Carter’s presidency Delivered almost Double home price gains

- Santa Clara County High's and Low's

- Carter’s presidency was No. 1 for California home-price gains

- Los Gatos Home of the Week

- Price Reductions

- FREE HOME BUYER CHECKLIST HERE https://abitanogroup.com/Homebuyerchecklist

- Home Inspection CHECKLIST HERE https://abitanogroup.com/homeinspectionchecklist

Introduction and Overview

Carter’s presidency was No. 1 for California home-price gains.

President Carter's presidency saw almost doubling the price of homes in California. That is on top of this week's highs and lows. Tuesday, Los Gatos House of the Week.

And, price reductions and price reductions. Let's get going here. Normally I do this in the morning. It's three o'clock in the afternoon because stuff got busy. All right.

Historical Home Price Trends

Carter's presidency was number one for California. When you look at the numbers from, every four or eight years, President Carter saw a huge Jump in home values in California. This is after years of massive inflation. Torturous home losses people going broke and massive layoffs and hey, guess what? We're in the same throws right here right now We're seeing unprecedented Inflation and crazy market shifts.

Talks about employment, unemployment, and different things going on. This is very important and timely not a big fan of what Carter did. He was a paper tiger as far as being a president, but I respect him because he held out. He was the oldest living.

President after the term, but also he was a major player in Habitat for Humanity. And I used to be a pro bono, pro tem broker for Habitat for Humanities. So I think it's a great program. He did a lot for his country, even though he wasn't that effective in the hostage negotiation, during Carter's four years in the Oval Office, California home prices jumped 90%.

Now, granted, we had the inflation thing going back. But look, if anything is telling you that things What we just see the last couple of years, the last four years, massive inflation, doesn't matter who did it, I don't care who you blame, My point is that there is a position here for people to see a doubling almost of their home values all across the nation.

If you look here, from 2021 to 2004 Bush, he saw 82% in California in 85 to 88. Ronald Reagan's, this is after Carter saw a robust economy and 58% higher home prices.

And rates dip 2.2 points to 10.8%. During Obama's reign, we saw 42 percent home gains and we were all happy about the 4. 2%, right?

FREE HOME BUYER CHECKLIST HERE https://abitanogroup.com/Homebuyerchecklist

Current Market Analysis

Joe Biden's term has seen a 33 percent jump in California prices, but the push for an economic recovery from the pandemic fueled another inflation outbreak, forcing rates to go up, and now we're seeing 6.

8%. And we don't know if that's going to go down this year. We just don't know, but I'm telling you, figure out how to make it happen because now is the time to buy, get your butt into real estate. Trump's first term saw 24 percent and we saw historic lows of 2. 9%. That was because we were in the pandemic and we needed to keep the economy going.

Reagan's first term saw 13 percent and 13 percent interest rates. Crazy. George H W only term prices increased by 12 percent and we saw 7. 7%. Clinton, we saw 7. 8%. During Obama's first term, we saw 7 percent depreciation, which, was, I think the. Com bust and rates were down to 3. 5.

So there's stuff that we can do to trigger it. This isn't just a myopic view of the economy. This is just part of the GDP. A small portion of it is real estate. It's important to know but we have technology medical healthcare research and all these different things affecting it, this is one of the main drivers.

So when you look at the. Percentage, the rates that we're looking at. We're also looking at business rates, cashflow rates,,s and personal loan type rates as well The housing crash, of 2008 prompted 18 percent losses in California, 18. So everybody's telling me, Oh, I'm holding out.

I'm holding out until there's a crash. You only saw an 18 percent loss. It's 180, 000 off of a million dollars. It's not a huge crash. If you look over the last five years, four years, houses are almost, I would say they're close to 80 percent all through California. So there's another thing that I want you to look at right here Fred's account.

All these gray columns are recessions that we saw. There's the pandemic, there's 2008, dot com, 1990, 1980. So just remember, what we're looking at here is

When recessions happen, prices tend to increase. This is Carter's reign right here, a little dip, but it came right back and there's that flat-lined out. In 2001, prices went up and in 2008, we saw an 18 percent drop. That's what it was. And now we're here and people are telling me all throughout the last five, 10 years, I'm going to wait for a crash while if it goes down 18%, You're not getting the great deal you think you're going to get. You might, but you might have to rebuild that house. Enough said.

