🚨 🔴🎧 Real Estate is Still STRONGER than Last year | one company owns more than 9,000 homes in California | State of the Market SAN JOSE 40DOM. 🦅 🌎 ⚓️

https://podcasters.spotify.com/pod/show/siliconvalleyliving/episodes/Real-Estate-is-Still-STRONGER-than-Last-year--one-company-owns-more-than-9-000-homes-in-California--State-of-the-Market-SAN-JOSE-40DOM-e2ctdgl

#REWTF of the Week

One company owns more than 9,000 homes in California

Financial Intelligence https://docs.google.com/forms/d/e/1FAIpQLSc0R5pjHIAPguZ5GDEB-fTbGJXKpWK3coK9Khymv_GTWkMnyQ/viewform?usp=send_form

Home search: https://www.onereal.com/vito-scarnecchia-1

🚨 🔴🎧 Real Estate is Still STRONGER than Last year | One company owns more than 9,000 homes in California | State of the Market SAN JOSE 40DOM. 🦅 🌎 ⚓️

#REWTF of the Week

Fraud on the rise http://blog.abitano.com/2023/08/title-theft-is-on-rise-what-is-it-how.html

One company owns more than 9,000 homes in California

Local Real Estate Market and Home Value Report https://hmbt.co/bT7qRJ

MARKET SNAPSHOT

Morning, morning real estate WTF of the week. Fraud is on the rise. One company owns more than 9, 000 homes in California. And a local real estate market. What else? Market snapshot. We're going to go look at San Jose. Let's go.

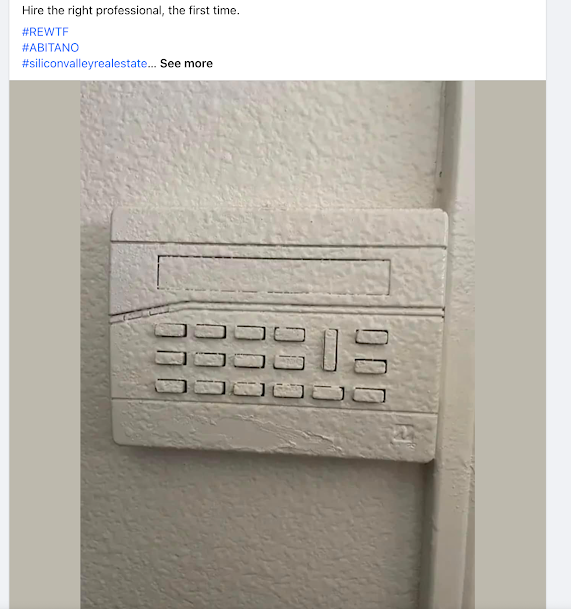

Real estate WTF real quick. I want to make sure that we take a look at this because I always say you hire the right person for the right job Not because they're cheaper not because the cheapest people cost money It costs a lot of money to live in this valley cost a lot of money to live today pretty much anywhere the same time You get shoddy workmanship like that.

What are you going to do?

It's always better to get a referral and see the person's work, but not always because I did a tile job. I gave a new guy, a new tile guy a job to do my master and he did a horrible job. I popped the tile pops and just didn't know what he was doing. But, uh, I gave him a chance because he was. A referral but the referral is the guy just I don't know.

I don't he probably underbid the prop the thing He wasn't the cheapest, but I never go with the cheapest guy. Anyway, there you go R e w t you know what you're doing when you're talking to a painter tell them you want your doorknobs removed before they paint not just taped you want the hinges taped up, right?

Common sense, stuff like that, just, that's just horrible. That's I don't know. I don't know what to say, to that guy. Anyway. Yesterday I spoke about three 89 uh, for gas. I went, I actually went there because I have a listing that we'll talk about in a second near Central Road, Costco. And that's exactly it. I paid 3 and 89 90 cents for a gallon of gas, even though I was three-quarters full. I felt like I had to. So there you go. Okay. Now this is what is a little more serious.

