consumer no-ratio mortgage program Fed raises rates a quarter point- what does it all mean?

consumer no-ratio mortgage program Fed raises rates a quarter point- what does it all mean?

Fed raises rates a quarter point Will this be the start of the crash? probably not. today we're checking in with Scott Hill Mortgage Maestro

consumer no-ratio mortgage program Fed raises rates a quarter point- what does it all mean?

http://blog.abitano.com/2023/02/consumer-no-ratio-mortgage-program-fed.html

https://youtube.com/live/OUcTAgGu3Iw

https://fb.me/e/3bGnhD5XO

https://anchor.fm/siliconvalleyliving/episodes/consumer-no-ratio-mortgage-program-Fed-raises-rates-a-quarter-point--what-does-it-all-mean-e1ucckr

Brian Stevens Joanna Lockhart

#realestatelife #realestate #mortgage #mortgagebroker #loanofficer #lender

408-898-0100 hillmortgageinc.com

Fed raises rates a quarter point Will this be the start of the crash? probably not. today we're checking in with Scott Hill Mortgage Maestro Vito Scarnecchia Realtor®, Broker, Veteran, Dad DRE#: 01407676 Website: abitano.com UPDATE YOUR HOME VALUES HERE https://get.homebot.ai/?id=04198407-86e6-4db0-8902-ddf0de6dbabc If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents! Book appointments here: https://calendly.com/abitano/15min Home Buyers Course YT YouTube.com/SanJoseLiving IG https://www.instagram.com/abitanogroup/ FB https://www.facebook.com/vito.scarnecchia/ LI https://www.linkedin.com/in/vito-scarnecchia/ Blog http://blog.abitano.com/ POD https://spotifyanchor-web.app.link/e/oxdH1Hwfcvb Professional Photography by Kim E https://photosbykime.com / Compass site: https://www.compass.com/agents/vito-scarnecchia/ VydeoEase.com- video post-production service for business marketers. $5 trial- Use Vito50 when you sign up… Video Marketing Course for Realtors https://karincarr.samcart.com/referral/O0FGKRS3/0orWK4vK5bAYBD6E Try Streamyard! https://streamyard.com/pal/5353055951519744

Transcript

I'll be coming down. All right. Welcome back, everybody. This is Thursday, February 22nd, 10:15 AM and today I told you, I promised you I was gonna have Scott back and talk. Scott Hill is back to talk about what's going on in the market and a new loan product that he is in love with. Scott, how are you doing?

He's in the Altamont Pass right now. , it's perfect timing. Scott, can you hear me? Yeah, we'll be coming out soon here. Okay. So why don't I talk until you stop getting jittery and then we can just really quickly go, what's up? On my chart and Scott, I hadn't shown this to you.

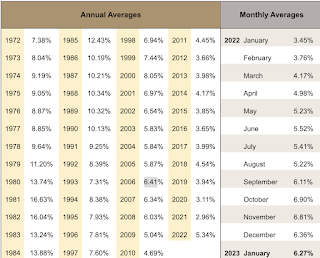

I wanna show this to you, to the viewers real quick. What's going on? This is why the market is, the market is doing what it's doing. Real estate is still excelling, not at the same peak, same fruits, and the same velocity, but houses are still selling. We're still far below a 30, 40-year average of interest rates.

The average from 1972 to 2022 is 7.7. And today we're seeing rates around five and a half. Five, 5%, Scott, is that right? Yeah. In some cases, depending on credit score, down payment, and points we're definitely into the mid to lower fives, which is awesome. Yeah. And in January 2023, it was an average of six and a quarter, 6.27.

But today we saw the rates. The feds talked about the quarter. Or 25 BIP increase to st to further slow down inflation. You look at the stock market, you look at the rates already known. They adjusted a couple days ago knowing that this is a possibility. And today we have rates way down below like you can get below 5% with the point, right?

Yeah. You can and then 15 years, of course, even a little lower. And you made a huge point there in regards to hey, what, if Fed just raised a quarter why are mortgage rates dropping? And, this goes back to the old this stuff gets kicked in or baked in, if you will, ahead of time, right?

