U.S. House Price Growth by State in 2024 | Beware of these hidden costs before you buy a house

The Growth in U.S. House Prices by State in 2024

Introduction to House Price Changes in 2024

Changes in house prices, 2024 from 2023. How much does it cost to maintain a house? Homes from Apple, home of the week in Mountain View, home of the week, REO, bank owned, and the last three, the seven days of sales report. Super exciting stuff. Okay.

Regional House Price Trends

Let's take a look at this one right here because it's pretty important that, you understand where we are compared to the rest of the nation.

Delaware and New Jersey happen to have the highest growth out of everything. In Vermont, look at that, 12%. Everybody's rushing to get out of Florida because of the high cost of insurance and going back home. Illinois is 9. Wisconsin is 9 or almost 10.

California is a poultry 6. 3%. Why is this important? It is where the prices remain the same. It could indicate where the Investors are spending a lot more of their money, meaning inventory is tight or tighter in those areas, who knows, but it's just something to keep an eye on.

If you want to look at this, it breaks it down all the way through 12. 8, New Jersey, 11. 9. These are changes in, quarter by quarter. So quarter one, 2023 quarter one, 2024. There you go.

Hidden Costs of Homeownership

Beware of these hidden costs before you buy a house

How much does it cost to, have hidden costs? I thought that originally I thought this was going to be about selling your house or buying a house, but it's not.

This is more about maintaining your house and you do have to maintain your house. Even if you're a renter, you should be maintaining the house, taking care of the appliances, taking care of the flooring, taking care of the windows, et cetera.

State-by-State Maintenance Costs

This is more about if you're an owner and how much it costs per state. To maintain your house. This came from the bank rate and we'll go into that a little bit, but it's on average 18, 000 per year, but that's not that bad.

It's 26 percent higher than it was four years ago because of inflation. Inflation is killing everything and everybody right now, right? Or hurting everyone and everybody. I clicked on that link. Brought me right here. Talk about the bank rate. I go to bank rate quite a bit This is the average right and it says right here 18 000 value that and it says redfin but red this is from Fred It measures these by the month and it tells you where we are.

The median price is now over 400, 000 in the United States. It's over 900, 000 in California and it's over 2 million in Santa Clara County. That's median. Our median, our average price in Santa Clara County is 2.3 right now, California is one of the most expensive places to live just to maintain your house.

It costs about 30, 000 a year to maintain a house. That's the average. Does everybody take care of their stuff? No, not really. Hawaii is also the most expensive by 29, 000. There's a chart down here. I'll let you take a look.

Impact of Inflation on Homeownership

Why are homeownership and maintenance costs higher now? Inflation.

We're spending trillions of dollars or printing trillions of dollars. And every time we print a dollar, your saved dollars become less and less valuable Consumers are also continuing with after effects of pandemic-driven inflation.

It's not just a pandemic. It's the fact that we're spending money, throwing money at wars that we shouldn't be involved in.

Most and Least Expensive States for Homeownership

States with the most expensive homeownership are Hawaii, California, Massachusetts, and New Jersey. and Connecticut with the least expensive homeownership Kentucky, Arkansas, Mississippi, Alabama, and Indiana.

If you want to look at it, these are the charts. Again, in the comments below is a link to my blog. Click on the blog and I'll take you right to these articles.

Featured Homes of the Week

These are houses, the House of the Week, close to Apple Corporation. This is Warbler, it's a three bedroom, two bath, built-in 1955. Nice little ranch house for poultry three, 2. 4 million dollars.

And if you want to know exactly where it is right, Apple's right here, so yes, you can still walk to it. This, I believe, is Kaiser, yep, that's Kaiser, and then that's Apple.

That's the location. Let's take a look at a couple pictures.

Home Inspection CHECKLIST HERE

New roof new windows new flooring

It's hard to cough up two and a half million dollars when it's original kitchen You have to put another hundred thousand dollars into a kitchen if you want the ability to live close to Apple That's what it's going to take, just so you know, this segment of this episode is brought to you by the free home buyer checklist.

FREE HOME BUYER CHECKLIST HERE

This checklist goes through every little aspect, but when you're looking at five, six, or seven different houses, it allows you to compare and contrast every house that you went to because there's a little checklist that tells you to house one, house two, et cetera, and you can do it yourself.

Mountain View home of the week

You can make it up in your own spreadsheet. But this is done for you. It's easy. It's free. Download it. All right. Mountain view home of the week. I picked it because it's within walking distance of Castro Street, which is the place to be. This is a two bedroom, two bath. 1400 square foot house built in 1938, 3.2 million. And it looks like it's a wood shingle roof. That's awesome. You can't even get insurance on that. You can, but you have to go to AAA and then it's super expensive. I think these are called bungalows. The look and feel of a bungalow. Somebody wanted to go high-end. I don't know. That's just not my style. Sorry. Not for that small of a house.

