Housing market crashing? Silver Tsunami from an economic view (Los Gatos Home of the Week)

- housing market crashing?

- Los Gatos Home of the Week

- Silver Tsunami from an economic view

- Santa Clara County High and Low

Housing market crashing? Silver Tsunami from an economic view (Los Gatos Home of the Week)

Is the housing market crashing?

Introduction: Is the Housing Market Crashing?

Is the housing market crashing? We'll find out. We're also going to talk about the Las Gatos home of the week, the silver tsunami from an economic point of view, and Santa Clara County's highs and lows. And also I want to repoint out a video I did a couple of minutes ago or a couple of days ago. I don't think I did it enough.

I want to really re-emphasize what I'm talking about here. And unfortunately, I lost the data. I lost that sheet. So I have to go recreate it.

Los Gatos Home of the Week

Las Gatos Home of the Week: A Detailed Review

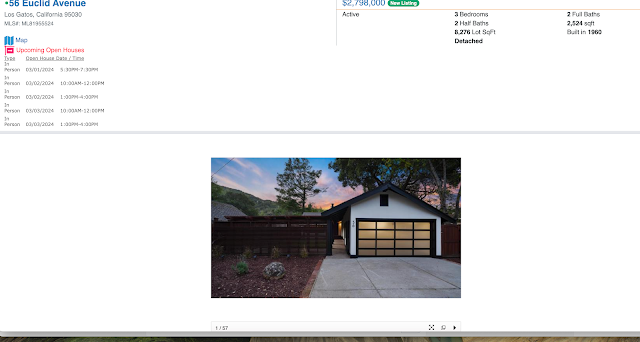

Anyway, Las Gatos, is home of the week. This is Euclid. It's a 3 million, three bedroom, two bath built in 1960, completely redone. It looks nice inside, 2, 500 square feet, 3 million.

And here's my problem with this. They're probably going to get it to remember what they say about one thing you have to know about real estate location. Look at it. This is a gorgeous house. It's completely done up beautifully, right? Let me do this again. There we go. Let me show you this one.

Let's start over again. This is Euclid Los Gatos. This is Los Gatos home of the week. Take two

3 3. 3 bedrooms, two baths, two half baths, 2, 500 square feet built in 1960, but it's gorgeous inside. It's amazingly gorgeous. Let's take a look inside here. All right. There we go. Now we can do that. Look at that. Gorgeous.

Wow. Wow. It's just amazingly beautiful. Now, the good thing about this on the exterior part is, look at that beautiful stove top, no cheesy backing thing there that they have the controls there. They have the glass refrigerator. I'm not a big fan of that, but whatever. It looks good. I like the blue kind of sharp, stands out.

It's better than, Dated ruby red, cherry red.

Okay. So you can do a little bit more of a stand back or have a wider photo, wider lens on that. See, it's a gorgeous house, a big house, and it sits next to the trail in Los Gatos, which we're going to see on the map. That's really cool. That just caught my attention. That's a beautiful picture.

What the hell's going on there? Can't have straight beams. You have to have a wavy beam. I don't get it.

That's a little busy.

Nice pantry. That is a nice pantry. So well a well-thought-out pantry. Okay. So there you go. Las Gatos home of the week. Let's take a look at the map. You ready? Where's the map? Where's the map?

It has everything going for it. Los Gatos, is a beautiful house, except for one thing. You have to go a long distance away to get there. You can walk to the main street in downtown Los Gatos. Which is great, but you're right on the freeway. You're right on the freeway and That would be a major no for me. So I don't care if it's a hundred dollars or three million dollars.

I'm not gonna buy it.

Silver Tsunami from an economic view

The Silver Tsunami: Economic Implications

So there you go Silver Tsunami from an economic point of view now This whole thing is from freddie mac one of the main players in the home mortgage industry And they're the ones that actually Set up the guidelines and how to create fair loans. So this is our contribution from the mortgage standpoint.

Our contributions to the mortgage to the entire GDP, right? So anywhere from two to two and a half percent, we contribute to the entire GDP. Revisions of nonfarm unemployment. I want to get into that. Distressed sales as a share of single-family residents and vacant units are massively low. This was 2008, 2009.

So whatever data you're seeing or whatever videos you might be seeing that are saying, Oh, REOs or bank loans are coming back. They're not. They might have ticked up a slight bit. And if you go from here to here from this little point of view, Yeah, that's a tick-up. But it's nowhere near what we're seeing.