Okay. We know they're gonna raise in a couple weeks, a quarter, and then all of a sudden it happens. It's ho-hum. The mortgage bonds already knew what was going on. Proof right there that mortgage rates can come down even though the fed rate goes up. It's crazy, right? Yeah. But we've been doing this long enough.

The market knows what's going on. They, they can assume what's going on. Maybe like in the beginning when they started doing the 0.75 increases that, that was a shock to the system. Cause we're used to freeing money for so long. But that wasn't healthy. It wasn't healthy, it wasn't bolstered a lot of things.

That's why we have inventory shortages all across the nation world for everything from chips to eggs to toilet paper to cars, right? Absolutely. All right, Scott, the reason why we talked earlier last week, you wanted to talk about a new loan idea, and I'm excited to hear more.

Can you hear me? I think I lost you a little there. Vito, can you re Yeah, go ahead and try that again. , you, we've been talking, you and I have been talking for the last time. I'm at the bottom of the ultimate. Is that good or bad? We're good. Okay, good. So you've been talking about this new loan product that's out there.

Yeah. I wanna learn a little bit more about it. I'm excited to hear about it. I didn't ask you too many questions, but I wanna see what this is good for our consumer friends out there. You got it. This is a kind of product that I think a lot of people are not aware of.

And it does exist that is really going to help a lot of borrowers that fit this particular niche if you will. I'm gonna read the loan program mission. And try to not crash here, but I wanna get it word for word. The loan program's mission is to empower the dreams of diverse homeowners and underserved communities by providing non-traditional access to prime capital for underbanked borrowers and communities.

That's why we have inventory shortages all across the nation world for everything from chips to eggs to toilet paper to cars, right? Absolutely. All right, Scott, the reason why we talked earlier last week, you wanted to talk about a new loan idea, and I'm excited to hear more.

Can you hear me? I think I lost you a little there. Vito, can you re Yeah, go ahead and try that again. , you, we've been talking, you and I have been talking for the last time. I'm at the bottom of the ultimate. Is that good or bad? We're good. Okay, good. So you've been talking about this new loan product that's out there.

Yeah. I wanna learn a little bit more about it. I'm excited to hear about it. I didn't ask you too many questions, but I wanna see what this is good for our consumer friends out there. You got it. This is a kind of product that I think a lot of people are not aware of.

And it does exist that is really going to help a lot of borrowers that fit this particular niche if you will. I'm gonna read the loan program mission. And try to not crash here, but I wanna get it word for word. The loan program's mission is to empower the dreams of diverse homeowners and underserved communities by providing non-traditional access to prime capital for underbanked borrowers and communities. So that's the mission of the product, but don't let that fool you because it is actually a product that's open to everyone. Okay? And I have used this product quite a few times already for clients. Very effectively. And let me tell you, to lend on this product, the institution that does the loan has to be what's called C D F I certified.

They have to have a c d FFI certification, which stands for Community Development Financial Institution. And that gets around the atr, the ability to repay situation that we have to follow as lenders to make sure we're not putting clients into loans that they can't. One of the ways they're gonna look at this is they gonna look at, the down payments gotta be strong.

First of all the credit score has to be reasonable. It doesn't have to be perfect. The client has to show the ability to have money in the bank left over, which we, in the lending world, call reserves, right? Take the monthly payment and multiply that times, 12 months 18 months, or whatever that may be.

If they can show. And then they can qualify for this program. So let me give you a case study or two that's perfect for this product case study one. I had a client several months back. She was a teacher making a modest income. The father had just got out of, a stressful job and wanted to take time off with the new baby.

And they were gonna be living only on the wife's And they had just inherited about a million and a half bucks from a family member that had passed away. So essentially they found a wonderful home they wanted to buy in Livermore. They actually, believe it or not, had two other rental properties that they were generating income on, but they were not reporting it on their taxes.