Big enough rooms. That looks like a queen size bed. Original bathroom. Off-bedroom for your kid. Yeah, there you go. All right. Pass on that one. Bonato.

Bank-Owned Properties and Market Strategies

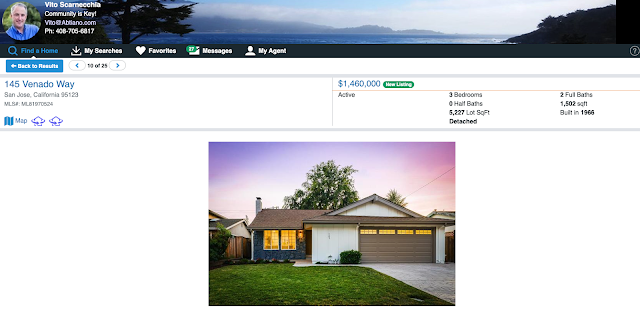

This is a bank-owned property. It's still 12 days, three bedrooms, two baths. This is pretty much turnkey guys. You can walk into this thing and just be amazed. Now, here's the thing, all these ads saying, Oh, you can buy a bank on property.

You're going to get a great deal. You're never going to get a great deal here in California. You just don't, you just have to figure it out. And I can tell you right now that there's a certain waiting period for homes that are bank-owned The disposition companies say you have to wait 15 days or 20 days to expose it to the market, right?

Why is that? Because when you look at putting a house on the market, You want to expose it as long as you can build up that buzz and then see what offers come in. It's a normal thing. So look, this thing's completely turnkey. Do you think you're going to get a good deal on this house right now? I can bet that there'll be 25 offers on this house,

right? When you list a house with an agent and they tell you they have an off-market offer, say no. Look, we have this thing like it's called coming. It's called members only, but it's coming soon, right? We are allowed to put it on the MLS drum and drum up some excitement with this coming soon.

What they, I think it's horrible. It's a horrible strategy because you're not exposing it to the market, the true market. You can't see it. Sometimes you can see it. Sometimes you can't. I think it's just a horrible strategy. It really filters out. Potential buyers. And if you take an offer off the market, you don't know what that house really will give you substantiate.

I've done it once in my life and I felt it was a horrible deal for my seller. It worked perfectly for him because he didn't want to have a lot of people coming through. He was older. He wanted to move into a retirement community. So we took the offer, but I feel like we didn't expose the house to the market.

We didn't give the house. The potential of finding out where the market really is for that house. And I felt I could have got him a little bit more money, but he wanted to do it. So against my advice, he took it, it was a split level. It was a good-looking house and those people were happily living there.

Final Thoughts and Safety Tips

And the last thing is nothing super crazy going on. There are no spikes that I'm really worried about. We're still very low in inventory now because we are going into the holiday weekend. And speaking of the holiday weekend, be safe out there. Make sure you don't go to the emergency room, and keep a hose and a bucket near you if you're doing fireworks or the fireworks display. I'll let you watch this for a couple minutes. Have a great Fourth of July. I'll see you in a week and a half.

Nobody will watch your 4th of July Fireworks Video

Vito Scarnecchia Real Estate Broker, Veteran, Dad DRE#: 01407676 We’re Hiring! 408-705-6817 Vito@abitano.com Website: abitano.com https://www.onereal.com/vito-scarnecchia-1 update your home value: https://hmbt.co/bT7qRJ RELOCATION@ABITANO.COM FREE DESKTOP APPRAISAL https://www.propertyrate.com/agent/vitoscarnecchia If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents! Book appointments here: https://calendly.com/abitano/15min Home Buyers Course YT YouTube.com/SanJoseLiving IG https://www.instagram.com/abitanogroup/ FB https://www.facebook.com/vito.scarnecchia/ LI https://www.linkedin.com/in/vito-scarnecchia/ Blog http://blog.abitano.com/ POD https://spotifyanchor-web.app.link/e/oxdH1Hwfcvb Professional Photography by Kim E https://photosbykime.com / Local Real Estate Market and Home Value Report https://hmbt.co/bT7qRJ Financial Intelligence https://docs.google.com/forms/d/e/1FAIpQLSc0R5pjHIAPguZ5GDEB-fTbGJXKpWK3coK9Khymv_GTWkMnyQ/viewform?usp=send_form https://www.onereal.com/vito-scarnecchia-1 Willow Glen's five most expensive homes https://youtu.be/3A_E2ck0ePg

Comments

Post a Comment