What might be the bastion and savior of our pricing? Of this market is the aging boomers' impact on the housing market. Now, 60, the youngest boomer is 60 years old. Boom, right there. It also means that these people, these boomers are going to go into retirement and a majority of them are going to go into retirement communities or move.

It's called empty nesting, which means that they might open up supply. And what have I been? Yelling about is that we have zero supply. We have a very low supply. And once this starts happening, it'll be another problem where maybe we start developing more senior communities a little bit further up. It's still close.

You're connected to the family, but you still have a destination to go to. I don't know, but a lot of boomers, a lot of older people tend to live in their house. And there's a reason why you want to live in your house until you pass away. If you have a trust, and only 5 percent of the people that I've ever surveyed have a trust, you get to transfer Your ownership of all your assets to your heirs, whoever that might be without having to go into probate.

But that's not the point. You also get a cost basis step up. So if you bought your house for 50, 000 and now it's worth 500 or 5 million. 500, 000 or 5 million doesn't matter. Once you pass on, you get to have a step up in cost basis, and your heirs or your spouse gets to enjoy that. So if there's a couple and one of them passes away, then the other one gets to.

Sell that house with a stepped-up tax basis enjoy that tax break and move to another place. So they get to take all that equity without having to pay taxes in California. You might have to pay income taxes. It all depends on all that stuff. I'm not a tax advisor and I'm not giving tax advice.

Okay. But learn about that. So don't sell your property to your kids. Let them take it over when you pass on period. And if you're not going to do it, If you're not going to live in it rent it out because of the way the tax. So tax laws are set up is force us to hold onto our properties a lot longer than we should.

This is a 2,500-square-foot house and when my kids go to college and move out, there's no need for me to have this house, but I'm going to hold onto it because he continues to make money. And here's the reason why. Okay. So anyway, the bottom line of this is that 69 million boomers account for 21 percent of the population at 30 percent of the total.

Homeowners boomers are overrepresented in the homeowner demographic and tend to increase household age. See right here, as they start passing on and we start taking over, I don't want to say I'm a Gen X, I don't know whatever I, they're going to start increasing the supply because they're going to pass on.

And the way the rules are set up is that it forces the heirs, the children to sell the house, which is actually good because it reinvigorates the market. We need more supply. Anyway, if you watch this, I'd like you to watch this for a second. This is just a couple of minutes.

Let me know if you can hear this.

The Power of Equity: A Case for Home Ownership

Alright, so that shows you, in Santa Clara County, you're earning, if you own a house, you earn on average 377 a day. Why would I ever sell my house? It's just equity that I can borrow from, I can leave to my children, I can do a lot with it. My house is something where it's going to continue to increase cash.

Could World War III break out tomorrow? And all of a sudden all of our values plummet to, to, to ashes. Yeah, absolutely. Where I'm going right now is that's the foresight that I'm seeing. I should buy four or five more properties over the next five years and let that continue to go up. When you buy a house.

A lot of my buyers are like, Oh, it's so expensive. Yeah, there's nothing I can do about that. I understand that there's the median cost of a house, and if you don't make the median price or income, you're short on that. However, if you buy a townhouse and get into a house or something that's building equity, you're not making 377 a day.

377, that's 11, 000. A month that you're gaining in equity on average for the median price to offer average price house. That's 335 for the median price house in Santa Clara. Right?

But if you had 10 houses, you'd be making a million dollars a year, just an equity tax-free. So anyway, there you go. Yes, it's expensive to buy into it, but people get it. People that get it. People who don't think it's a scam. I get it. I don't understand. All right, we already talked about that.

Predicting the Market: Is a Crash Imminent?

Is the housing market going to crash? That's a great segue. Yeah, it could possibly crash. Absolutely could possibly crash. We don't know. Do you have a crystal ball? I surely don't. I don't know. But I'm looking at all the different signs. I look at the automotive market. I look at the credit card market.

I look at the healthcare market. I look at All the different pieces of the GDP from an economic point of view and try to figure out where we're going. And yes, you can have their opinion on every piece of the GDP, every industry that feeds into the GDP. You can say the stock market is corrupt. You can say our politicians are corrupt.

You can say all this other stuff. It doesn't matter because whatever's going on right now, it's still going well. Crash tomorrow? Absolutely. Could be a house of cards, right? It could be China's apartment-dwelling Ponzi scheme thing that goes, I can't remember that frickin name. I keep on remembering, forgetting to look up that name.