So I could not use that as income. So all I had was the teacher's salary. So this product was, They had the 12 months reserves we needed, they had the 20% down we needed, and they had the credit score at the time. The credit score was 700 for 20% down. They have since upped that to seven 20 and just tightened it a little bit.

Fast forward a month or two. They're in a beautiful home, and they've got

I think they put 30% down. Actually, they still had a million dollars to live up to in addition to her salary. So it was a perfect situation where o otherwise they wouldn't have been able to buy a home. The second scenario that we just closed actually, I'm sorry, we're about to close on it right now.

And this is a situation where a mom whose husband just passed away has a 25-year-old daughter. Hallmark. Okay. So she doesn't have a really huge income, but, they had to sell their home. The husband passed away and the mom couldn't afford to make the payments anymore. She wasn't working.

So the daughter and the mom said why don't we buy a home together? I don't have a salary, but my daughter does. Thinking that they might be able to afford something. Traditional financing was not gonna solve the problem because the income was not. For the daughter, but the down payment was there.

So that's the mission of the product, but don't let that fool you because it is actually a product that's open to everyone. Okay? And I have used this product quite a few times already for clients. Very effectively. And let me tell you, to lend on this product, the institution that does the loan has to be what's called C D F I certified.

They have to have a c d FFI certification, which stands for Community Development Financial Institution. And that gets around the atr, the ability to repay situation that we have to follow as lenders to make sure we're not putting clients into loans that they can't. One of the ways they're gonna look at this is they gonna look at, the down payments gotta be strong.

First of all the credit score has to be reasonable. It doesn't have to be perfect. The client has to show the ability to have money in the bank left over, which we, in the lending world, call reserves, right? Take the monthly payment and multiply that times, 12 months 18 months, or whatever that may be.

If they can show. And then they can qualify for this program. So let me give you a case study or two that's perfect for this product case study one. I had a client several months back. She was a teacher making a modest income. The father had just got out of, a stressful job and wanted to take time off with the new baby.

And they were gonna be living only on the wife's And they had just inherited about a million and a half bucks from a family member that had passed away. So essentially they found a wonderful home they wanted to buy in Livermore. They actually, believe it or not, had two other rental properties that they were generating income on, but they were not reporting it on their taxes.

So I could not use that as income. So all I had was the teacher's salary. So this product was, They had the 12 months reserves we needed, they had the 20% down we needed, and they had the credit score at the time. The credit score was 700 for 20% down. They have since upped that to seven 20 and just tightened it a little bit.

Fast forward a month or two. They're in a beautiful home, and they've got

I think they put 30% down. Actually, they still had a million dollars to live up to in addition to her salary. So it was a perfect situation where o otherwise they wouldn't have been able to buy a home. The second scenario that we just closed actually, I'm sorry, we're about to close on it right now.

And this is a situation where a mom whose husband just passed away has a 25-year-old daughter. Hallmark. Okay. So she doesn't have a really huge income, but, they had to sell their home. The husband passed away and the mom couldn't afford to make the payments anymore. She wasn't working.

So the daughter and the mom said why don't we buy a home together? I don't have a salary, but my daughter does. Thinking that they might be able to afford something. Traditional financing was not gonna solve the problem because the income was not. For the daughter, but the down payment was there.

So we got them into contract here just recently. I think it's down in Gilroy on a beautiful home. The mom's gonna be able to move in and the mom is going to be getting a job again, but she's not ready for the job right now. So they're gonna put down 450,000, they'll have a hundred thousand left over.

There is no income-to-debt ratio qualifying. So typically this would not work. The other scenario I mentioned would not work. So you can see this fits a niche for people that have money, can make the payment, but can't prove it, or will be using the cash they have in the bank to allow them to comfortably live with this mortgage payment.

That's awesome. This is really I was just imagining you can use it for small business owners, people that don't necessarily, report all income types of things. Where they have money in the bank mattress money. Now, do they have to show where the money has been sitting for a couple months?

