Highest and Lowest Sold Homes in Santa Clara, and Guest Hector Ramirez

Highest and Lowest Sold Homes in Santa Clara Tuesday, Feb 7th, and Guest Hector Ramirez

http://blog.abitano.com/2023/02/highest-and-lowest-sold-homes-in-santa.html

https://youtube.com/live/X2nmmXAk0P0

Highest and Lowest Sold Homes in Santa Clara Tuesday, Feb 7th Guest Hector Ramirez will talk about the market from a lender's perspective.

loan applications, rates, what the next rate fluctuation will be, and what that will look like with our market. This is good folks! You have to listen in! Vito Scarnecchia Realtor®, Broker, Veteran, Dad DRE#: 01407676 Website: abitano.com UPDATE YOUR HOME VALUES HERE https://get.homebot.ai/?id=04198407-86e6-4db0-8902-ddf0de6dbabc If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents! Book appointments here: https://calendly.com/abitano/15min Home Buyers Course YT YouTube.com/SanJoseLiving IG https://www.instagram.com/abitanogroup/ FB https://www.facebook.com/vito.scarnecchia/ LI https://www.linkedin.com/in/vito-scarnecchia/ Blog http://blog.abitano.com/ POD https://spotifyanchor-web.app.link/e/oxdH1Hwfcvb Professional Photography by Kim E https://photosbykime.com / Compass site: https://www.compass.com/agents/vito-scarnecchia/ VydeoEase.com- video post-production service for business marketers. $5 trial- Use Vito50 when you sign up… Video Marketing Course for Realtors https://karincarr.samcart.com/referral/O0FGKRS3/0orWK4vK5bAYBD6E Try Streamyard! https://streamyard.com/pal/5353055951519744

Transcript

How are you doing? I'm doing awesome. Yeah. Got you. To sit down, write at the chi hair, your chinch in

there. It's the story of my life, Now you know what the story of your life is you get shit done before it

becomes an emergency, and when you need something done, call Hector and it gets done right then and

there.

That's the whole point of Hector. Absolutely. We prioritize. It's important before it catches on fire. And I

think that's the kind of the name of the game of this business, right? Like before we know it, things move

and shift and gosh, you've seen it. You've been in the business a long time.

What's interesting is that despite how much, we watch and read and listen. Things continue to change

right before our eyes. Some of the stuff that we talk about and expect and other things are just the way

the world is today. And obviously, it's our job, if you will, to stay on top of everything.

And to provide more importantly. solid advice. Provide very good advice to clients. And yeah and here we

are, right? I know it's Tuesday, February 7th, dude. Last month just blew by. I've been busier than ever

before. I've been working with a few listings, and I'm working with a lot of buyers.

Buyers have entered the market. It's crazy. Wow. Awesome. Then we should be sitting down That's what

we're gonna talk about today. Let's get your pipeline on the display here and let's go

over it. Yeah, let's call every one of them. Plug them. Calm Live Guys Meeting.

Hey Jen, you're live on YouTube now with that approval? Yeah. So rates have been going up and down.

What's going on with what's, what's going on? Tell me for sure. I think the big news that surfaced over the

last week is that the Fed has raised rates again.

And what's interesting is despite that, one of the biggest fallacies is that every time they raise rates that

mortgage rates also go up. And that's not the case, right? The Fed is here to control. Our monetary policy

and they don't like things being too hot or too cold.

They like things staying just lukewarm. And one of the tools that they use to do so is the federal funds rate.

So it's a rate at which banks exchange money, and it's the rate that we as a consumer I guess you could

say, pay for when we finance a vehicle. When we charge money on a credit card or when we exercise

some cash from our home equity lines of credit.

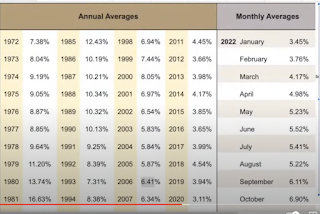

And the good news about interest rates is that we've seen a very steady decline since about October.

November. And we've seen rates drop about 1%. . So that's been good news. And I feel that's a huge part

of why you were busy today, right? The reality is that news and media affect the consumer, right?

And, with a few months of rather steady and lowering interest rates, we've seen a significant rise in activity,

particularly over the last. in the mortgage world, one of the ways that we, I guess you could say evaluate

activity is by mortgage applications, right? And in January they were up about 30%, right?