But,

high grand, high land, whatever. Anyway, I digress. It could be that. It could be sanctions that we put in place that are hurting China that could collapse the market. There's a lot of different things that could happen. Could it be Bitcoin that hurts the US economy? Yeah, there's a lot of different things that can do it, but it's such a huge economy spending trillions of dollars every year.

It would be hard to just stop it right now. There's something that could happen, right? Could be the abundance of shadow inventory of repossessed cars. In the U S market could be a ton of different things. We don't know. Is the housing market going to crash? That's, I don't think it is. And if you look at what's his name, Lawrence Yoon, our chief economist at NAR.

Yes, the same NAR that's getting sued. This guy's been around for 10 years. He's very well-trusted. He's a smart dude. Talk to him. I talked to Lawrence, the art guy from the assessor. I've talked to him.

There's not a lot that could be in our way. And even if the market does crash, it's something else. We're insulated in a very high-tech bubble. So yes, we see our market is cyclic. We have layoffs and then we have hiring. We have layoffs and then we have hiring. We have good times and bad times in the market chip industry and all the way out.

There's a big, huge explanation of that. But there are always jobs that are available here in this valley. Is the market gonna crash? Yeah, it could. It could affect everybody globally. Is it going to? I don't know. I don't think it is, but you can't take that to the bank. Please don't take that to the bank.

I'm buying another house.

The Microcosm of the Housing Market

So the other thing to keep in mind is we're a very microcosm of the entire GDP. So if you look at Santa Clara County and the 10 Bay area counties, and then you look at California and you look at the United States, every different County, every city is a microcosm and a microeconomic bubble that could pop.

So if I tell you to go buy a house over in St. Louis or, Moose Jaw, Moose Factory. Whatever in Canada and I tell you to do that and then the market bubble pops there. It's not going to affect over here It could Cause there's a butterfly effect, but probably not. And right now there are actually counties across the United States that are seeing negative equity.

I heard that it's happening over in Florida, but that's, I haven't really researched that. Different areas are seeing economic downturns, right? There are commercial properties that are seeing economic downturns. Even here, we've seen prices devaluate. So keep that in mind. All right. We're also doing a talk about financial intelligence, which is another channel I interviewed on.

I host, we interview people and we talk about that.

Santa Clara County High's and Low's

Santa Clara County's Highs and Lows

So this is the highest and lowest. Let me see. I don't think I. I did not set this up correctly. So let me get this really quick. The highest was 4. 7 and the lowest was 789.

It's actually two that made it. Okay. Quick.

Okay.

So glad I'm not recording right now. I'm not alive. Surely showed my ass on this one. Nine-five, two,

four, three.

Okay. All right. Today's. Highest and lowest of Santa Clara County. You ready? Let's get into this real quick. Copy of agent. Boom agent. No client page is full. There we go. All right. This is the highest-sold house in Santa Clara County. Let's see if I can make this bigger for you. There you go. Shrink it up there.

All right. The highest sold property in Santa Clara County is 4. 7 million. Started off at 4. 8 and was on the market for 22 days by bedroom three baths. This is, these are not my listings by the way. And it's a beautiful Shea house. You want to say it's custom, but it really isn't. They did some upgrades to it. But the reason why it's sold for so much is that it's a large house.

It's not nothing great. It's just a standard house. It's a large house. But it's also in Los Altos. So you're paying for a Los Altos zip code. That's why. And then the lowest priced house is Morgan Hill. 789, 000 two bedrooms, two baths. This is attached. Yeah. It's an attached house, which means it has HOA.

505, 000. Oh, man. Stay away from those HOAs. I am not a fan of HOAs. That's all I'm going to tell you. You have no control. You're basically renting the property. You have no control over what you want or how you want your house to look if you ever want to upgrade. So just not a big fan of it.

It's the highest list price to sales price ratio. Is it really? Oh, seven, nine.

I'll come back to that new system. I have to figure this out. Sorry. Oh, this is it right here. Three 11 highest. Yeah. Highest list price to sales price ratio. The list price to sales price ratio is. Let's

The highest list price-to-sales price ratio is Schofield Drive. Again, it's not my listing and it listed originally at 2. 5 and sold for 3. 32. It's a four-bedroom, three-bath built in 1951 and just under a third of an acre. And it's a fairly standard house in Cupertino. Let's take a look at the house. Ooh, basic.

