Los Gatos. I've been back there. It is dark and dreary until you get to your place. And if you have it clearly cut out, then you're good. Last year, I sold a house. It wound up being an Aptos, but we looked at houses all over this place.

And crazy, you really need a four-wheel drive to have this kind of a house. And it is rustic living. It's a pretty house. I love the wood grain, but there you go that sold for 82 percent of the original list price. Eden, that one in sales in Sunnyvale, the really rough one, sold for 36 percent over the list price.

Crazy. All right. Today we talked about gas prices. down. How much does a house cost or how much will a house cost by 2030? We did talk a little bit about how much it costs you every day to not own a house and the Las Gatos house and the highs and lows of Santa Clara County.

Conclusion and Contact Information

I'm Vito with Abitano.

Hope this helps. If you have any questions or you want to see some other data, please let me know. I'm always happy to help out and talk about it. I'm Vito with Abitano. We'll see you out there.

Vito Scarnecchia

Real Estate Broker, Veteran, Dad

DRE#: 01407676

408-705-6817

Vito@abitano.com

Website: abitano.com https://www.onereal.com/vito-scarnecchia-1

update your home value: https://hmbt.co/bT7qRJ

FREE DESKTOP APPRAISAL https://www.propertyrate.com/agent/vitoscarnecchia

If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents!

Book appointments here: https://calendly.com/abitano/15min

IG https://www.instagram.com/abitanogroup/

FB https://www.facebook.com/vito.scarnecchia/

LI https://www.linkedin.com/in/vito-scarnecchia/

Blog http://blog.abitano.com/

POD https://spotifyanchor-web.app.link/e/oxdH1Hwfcvb

Professional Photography by Kim E https://photosbykime.com /

Local Real Estate Market and Home Value Report https://hmbt.co/bT7qRJ

Financial Intelligence https://docs.google.com/forms/d/e/1FAIpQLSc0R5pjHIAPguZ5GDEB-fTbGJXKpWK3coK9Khymv_GTWkMnyQ/viewform?usp=send_form

https://www.onereal.com/vito-scarnecchia-1

Willow Glen's five most expensive homes https://youtu.be/3A_E2ck0ePg

Forecasting U.S. Housing Market Trends up to 2030, with a Focus on Santa Clara County and Los Gatos Real Estate

In this video, the presenter provides a detailed analysis of the U.S. housing market and makes projections for what the costs might be like in 2030. The presenter discusses the importance of owning a house and how much equity potential homeowners are losing by renting. The video also features updates on current mortgage rates, an analysis of Santa Clara County's real estate market trends, and a focus on Los Gatos housing options for sale. Homebuyer guidance and various housing market tactics like underpricing are also discussed.

0:00 🚨 How Much Could it Cost to Buy a HOUSE (in the U.S. by 2030) | Los Gatos Homes for sale

00:11 Introduction

00:18 Discussion on Mortgage Rates

01:24 Predicting House Prices by 2030

03:31 The Cost of Not Buying a House

06:37 The Importance of Homeownership

09:32 Understanding the Housing Market

14:06 Conclusion and Contact Information

1. Post Idea 1:

🏡 Wondering how much it will cost to buy a house in the U.S. by 2030? 🤔 Dive into this eye-opening script that reveals future trends and insights! Don't miss out on valuable information about Los Gatos homes for sale. 📚 #RealEstate #MarketTrends #LosGatos

2. Post Idea 2:

💰 Curious about the future of house prices in the U.S.? 🌟 This script breaks it down for you, providing projections and tips on buying a house by 2030. Get ready to be surprised! 🤯 #FutureOfHousing #HousePrices #Projections

3. Post Idea 3:

🔍 Did you know that the average home value in Nashville is projected to reach $539K by 2030? 🏠 Read this script to discover more fascinating insights about the U.S. housing market and the highs and lows of Santa Clara County. 📈 #HousingMarketInsights #Nashville #SantaClaraCounty

silicon Valley real estate, how much will my mortgage be, Santa Clara County real estate tax, real estate news, stock market, real estate crash, Bond yields, Wealthion, Airbnb, Blackstone real estate, MLS listings, Zillow, redfin, Santa Clara homes for sale, MLS listings san Jose, Airbnb property for sale, AirBnBust

Comments

Post a Comment