That means that people are approving, and submitting applications. We're running credit, we're approving

them to buy. You guys tend to see a lot of activity in open houses. That's one barometer you guys use,

right? And then obviously, ultimately what's on the market also, and then what goes into contract, so our

rates have been declined. I think today, the standard 30-year fix is about 6.3%. Okay? And for, and many

scenarios are currently under six. Okay. And for a moment here we were under 6% and so we're settled

into a very normal interest rate range, right? And I think that's also in part what's helping our consumers

come out of the woodwork cuz step, step forward again and say, Hey, why don't we revisit this, right?

Because what happens with interest rates going up is the effect afford. We just simply can't qualify for as

much home and our monthly payments go up and we saw that happen significantly last year. And it peaked

in October. And I think a lot of that conversation, we were talking about, there were, there, there are

opinions out there that we're thinking we might hit nine and 10% and I didn't think that was entirely wrong.

We almost hit about 8%. But I think a lot of that, to be honest, is probably behind us. It's probably behind us.

And I think this is a new norm. And I do feel that moving forward later on this year, q2, q3, and four, we're

gonna see rates continue to go down a bit just a little bit, right?

I think our new norm is probably gonna be somewhere in the five. And which I think is great, right? Because

it allows. Bars to qualify for more, and it's just a happy medium that I think is gonna work for us. And I think

you mentioned it yesterday when we were talking on the phone, everybody was used to, it for a year and a

half.

Free money at two and a half percent. That's why everybody jumped in. And the backlash of that is when

you can afford more, then you have to put more into the house. That means you pay more for the house.

So it stays the same. It makes it frustrating cuz we're used to seeing 1525 offers per house.

Now we. have 15, 25 houses for every buyer. But that's gonna normalize and it is normalizing, right? It did

shift a little bit. I think the reality of that market that we were in the last few years is unrealistic. That's not a

regular market. And the thing is that in human nature, we have very short-term memory.

We have very short-term memory. And we've never seen rates that low. And I just don't believe we can ever

get that low. Twos and low threes. That's just crazy, right? But when we look back before, BC before Covid

and historically over the last quarter years, we're in a very normal interest rate range right now.

Yep. And when we look at, all the other, barometers that you guys go off of, like days on the market,

percentage over asking, and all this stuff. We're in a very, I think very normal, very strong range. I don't

know you, you'd be better to, yeah, I mean I can go over just a high, so high and lows.

That's the whole function of today. Tuesdays we typically go over the highs and lows. And like yesterday this

last week we had 53 sales in Santa Clara County, which. Traditionally sales. I'm sorry, what was that? 50?

Yeah. 53 sales, single-family homes, right? Throughout the county.

Single-family, not PUDs, not townhouses, condos. We're just talking about single-family residences. 53

sales the week before. I'll put it on the mark on the thing real quick for you. Cool. Last week we had 60.

We have 59 houses sold. That means they got. They closed, right? So the houses are consuming.

People are out there buying. And two weekends ago I had no two open houses. Sunday we had 16 sets of

people during the finals, during the niner. Finals during the football game, and we still have people showing

up. People are serious. Yeah. The serious buyers are still out there.

When it's raining and people going into open houses, yeah. It means that the market is serious, right?

Yeah. Not absolutely. There are fair-weather buyers out there all day long. And there's fi there's still those

buyers, and we talked about them yesterday. There are those buyers that have been on the fence for

10, 15 years and I'm gonna wait for the market to crash.

I'm gonna wait for the market to crash. That's crazy. The last. 10, 11 months is when the market crashed.

It didn't crash as we expected it to, but it went down a little bit. We saw five to 8% re-contraction, and

that's pretty much all you're going to get, right? Yeah. Houses are still selling for over.

Look at the one here in More Mountain View, right? I'm sorry, but the one here in Mountain View is it went

Look at the one here in More Mountain View, right? I'm sorry, but the one here in Mountain View is it went

for 131% over the list price. Now my contention on that is it should have been listed. , closer to 1.9. It is

listed at 1.4. . And then you look at the lowest list price of the sales price. This one Crescent Drive, it listed

it sold 73% under, because that was probably listed over cuz the house needed con work.

So it's all location, price, and condition. Yeah. So if you look at these houses, We get to this quickly. That's

one thing I've noticed, and especially in speaking with many colleagues like yourself, now more than ever,

it matters who you work with, right? Because Yep.