Usually it just, I, they require about a month in the bank. And this does work for what you're talking about. And let me just pivot off of that for a second. Notice neither of these people was self-employed, but they had income and they had cash. I would probably use a bank statement program or a 10 99 program as my first option for someone like that.

And the reason I would is that the interest rates are going to be a little bit better than the program I'm mentioning. So the program I'm mentioning, you're gonna be paying probably at least two and a half percent higher. For this product, it's because there is a total risk for the lender to not do any income qualifying.

We don't even put a job any job information on the application. That's how barren it is. If we're gonna do maybe a self-employed person that has to allot of deposits has 10 90 nines, but maybe they just write off a lot and they can't use the tax returns, then I'll use a non-QM product.

And that's going to save them some money. They really don't need this product. Okay. Got it. I understand Now, okay, so this one right here, you said two, two and a half percent hit on the interest rate. So if it's 6%, you're looking at 8%, but you're getting them into a house. Yeah. And there, there's a couple, there's a, yeah, there is a couple tier.

If you have 20% down, just let's talk about that 12 months. Seven 20 FICO score minimum if you can put 25% down 700 FICO score, minimum 12 months reserves, if you can put 30% down, you can get away with six 80 FICO scores and condos must have 25% down. Okay. Okay. Yeah. Yeah. All right. And one other thing.

So we got them into contract here just recently. I think it's down in Gilroy on a beautiful home. The mom's gonna be able to move in and the mom is going to be getting a job again, but she's not ready for the job right now. So they're gonna put down 450,000, they'll have a hundred thousand left over.

There is no income-to-debt ratio qualifying. So typically this would not work. The other scenario I mentioned would not work. So you can see this fits a niche for people that have money, can make the payment, but can't prove it, or will be using the cash they have in the bank to allow them to comfortably live with this mortgage payment.

That's awesome. This is really I was just imagining you can use it for small business owners, people that don't necessarily, report all income types of things. Where they have money in the bank mattress money. Now, do they have to show where the money has been sitting for a couple months?

Usually it just, I, they require about a month in the bank. And this does work for what you're talking about. And let me just pivot off of that for a second. Notice neither of these people was self-employed, but they had income and they had cash. I would probably use a bank statement program or a 10 99 program as my first option for someone like that.

And the reason I would is that the interest rates are going to be a little bit better than the program I'm mentioning. So the program I'm mentioning, you're gonna be paying probably at least two and a half percent higher. For this product, it's because there is a total risk for the lender to not do any income qualifying.

We don't even put a job any job information on the application. That's how barren it is. If we're gonna do maybe a self-employed person that has to allot of deposits has 10 90 nines, but maybe they just write off a lot and they can't use the tax returns, then I'll use a non-QM product.

And that's going to save them some money. They really don't need this product. Okay. Got it. I understand Now, okay, so this one right here, you said two, two and a half percent hit on the interest rate. So if it's 6%, you're looking at 8%, but you're getting them into a house. Yeah. And there, there's a couple, there's a, yeah, there is a couple tier.

If you have 20% down, just let's talk about that 12 months. Seven 20 FICO score minimum if you can put 25% down 700 FICO score, minimum 12 months reserves, if you can put 30% down, you can get away with six 80 FICO scores and condos must have 25% down. Okay. Okay. Yeah. Yeah. All right. And one other thing..jpg) If you put 25% or more down, you can set this up as an interest-only payment, not on the 20% down. Oh, I see. Yeah. That's running against, so you're a little bit more flexible with cash flow. It makes it a lot more affordable. When you're using interest only, you're just not putting away in principle.

If you put 25% or more down, you can set this up as an interest-only payment, not on the 20% down. Oh, I see. Yeah. That's running against, so you're a little bit more flexible with cash flow. It makes it a lot more affordable. When you're using interest only, you're just not putting away in principle.

non qm loans, no income verification mortgages, DSCR Mortgage, no ratio, Assumable, v a mortgage rates, mortgage rates non owner occupied, review mortgage lenders,

.jpg)

Comments

Post a Comment