Let's take a look inside. Okay. So everything's, updated, but not original, which is good. Let's take a look at the kitchen stove. Here's what my thoughts are. Somebody just bought this for the property for the land. Yeah, that's a foil. So it's like a sticker. They updated this You can tell because it has the grains just follow it.

So it's just a sticker. So what they're doing is they're selling this for the land. Once somebody is going to take this house, which is 1, 700 square feet, they have a third of an acre and it is right here.

Let me take a look. Stelling.

Yeah. So the value is in the land on this one right here. See. They're going to tear down this house and put a McMansion on it. Watch, call me in two years, Schofield, call me. I'll, we can take a look and I'll guarantee you that it's on sale for that. Okay. This is the lowest price.

It's the lowest list price sales price ratio, meaning start high, and try to be a market maker. Got shot in the foot and 134 days later, 134 days it took to sell it because of hubris, and ego. It says that the house is worth 1. 9 million, but guess what? Buyers told you otherwise. I saw this house. I saw it for months because we do a mountain view look and look, it's sold for 1.

6. And I can, again, this is sold for the property, the land, because look at this, you have to tear down that tree, that house just beats to hell, and you're behind a commercial property, so this is worth 1. 6 but here's the other thing too, you're right close to the freeways, I would never have bought that house.

You're doing yourself a disservice, but it is what it is. Land is tight. You can build a McMansion on it. That's great.

This is the highest-priced home for sale in Santa Clara County, 32. 8 million. And guess what? It's just land. I know it's actually a hotel. Look at that. Wait, why in the hell are you selling a house as a hotel? No, this is misrepresented. Okay. Sorry. We'll get to you next week. And this is the lowest sales price.

It's active for sale. It's on the market for four days right now. And again, it's only one picture. So I guess the value is in the land. Cash offers only will not qualify for net financing. There's a full basement with a kitchen and bathroom. Bring your investors a large lot. Yeah, look at that again. I can almost guarantee that it's going to sell for 700 that's newly parked right here, in Japan town new park.

That's the Apple campus going in.

Yeah, that's a good value for that. It's going to sell quick. I can guarantee you that thing's going to sell quick. All right. Today

Conclusion: The Future of the Housing Market

we talked about the economic point of view for the Silver Tsunami and the Las Gatas Home of the Week and why renters are losing money every day. 377 in Santa Clara County. Holy crap. The total median price. We didn't talk about that. We did. Is the housing market going to crash? And we talked about the highs and lows of Santa Clara County.

I'm Vito with Abitano. Have a fantastic day. Have a fantastic day. We'll see you out there.

Vito Scarnecchia Real Estate Broker, Veteran, Dad DRE#: 01407676 408-705-6817 Vito@abitano.com Website: abitano.com https://www.onereal.com/vito-scarnecchia-1 update your home value: https://hmbt.co/bT7qRJ RELOCATION@ABITANO.COM FREE DESKTOP APPRAISAL https://www.propertyrate.com/agent/vitoscarnecchia If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents! Book appointments here: https://calendly.com/abitano/15min Home Buyers Course YT YouTube.com/SanJoseLiving IG https://www.instagram.com/abitanogroup/ FB https://www.facebook.com/vito.scarnecchia/ LI https://www.linkedin.com/in/vito-scarnecchia/ Blog http://blog.abitano.com/ POD https://spotifyanchor-web.app.link/e/oxdH1Hwfcvb Professional Photography by Kim E https://photosbykime.com / Local Real Estate Market and Home Value Report https://hmbt.co/bT7qRJ Financial Intelligence https://docs.google.com/forms/d/e/1FAIpQLSc0R5pjHIAPguZ5GDEB-fTbGJXKpWK3coK9Khymv_GTWkMnyQ/viewform?usp=send_form https://www.onereal.com/vito-scarnecchia-1 Willow Glen's five most expensive homes https://youtu.be/3A_E2ck0ePg

Fraud, Homebuyer workshop, Bay Area housing stats, Veteran Home, best time of the year to buy a house, Bay Area Luxury homes, next housing crash prediction, housing market projections, Should I Buy A House Now Or Wait?, should I buy a house now or wait until 2024, Why You'll Regret Buying A House in 2024, Housing Market 2024: 5 Options If You Regret Buying a Home, when will the housing market crash again

Comments

Post a Comment