The houses that sit it's either, poor pictures, poor staging, or just in poor condition. . And exactly. So if that's

the case, then you just have to be careful how you price it, right? And it just seems like the house is in a

desirable area. They have great curb appeal.

They're moving, right? And then, houses that aren't, they're just not selling as quickly as they used to, right?

A year and a half ago didn't matter what heck it was gone, in a matter of days, it seemed like it did not

matter what condition it was. Back before it was really easy and you get the thing, it's so easy to sell houses.

No, it's not. Because when the market turns or you have an overpriced house, how do you deal with that?

And this one right here, this Crescent Drive in San Jose, is listed at 1.99. The listing agent, I'll tell you right

now, the listing agent didn't say, Hey, we should list at 2 million.

It was the mindset of the seller saying, my house is worth 2 million. There's another house over here on

Hu, you and I talked about it with another client of ours, right? It, they think the house is worth $2 million

and it's listed at 1.6. Now. They had it listed before, but nothing. Crickets. Now it's down to 1.6 and now

they're getting a little bit of feedback.

It's the same thing right here, right? , this one's in a lot better condition than the one on haul. And that's just

the way it is. This one listed for $2 million and it went for 75%. 73 point whatever underneath. And then,

you're still, and then the most expensive house, it's $4 million.

Crazy, right? But it's a beautiful house. It's in Los Altos. Where is it? Look at that thing. The thing's

gorgeous. Love it. Big one story. But look at the staging, look at the coloring, look at the upgraded

everything. Those aren't the cheap windows that you get at Lowe's. Those are high-end Anderson. So so

what do you think, is it from a seller's perspective?

Is it a good time to. . Absolutely? Do we see a lot of new homes hit the market? Is that what our, inspectors

are saying? Is that what you're seeing around the office? Are homes coming to the market and is it a good

time to do so lie? We still have a very truncated low inventory compared to what we were seeing if you

looked at inventory.

I think, let's see if I have, Inventory. Inventory watch. This is San Jose Single Family Homes, right? These

numbers are right here. Last year we were at 500 600 homes, right? Right now, number one, January,

February and March are one of the slower times of the year, traditionally right?

March, April, and May is our selling season. So what happened was houses that naturally consumed, right?

Those are houses that sold. Houses got frustrated. So they took 'em off the market. They're gonna fix 'em

up and wait until March, April, may put 'em back on the market because that's what's gonna happen. So

watch when you see March has come around in three weeks, you're gonna see, a major spike in those

numbers.

In homes available for sale in the home. Yeah, these are the inventory homes right here. I'm not talking

about actual sales. This is just San Jose, not Santa Clara County. So just Santa Jose. Got it. Cause I had, I

did a call with a group last week and I looked up in Santa Clara County, 989 homes, condos, and

townhomes.

With a population of what, 2 million people. It's crazy. And then 529 were under contract. Santa Cruz County

speaking to another group. They had 209 for sale, 209 with 84 in the contract. And that just seems just like

extremely low inventory, which to me would say, Hey, if I have something for sale I would want to.

in the market now, right? Because fewer options, chances are you're gonna land a better offer, and as long

as you don't let your ego get involved, your house is gonna sell, right? Understand that you can't control

what buyers are gonna want or what they're willing to pay. You might think, oh, my house is worth 2 million,

and it sits for six.

And then you're gonna blame the agent, right? It's not the agent. The agent's gonna tell you, these are the

comp, this is what I suggest we do. This is a course of action and every time you question that, it's just

gonna wind up hurting your chances of having a smooth sale, right? Sure. You want to have multiple offers.

So you can use leverage. When you have one buyer coming in and saying, I'm gonna pay you 20% or 25%

of the list price, what leverage do you have? You have none. Exactly. So it behooves you. If you're gonna

work with an agent, listen to them. and especially, and you might think, oh, there are only 250 houses in

San Jose that are actively for sale.

Yeah. But there are also a lot of houses that are 90 days on market. There are 144. Now, this is multiple

counties, right? Multiple counties. The 10 counties and Monterey counties. Do you ever have a challenge?

Do you ever challenge this? Have you ever run into just difficulty with trying to and just both sides actually,

like whether you're trying to list a property or making an offer to determine what the value of the house is?