One company owns more than 9,000 homes in California

Local Real Estate Market and Home Value Report https://hmbt.co/bT7qRJ

The guy who reported this is Ryan Lundquist. He's an appraiser up in the Sacramento area. He's also my muse for all the charts that you see. Every chart that, not everyone, but a majority of the charts that I show off today are because of this man right here. And he has the same mindset as I do. You can go to the Sacramento appraisal blog if you want.

He's a very competent appraiser. He knows the market and he shows it. He was talking about this right here. Now 9, 000 homes. I want to show you this little thing too. This is from one of the. marketing companies that I follow who own all the single-family rentals in America. This is America-wide, 80 percent are mom-and-pop, and over a thousand or 3%.

So this is the small part of the market. I don't know if I agreed to this. Mostly because if you think about it, the haves and have-nots, the haves are all the way at the top of the market. And then you look at a thing like this where, holy crap, they have 9, 000 homes that they own in California, LA, by far as the far, biggest 2, 500, almost 2, 600 and Sacramento area is 1, 700.

So they definitely have a foothold in this. And the name of the company that owns it is Imitation Homes. Jump over to their site right now and it's all about rental. Their pitch is to live a free, freer life in Lisa House growing up, even before I knew owned a house, I knew that I had to buy a house because that was my launch into financial freedom, not freedom, but stability.

When you lease a house, somebody else's house. Now it's a corporation that owns it. You're subject to their rules. If you want a dog or a chicken or whatever, you can't do that. Not that's a big deal because dogs do destroy your house as do cats. You can't paint, you can't do improvements. You can't remodel the kitchen if you really want it to.

And you're pretty much stuck with their rules. If they decide to sell it, they're going to evict you and move you on out to wherever you go. And then you have to pay market rent. And they're going to increase their market rent, their rent, your rent every year. It's just a thing. It's just the way it is.

Now you might have a nice landlord, a mom-and-pop that, Oh, I don't need you to increase the payment. But at the same time, you don't, a lot of people don't have that choice. And I'm not against this. This is the American way, right? The halves get to do this. I'm thinking of even investing in this because as a stakeholder, I can make some decent money off of this and they're nationwide.

So if you don't want to invest, and I think Grant Cardone mentioned this a while back, he doesn't own the house he lives in. He rents it, but he does not own real estate because there are tax reasons to do that. And there's nothing wrong with that. If that's a financial strategy that you're working on, you should absolutely do that.

I don't know what it's like to work with these people. I don't know what it's like to rent from these people. I don't know how they deal with you, right? But I, just have one more level of inconsistency in my life that I don't want, which is why I'm in real estate. I understand the process. I understand the value of owning a home, buying a home, and the emotional turmoil that goes through buying and moving and setting up and settling in.

Yes. Meditated for me because I've done it so many times, but when you're doing it, it's a process. When you lease a house, you have the same process. You might have to move next year because they decide to sell the house or their rent goes up too high and you have to find a lower cost house. When you buy a house, you're economically locked in unless you refi, which is, another concrete conversation at the same time.

There you go. Okay. So Ryan continues to show how many homes are all over. Now, the reason why I'm against this is because it makes it less affordable for Americans, single-family homeowners. For homeowners to buy a property this actually increases the price because there's less Supply out there for people to buy a house and own and these are just regular homes guys These aren't brand new homes a lot of them are but a lot of them are just standard

Let's see some thoughts. Main Street and fading Wall Street. Sobering to see this company's holdings on the neighborhood level because it starts to feel really personal. This is a very local trend, not just the national state where we can say invitation home zones, about 80, 000 units across the country.

That's almost a percent. That's crazy. Anyway, there needs to be a discussion here. What, is this what America should look like? Should big companies become giant landlords? How does this evolve in the future? How does this affect affordability in neighborhoods? We already, I just talked about this. It makes it less affordable because there's less supply.

And when there's less supply and consistent demand,

there used to be an affiliate

they bought it 5 to 11 years ago. I would love to see them start selling off because that would help increase the supply and reduce demand.

