🔴The housing market has 80s vibes? US Median Home 382,600 | Cost to Build a House? 🚨 State of the Market SAN JOSE

- #REWTF of the Week

- Median Home is down 382600

- REO of the Week https://www.onereal.com/vito-scarnecchia

- MARKET SNAPSHOT

- The housing market has ’80s vibes

- Mountain View Home of the Week

YOUTUBE

Does the housing market have 80s vibes? US Median Home 382,600 | Cost to Build a House?

Does the housing market have 80s vibes? US Median Home 382,600 | Cost to Build a House?  State of the Market SAN JOSE

State of the Market SAN JOSE

Housing Market Overview

The housing market has eighties vibes, REWTF of the median Median home is down. Median home prices are down across the United States, REO of the week market snapshot and mountain

The housing market has ’80s vibes

view home of the week. Let's get ripping. Lots of cover. We're going to make it quick. Easy and dirty and done. Okay. Let's really talk about this guy right here. I'm going to torture you with that view.

Influence of Ryan Lundquist

If you follow my other posts, most of it, a lot of the stats that I come up with are from Ryan Lundquist, who's an appraiser up in Sacramento. And this guy is just my muse. He has some amazing data. And I share what I. Do with him. He brings me tons of ideas as far as presenting statistics.

Make sure to visit his blog. https://sacramentoappraisalblog.com/2024/01/23/the-housing-market-has-80s-vibes/

So whenever I do statistics on my Facebook or what have you see them, it all comes from his ideas for the Sacramento region. And I bring it down to Santa Clara County so we can all have, level conversations. And he's just a great guy. He's really smart. Far smarter than me.

Housing Affordability Issues

So this article really talks more about, yes, we're in a precarious situation, and believe us when we tell you that we feel for you because if you're trying to enter the market, housing affordability is a huge issue. And I know it's totally different.

Housing Market in the 1980s

But this is the 1980s, right? California still faces the worst worsening housing shortage, right? So slump is blamed on the feds overkill when they dropped the. Then, we had inflation back then and work. What else is there in search of affordable homes? It's nationwide.

It's worldwide right now.

Current Housing Market Situation

Affordability is just out, out the door, which you will find is an enormous pent-up demand waiting to be served, but finding no service at all. They're a huge group. The boom babies or. Gein n Xers the 1950s, they desperately want houses. They don't need to be sold on the idea, produce the house and the lineup for it.

That doesn't mean you can come at it with my house worth 2 million when it's really worth 1. 8. It's one of those things where you have to still attract the market, and get the right amount of eyeballs. It's a balanced. The science that we use to attract the market, bring in the market, create offers, and negotiate with those offers to get to the highest price possible.

Local Real Estate Market and Home Value Report

You as a seller don't demand a price. You can negotiate a price, right? That's if they can get financing, which in turn is the greatest challenge to home order. So back then it was 14, 15, 17%. So home prices were much lower, but we were paying a whole lot more per dollar borrowed. 1982 was a good football year, but not as good for mortgage rates.

1981 mentions inflation, dropping sales volume, and younger adults having to live at home longer. We had that same problem. I graduated high school in 87 and went to the Marines. I came back and tried to find a house. And I, at that time it was hard. This article right here was a problem back then, housing construction.

Right now we're at maybe a third of that. We're at like, I want to say 600, 000, maybe a half of that, 600, 000 housing starts last year across the United States. We need more homes. So if a policymaker is going to do anything to push this out is to create more homes. Not more homes to rent, more homes to purchase.

We can't be a home, a nation of home renters. It just doesn't work like that, right? California's median price exceeds a hundred thousand dollars. I'll show you in a second where we are right now. This is California, right? So closing thoughts, affordability today is no joke. It's actually. That's a preeminent problem.

It's been a problem since the 80s, 90s, 2000s. Always going to be a problem because we don't have enough houses to go around. Every generation struggles. It's different. We had different struggles back then versus what you're facing today. We're seeing rents escalate. We're seeing all sorts of different things that are making it far more difficult for you right now.

And we understand that. Understand that this is a bad time, right? We had a great time two years ago. We had a firestorm. People were buying up houses left and right fo to five, or 15 years. We had a good seller's market. And right now buyers are struggling to get into first-time buyers, right?

Financial Intelligence

Advice for First-Time Buyers

I get that yesterday we talked about how much you need to make to buy a medium-priced home in Santa Clara.

It's. Yeah, go back and see it. You can go to my blog and see yesterday's video on that. Don't lose hope. Don't lose hope. I know it's struggling. It's hard. My suggestion is if you can't buy a house, buy a condo or townhouse. The HOA idea, but at least you get into it. You build up some equity while you're saving up more money.

And then you have a little bit more control because when you're a renter, you have zero control. Your rent goes up, and equity builds. All sorts of stuff. It makes it really difficult for you to continue to rent in a place over 30 years by now, I think it was 337 every day you're losing an equity build.