Do you ever, is it something that's challenging to explain to a client or even to yourself? You've been in this

long time but regardless is that ever a challenge? It's always a c. Wow. It's, it always is, and you. It's

because people come from the mindset of, I need this money, I need this amount of money, and because

this is my retirement.

I need this much. If you come from a point, a mindset of abundance and you need to trust the person you're

gonna hire, then you will be. and selling the house, there's a strategy that's behind it and different agents

have different strategies. Mine is typically listed a little bit lower, about 5% lower than what the market

commands and let it happen.

And within days, I will get offers, right? I, it just happens when you list it low below the market, right? If the

market's saying, here are we coming right here, you're going to get offers, you're going to get two or three

offers, and it. When you're, when you don't trust me and you challenge it and you say, I need to have this

much money, we'll work with you.

But then, that's what happens. That house on, I think you're right. You've gotta trust, you gotta trust who

you hire. Yeah. If you're going to work with somebody, I think that's the key, right? Is that you allow that

professional to work, right? And follow.

And then the other thing too is after I want to say 25 years, we've had a little bit, a couple of little hiccups,

right? We had 18 months from 2008 and then 2018, but for 25, 25, and 30 years, it's pretty much been a

seller's market. And now for the last, what is it, 18? 10 months, no. Yeah. 10 months.

The buyers are saying, you know what? I'm tired of listening to what sellers want. It's my turn. It's not a

buyer's market. Absolutely. But I'm gonna be a whole lot pickier. Absolutely. They're just not willing to pay at

any cost to have something. And what's interesting, I saw this stat last week cool.

We've had a steady appreciation for basically exactly 10 years. 10 years in one month. Steady appreciation.

And for the, with the, except the last five months. So for the last five months, like even in our local area,

we've seen flat to slightly negative growth. Slightly negative growth.

Just, super interesting and it speaks to what you're saying, right? We're, for the most part, the seller's been

in control. And, it's been a competitive environment for our buyers, and a big part of that, with the fact that

the last five months have been leveled to a slightly negative is part of the reason that I'm on here today.

And I think it's more important than ever, especially for the first-time home buyer to take advantage of this

right, this window. If things continue. To trend with interest rates coming down. I, we're seeing it already.

Our activity's starting to pick up. Now I'm not sure if it's gonna be the way it's been a frenzy that it's been

the last couple of years.

But I think that presents a unique opportunity right now for buyers, especially first-time home buyers, right?

Especially our buyers, the majority that just don't have, an unlimited stack of cash, right? That doesn't have

an extra hundred, 150. To potentially move up or cover an appraisal or what have you.

Yep. And I think now more than ever it's a great time to sit down with your lender, and with your realtor and

discuss where you're at and be realistic about what you can qualify for and see if you can get into the

market. Because the weight strategy just does not pay off.

Not anymore. Over the. Nine months, 10 months was the time to do that. And I think what we're seeing now

is the market's coming back, there are still houses out there that have been on market for a long time, 45,

60, 70 days. And those are gonna get, those are overpriced.

And then, there's they're eventually gonna get frustrating and go away and cancel out or expire. There's

gonna be those numbers of sellers that are gonna be willing to work with you, especially if you're an. An

upward seller. If you're selling upwards, like you have a three bedroom, two baths, and you want a four or

five bedroom, two bath, larger home, or you wanna move to a different area, you're gonna need to take that

equity out of that house and move it into another one.

There's a contingency when the market's crazy hot. They don't want to, and the sellers don't want to see the

contingencies cause that's a risk to them. There's a likelihood that we'll be talking about bridge loans and

our buy-before-sale program again, very shortly. Yep. Yep. Yep. I know even you and I have been

successful against some clients over the last, six months and right now getting them to transition from one

house to the other by doing it in that manner.

Traditional, Hey, let's put your house on the market, and then let's go write another offer. And, I'm hearing

you and you're right. It's like our window to do that may just be, diminishing very quickly. Yeah. As we're

seeing activity starting to rise again. Yeah. Starting march is when the market starts to heat up, right?

That's our selling season, March, April, and May. And you mentioned something about May 10th talk about.

So May 10th. Yeah, absolutely. So really what we look at and is what we're, what we follow closely and the

whole, really the whole purpose of what the Fed's doing by raising short-term rates is to get a handle on

inflation, right?