This is a great time for them to sell. Think about it. How do I get this data? Difficult to track because so many DBAs over 15. It's the same thing with open doors the same thing with Zillow and again, this is done by a human being and as amazing as he is, he's not perfect So don't expect it to be exact, right?

Right Sherry you can share this link. There you go I have a link to this map in all the links all the content below and on my blog please make sure you do it I'm going to actually take that. There you go. Is it a good thing? I think it's hard. It makes it more difficult for a family or a single person to buy a home.

I don't think single-families were built too, or single-family homes were built for corporations to own and manage. I get it. I want to buy more homes manage them and be a mom-and-pop. I want to be these guys here. I want to be the regional investor more likely, but it windfalls once you start buying one and two listings or houses, then you start buying more and more because it becomes more affordable and more efficient, the more you do it, which is where they're getting this right now.

They're making tons of money left and right on that. Okay. Enough said on that. What's next?

Fraud is on the rise, guys. I say it a hundred times. If I can't say it more than enough, watch this video. The links are down below. Check your title. Make sure that somebody hasn't forged your name and stolen your title. You should do this once a year. If not, every six months. It's just to protect you. Do it for your parents, too.

MARKET SNAPSHOT

Local real estate market report. You can get that here if you want. Market snapshot. There you go. That's it right here. Let me move this out of the way. So you can see the history a little bit. So phase 12, six, only 18 more days till Christmas. 153 days on the market 107. That number is growing. I killed this because I just went to Santa Clara County.

I went to the 10 counties for REOs or 71. That number. Stabilizing. Same with the REOs all over California. REOs are bank-owned properties, real estate owned. That's their term. We have 217 homes in San Jose available for sale right now for realtor.com. But if you look at the actual MLS feed is 360. It just goes to show that there's no consistency in those aggregator companies and websites.

So if you want true up-to-the-minute information, Work with a list, a real estate agent closed last week. We had 65, which is not bad. We're at about 61 on average throughout the year. So nothing's really slowing down. There was a hot part, but there was also a slow part. So on average, we were at 61 closes last year.

We were at 93. You're like, Hey, why is there such a big supply? We just talked about invitation homes, but it's not, they're not the only ones, right? The average list price is one six, three, three. The average sale price is one six, eight, or three. Let this week, the averages are right here for the year to date. And this is the average list price from last year.

We did have a dip last year and we're coming back. So yeah, we have that's just the weekly. So that's not really anything different. On average, we're only 23, 000 different from last year's average sales price. The median is 1. 6 and 1. 5. Overall, we're still selling over the list price on average.

I think it was 30. What is it? 30 38 sold over list price out of the 65 that sold so it's not big numbers But we're still at about a third of the homes are selling for over list price best That's because most people most home sellers listen to their agents' sage advice of listing low and selling high We go through this every day every all the time nothing That will never change, especially in this area.

If you're up in Sacramento, it's a little bit different. If you're in a different area, it's a different strategy. This is the strategy that works in Silicon Valley for now. It could change tomorrow, right? Last year, days on the market, it's much slower, but we're still seeing it. But we're also seeing a trend of lower than list price last year because the market was slow.

Now we're back to normal, even with high-interest rates, even though they came down. We have 35 houses pending so far this month, this week, or this last week, and the last list price decrease and TFTs are all pretty nominal. There you go. Okay. That's it for now. Tomorrow we're talking about,

tomorrow we're talking about the inventory watch across the United States. Today we talked about the San Jose snapshot. And also the 9, 000 homes owned by a one corporation in California that owns 80, 000 homes across the nation. We'll see out there. I'm Vito with Abitano. We'll see you out there.

Real Estate agent near me, Realtor near me, Campbell, San Jose, Silicon Valley, retirement, empty nest, Financial Intelligence, Best Realtor Santa Clara County, google jobs, apple careers, apple jobs, meta jobs, Hewlett Packard, Oracle, Intel, Cisco, Facebook, Broadcom, Adobe, eBay,

Comments

Post a Comment