Keep that in mind. Okay. No. So this is the median price, the median sale price of existing single-family homes, in Santa Clara, 1. 7 million. The average price is 2, 000, 088. The median

Current Median Prices

price was 1. 7. Last year, the year before, it was 1. 48. We had a huge jump, 16. 7%. That goes into that daily equity loss. And it's not just California, it's all across the nation.

#REWTF of the Week

Okay, Ryan Warner, a good friend of mine, a former client, loves to send me R E W T S, but check this out. Guys, if you ever see a plumber doing that to your house, these joists are there to support the house. This looks like it's in the attic even if it's on the floor, your house is going to cave in eventually.

All that will fail at one point or another. If you see that, tell them to stop. Serious. R E W T F.

Mountain View Home of the Week

Okay. Mountain view home of the week. This is Spencer Abt's beautiful home. Measly 4. 3 million five bedroom, four bath 3, 923 square feet. This is not my listing. Beautiful house. The only thing I don't like about it is the wood tiles.

I would have replaced that before I put solar on, but that solar heating, those are solar electric. This is solar heating for a pool and that's easy to remove.

Very well manicured, very well taken care of, updated, beautiful home for the age. This home has been completely updated and manicured-loved loved. It's a huge kitchen. That is a party kitchen.

If you want to look more into this, the link will be in my blog. Please take a look. REO of the week.

Willow Glen's five most expensive homes https://youtu.be/3A_E2ck0ePg?sub_confirmation=1

REO of the Week https://www.onereal.com/vito-scarnecchia

TMcKenzie'scKenzie place. This is in San Jose. It's a three bedroom, two bath. I think there's an HOA on this. 30. 1900 square foot built in 204. This is bank-owned. It's been on the market for one day. It's 20 years old.

Originalist price. Yeah. Yeah. I don't see HOA. Good. Stay away from those HOAs. Oh yeah. No, never mind. 103. I need help with HOAs. They control everything. Typically they're built by, they're managed by nitpicky presidents and they'll find you for every little thing. I don't know that gate right there that needs to be fixed.

It's a pain. But it is what it is, right? You get certain things like you don't have to take care of streets, the common ground, if there is any, but look, you're right next to wires. This is a typical 20-year-old home.

I sold a home that looks just like this in Palmia, but it was 2, 500 square feet, a much bigger kitchen, much bigger area here. It actually went back another. 10 or 15 feet and then we're in the kitchen area. We're on this side. It had a little family nook and then the buyer moved in. It wasn't in There There are two different developments in Palmea. One has no HOA and the other does. Those are like patio homes. The ones that aHOA-governedoverned. This guy came in and painted his house burnt orange. It's ridiculous. Vacant

house. Not too many pictures you can do with a vacant house, right? That's why I always say you should have it staged. There you go. If you're looking at buying a property, a bank-owned property, this is it right here. McKenzie Ave. Give me a call.

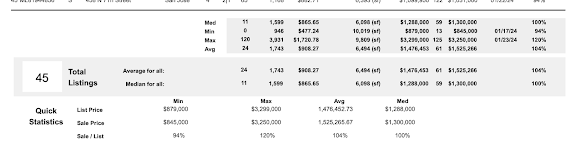

MARKET SNAPSHOT

Okay, these are CMAs. I keep these for a couple days and I get rid of them.

If you're interested in me sending you These are the numbers I use to form this up right here. So you can look at it. We have 8 homes over 40 the days on market. 47 of them are over the old 90 days. We only have owned properties in the Bay Area. That's ridiculous. at is right here. That's all these little green dots that you see.

Not a lot. All of California is 143 San Jose. We have 162 active homes for sale. That's another part of the problem, but we talk about that over and over again. Supply is just so short that prices there's built up demand. You have to have far more, you need to be at like seven or 800. Maybe even higher to have a balanced market in San Jose.

Santa Clara is the same thing. All over the United States, a dwindling supply closed last week. We had a measly 25 lastThe average average sales price is 1. 3 thisThe average average sales price is 1. 5, which is pretty big Delta. That's the median Median price is 1. 3. This is San Jose, right? You go outside, do the all of Santa Clara, and those numbers are much larger because you have Palo Alto, Mountain View, etc.

Those houses go for much more. I think say Measure B or Major, Measure 8, where we voted to increase Property tax. If your house sold for over 2 million, that really hurt home values increasing in San Jose. So if you're looking for a place to find your easing, move out of S Jose, because your house will not stay on parity.

With houses you buy in Los Gatos and Cupertino. And yes, I know that entry, that cost of entry right there is a lot higher, but you're going to see your home value increase exponentially higher than it will in SanThe higher. The High was 1. 2 over the literalist price. The low is 85. Pricing is huge. How you price your and house, how you attract your market is hugely important.