And inflation is the arch-enemy of mortgage rates. Okay. And how it's measured is it's measured year over

year. Okay. It's measured year over year. So we know that, for instance, the fall of last year and the fall of

the year before 2021 is when inflation started to go up.

And then we felt it all last year and it was, gosh, eight, eight-something percent. And with the fed's actions,

we're starting to see it go down, right? I think it was six and a half percent last month. And so what we're

doing is we're evaluating inflation last year, where it was over the next couple months, March, April, may,

okay.

And based on inflation going down, We expect it to appear, right? Cause we're comparing it to last year,

which was high, right? And we have lower numbers coming in this year. Now, if it appears inflation's coming

down, that's gonna be very positive for interest rates, right? And one of the greatest minds in the mortgage,

Barry's hubby, that's his forecast.

And many of us follow him very closely. He's very good at what he does. Many of you have probably seen,

them on, many shows and he's one of the best out there for sure. And this is what he's saying, and he

called November 10th, to be honest. And that's this, of this pasture and that's really since our rates have

been declining.

And now we're, again, we're comparing higher inflation rates over the next couple of months. And so we

see that's going to fair very well with the markets and it'll be favorable. And so we shall, we should see rates

continuing to decline and. may, we should see a nice little drop-off, which will only drive more sales and

more buyers into the market with lower interest rates.

Yeah. And so I think it's a really important date to keep in mind. We're already seeing that, and it doesn't

mean that look, rates are volatile, right? Like they're gonna go up and down. But they're continuing to

trend in a very. Direction. And we think that by May 10th or after May 10th, we'll see another pretty good

drop-off.

That should have us in the 5%. But what happens when the rates go down? More buyers enter the market.

Yeah. Affordability goes up. Affordability goes up. And that was one of the things that even though last

year, from a price perspective was very good too. What held the buyers is the fact that they couldn't afford

as much, right?

And their pay or their payment was much higher than what they were comfortable with, right? This is why

we started seeing, interest rate buy-downs and temporary buy-downs, and different tools to help buyers.

Cope with that higher payment at least until rates come down further, marry the house, not the rate or date.

The rate. Is that what people were saying? Yeah. That was pretty popular out there, and kinda so about that.

But yeah, that's the truth. We want to give solid advice, right? When we're gonna someone to invest in

any property. Yeah. That's a general idea, right?

That rates don't last forever. Anyone who's owned a home understands that every typically four to seven

years, there's typically an opportunity to lower your payment, right? Or travel equity, right? Understanding

that and just really planning, working with a good advisor, and strategizing and planning what works best

for you is super.

I a hundred percent agree. It doesn't matter. I'd love it if you use me, but if your advisor, if your realtor is, in

the North Bay and Santa Rosa, you need to trust that person and understand that they know that market

so much better than anybody else. And yeah, you might know your micro.

Mark it, right? You might know your street and the five streets around you because you keep an eye on it

and you get the little flyers whenever you walk around and whatever you know what that is. A typical real

estate agent works in one and a half counties, so they're not gonna know every street that you market

unless they live in your area.

Like I live on Mountford Drive and 95, 1 23 is my zip. And I know that like the back of my head, I look at it

every day, what's going on? What is the inventory, like, where the rates are falling, is it up and down? Is it,

what's the average? How many houses sell over the listing price? All that kind of stuff. You need to know

that kind of stuff because if you don't and somebody goes, Hey veto, how's the market doing?

Then you look like a schlub and that's why I do these so that I get into the practice of saying, Hey look, I

know. So that's the same thing with your lenders, right? If you talk to a big bank Chase or whoever, you're,

the minute you write that application, you're gonna be handed off to a processor, and then you're gonna be

handed off to a second person, a third person, and a fourth person, and you're gonna have to have

five, six, or seven different phone numbers.

Trying to figure out where your loan is, where your loan app is, and where's your loan approval. The

challenge is just, and I don't like to talk down too much about competitors, but the reality is it's just, is just

that you don't know what you're gonna get. Yeah. And I think as a consumer, and also you know, being one

at one point, it's just important to have options, right? It's important to work just slightly would work with a

local realtor. You should work with a local lender. And someone who has a lot of options. I think that one of

the most important things as an advisor is to be able to present several options to a client.

Many times there's no right or wrong, but there's one that's better for you. And it's important to know that

and understand. So many times consumers rush into finance. And it's wrong. It's the most important part

of a transaction is to understand not only what you approved for, but what those payments look like, what

options you have, how tax benefits work, what are your closing costs and what that entail, right?