Let's see. I'm not going to go into that. 24 out of the 40, 45 closes or 53 per over list price. That's from 1001 to over listerlist price. The days on the market averaged 24. We're averaging 21 days on the market. Last year we averaged 29 at the same time. Last year overall was 18. So you're, we did see the numbers go down and it's coming back up a little bit.

Pending's 57. That's good and healthy. 29 list price decrease. That means pricing is still an issue. If you overpriced your property, it's going to sit and then you're going to be off at your agent. And that's the last thing you want to do. TFT or transaction fell through. You have Mamby Pamby buyers that also.

produces them when buyers lowball an offer because it's the een on the market for 30, 40, 50 days. Then they try to negotiate cancellations last seven days, nine. So we're seeing properties. The properties that we have on the market actually sell, which is good. And it's healthy. It's a healthy market.

We're still in a very healthy market.

Conclusion and Final Thoughts

So today we talked about a comparison of 1980, and 1980s houses versus housing versus let's take two. Today we talked about 1980s numbers or housing versus today's housing and how there's the same vibe. It's different, but it's almost the same because of high-interest rates, lack of housing, and lots of stuff.

We also had REWTF, Mountain View House of the Week, and REO of the Week. And we did our Market Snapshot for San Jose. See you tomorrow. I'm Dido with Albatano. We'll see you out there.

Vito Scarnecchia Real Estate Broker, Veteran, Dad DRE#: 01407676 408-705-6817 Vito@abitano.com If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents! Website: www.abitano.com Get your Equity and Investment report here RELOCATION@ABITANO.COM FREE DESKTOP APPRAISAL https://www.propertyrate.com/agent/vitoscarnecchia Free Homebuyers Course YT YouTube.com/SanJoseLiving IG https://www.instagram.com/abitanogroup/ FB https://www.facebook.com/vito.scarnecchia/ LI https://www.linkedin.com/in/vito-scarnecchia/ Blog http://blog.abitano.com/ POD https://spotifyanchor-web.app.link/e/oxdH1Hwfcvb Professional Photography by Kim E https://photosbykime.com Local Real Estate Market and Home Value Report https://hmbt.co/bT7qRJ Financial Intelligence https://www.onereal.com/vito-scarnecchia-1 Willow Glen's five most expensive homes https://youtu.be/3A_E2ck0ePg?sub_confirmation=1

To promote your script on social media, you can create engaging text posts that highlight the key points or interesting facts from your script. Here are a few options for text posts you can make:

1. Post Option 1:

"🔴 The housing market has 80s vibes! 🏠✨ Find out how housing affordability is becoming a major concern in the United States. Discover the challenges faced by first-time buyers and the pent-up demand waiting to be served. Check out my latest script on the housing market. #HousingMarket #Affordability #RealEstateVibes"

2. Post Option 2:

"🏡 Looking to buy a home? The housing market has hit a new low in median home prices across the United States. 📉 Learn about the reasons behind this slump and the impact on housing affordability. Check out my script discussing this issue and get insights from expert appraiser Ryan Lundquist. #HomePrices #Affordability #RealEstateInsights"

3. Post Option 3:

"🌟 Is housing affordability a challenge for you? 🏠💰 Dive into the 80s vibes of the housing market and discover the struggles faced by millennials and Gen Xers in finding affordable homes. Find out how sellers can attract the right market and negotiate for the highest price possible. Read my script for an in-depth analysis. #HousingAffordability #RealEstateMarket #StrugglesAndSolutions"

Remember to use relevant hashtags and consider using eye-catching emojis to make your posts more engaging. Adapt these options to suit your preferred social media platform and audience. Let me know if you need further assistance or have any other requests sts!

1980s vs Today's Housing Market: Issues, Insights & Property Highlights

This video takes a comprehensive look at the current state of the U.S. housing market, drawing parallels to the 1980s. The host discusses 1980s housing issues such as high interest rates and a lack of affordability, indicating similar problems. He focuses on the pressing need for more homes to be built to alleviate current affordability issues and stresses that becoming a homeowner is beneficial in the long term. He also showcases three homes: a stunning property in Mountain View, and a bank-owned property in San Jose, and highlights a flawed plumbing job on a home. The host finishes with a market snapshot for San Jose, highlighting serious issues with overpricing and supply shortages.

00:00 Housing Market Overview

00:12 Introduction

00:27 Influence of Ryan Lundquist

01:07 Housing Affordability Issues

01:26 Housing Market in the 1980s

01:46 Current Housing Market Situation

04:43 AdviceFirst-Time Time Buyers

05:46 Current Median Prices

06:02 REWTF and Mountain View Home of the Week

07:15 REO of the Week

08:47 Current Market Snapshot

12:17 Conclusion and Final Thoughts

Comments

Post a Comment