We get so hung up on rates and want to compare rates in an environment like this. People are always

searching for something that's not there. And we find other lenders often do bait and switch, right?

Everyone gets hung up on a rate. And what we don't understand as the consumer is what is the cost of that

rate.

And would that still make sense? Sometimes looking at a lower rate makes zero sense, right? Especially

with us expecting rates to go down, right? So it goes beyond a rate. Buying a home is probably the

largest purchase you'll. And you want to look at every aspect of it and feel comfortable with who you're

working with because it makes all the difference when we're writing when we get to write the offer and

we're presenting on your behalf and negotiating that you're working with the right individual.

And. That I think, is the most important thing. That's huge when you have relationships with other agents

and you're like, Hey, it's Hector, and the other agent on the other side is like, Hey, Hector loved you on

the last. Transaction. This is gonna be a slam dunk. I know it, right?

I mean that. You don't get that talking. One of the most important things we do as a lender and an agent

when we're, when we're presenting, excuse me, when we're when we are presenting for a buyer, is that we

help the selling agent sell to their client.

We help them present. We help them. effectively explain our story to their client. And the goal of that is if

they have two offers side by side and they're the same, but we've done a very good job to separate

ourselves from the pack, then if two things are equal, we're likely going to get, either the counter or the

acceptance.

And that's the name of the game, right? Is to not miss out on an opportunity that you want, and yeah. My,

I'm a broker, but my office manager says it's true. It's like relationships matter 110% in this market and

working with the wrong agent.

Somebody has a bad name, a bad reputation, or it's hard to work with. It's just gonna make it more difficult

for you to get into a. Or solar. Do you know what sucks about that? Do you know what sucks about that?

a, from the real estate or the lending side, is you as a consumer, you don't realize that until it's too late.

You don't realize your loan went sideways till you're trying to close. And now it's just a very hectic, stressful

situation. Yep. Until you run into problems down the road. Everything's, hunky-dory up front. With rate,

what have you, but as you go on and it's almost like it's too late to turn around, that's when the problem

problems exist, right?

That's when things come up and, a lot of times that's where you can tell the professional how well they

handle it and how well they, navigate those rough waters, but yeah, just, more important than ever

especially in this changing market, to know who you're working with and trust 'em because it makes a

difference.

Yeah. Dude, it's been 32, or 33 minutes. I appreciate you coming on board. You gotta do this more often.

We should anytime, like once a week. Anytime. If you put me. I'm happy to talk. I'm doing stuff like this all

the time. I'm following the markets. I like to think I'm a wealth of knowledge, but I do enjoy what I do.

I do like sharing what's going on. One of the most important things is that as an advisor, we're sharing

data and information, right? I, we, I can, something I willing to be true. I can say it over and over Tom Blue

in the face, but if we show you and we talk about, statistics and rates and data it.

should make sense, right? Yep. And it really should help, our clients and the consumers out there to really

understand when it's the right time for them. Thanks so much for your time, Vigo. I always enjoy it. We're

long overdue for lunch or a sit-down, so we'll also knock that out in the next week.

I seem to remember the last time you and I went to lunch, I had to get driven home. Yeah. But I'm not

doing that much anymore. I haven't had much to drink. Not that I'm an alcoholic, cause I just lost my taste

and I stopped drinking. Oh. And I've lost so much weight. Not weight.

I've lost a lot of, I know. I went on a dry January. and I haven't, it's just I feel good, it's great. I'm more of

like a weekend guy, and so here we are. It's what, February 7th? I'm still rolling. Actually. I do lie though.

I did cheat. Went to the Niner game in January, had some friends, and had a couple of pops.

We won that game. . But since then it's just been, it's been cool. This was just a nice change and a little

more clarity and I'm hoping that the waistline is. Starts to improve too. . Anytime you want to go on a hike

when you're here can. Yeah, man. Sounds good. Do that. And then, every morning I'm there at six o'clock

in the morning, so I'm happy to shit hang out with you and get you in the gym there a little bit.

Appreciate it, man. Always appreciate it. We'll look forward to the next week. All right. I'll see you next week

. All right, have a good one. Thanks, guys. We'll talk to you later. You betcha. Take care.

Comments

Post a Comment