Home Inspection Checklist

Home Inspection CHECKLIST HERE https://abitanogroup.com/homeinspectionchecklist

This segment of this episode is brought to you by the Home Inspection Checklist. If you're thinking about selling your house, download this checklist because it will help you get through your honey-does and anything wrong with your house.

Get everything repaired, disclose it, and then bring your inspector in and then you have a nice clean report.

It might've been originally built, but this thing has been remodeled. This is like the. Winchester Mystery House of Los Gatos. You can see this low ceiling. Very typical of that. So this might've been a ranch house or a farmhouse at one point and then rebuilt. Love that pool. I just did a pool inspection today.

Price Reductions and Market Insights

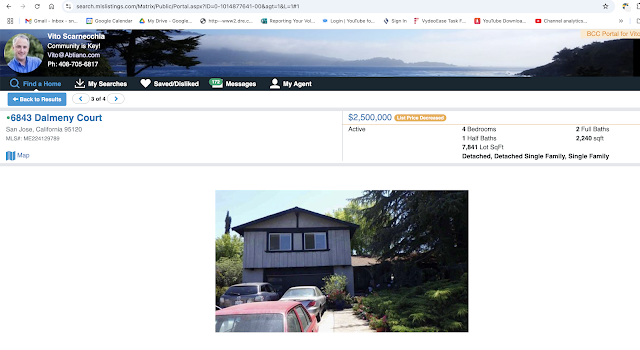

Price decrease of the month remember you can attract the market or you can try to be a market maker. This house is. Valued at around two and a half million dollars other houses in the Almaden area are going 2. 3 to 2. 3 million and more.

But for a standard house, this is a standard house. thThere'snly one picture. That means, probably having problems getting into it because there's a tenant that's refusing to move. You can see the schleppy cars and the exterior is beat up, not very well taken care of.

It's four bedroom, two-and-a-half bath, 2200 square feet, 7, 800 square foot lot. And how old is it? It's 52 years old. So 71. All in all, it's a decent house. What do you know inside? You just don't know. And one picture is not going to sell the house, especially if you're trying to be a market maker sitting there.

The original list price was 2. 875 and it sat on the market.

39 days. And I have a feeling it's going to stay there. This house is really worth one seven to one eight. The seller said, Nope, I'm not going to sell it. I don't have to sell. I want two and a half million dollars. I would never have taken that offer,

Price reductions. Okay. And then highs and lows. I'm going to go backward.

Highs and Lows in Santa Clara County

Santa Clara County High's and Low's

The most expensive house sold in Santa Clara County is El Monte Avenue in Los Altos original list price is 8. 5 117 days it took to sell it for 88 points something percent at 8. 3 million dollars. This is a five-bedroom five and half bath for 5100 square feet and four-tenths of an acre.

Not much to look at in this house. Pretty standard. For this price, it better look good, better feel good. But you get the difference, right? Eight million dollars for that. Crazy. The lowest sold house. The original list price is 915, 000. It's sold for 800, 000. 100, 000 less. Crazy. This is Main Avenue in Morgan Hill.

It's a three bedroom, one bath. Again, not my listing. 1, 000 square feet. 124 years old.

Let's take a look at this beauty. It's a standard ranch-type house, early 1900s, everything was long and narrow and you'd have to, there were no hallways. So this is pretty normal to see a house like this. You can see that there's an add-on here. So there's storage and entry.

Really what you're looking at here is the house and this is added on. Shed attached shed or if you're in San Jose that could be an ADU. The lowest-priced home in Santa Clara County is in Loma Chiquita. They just dropped the price to 400, 000. The only problem is it takes you an hour to get there

I did Google Maps from my house, it an hour to get there, with two bedrooms, and two baths. But the good news is, this is like a compound. So if you're expecting the zombie apocalypse. Or, an electromagnetic pulse, EMP attack This is a great way to protect your family for 400, 000 I feel like I hear the banjos playing in the background. Look at that caravan with the grass growing around it. Huh. And then the most expensive house available is La Vida Real. And it's been on the market for the longest time. A couple of weeks ago, another one took its place. That one sold. And this one is still at the same original price.

118 days. So five bedrooms, 12 bathrooms, seven and five half baths. And it's a mere 21, 000 square feet. It's just crazy, but it's in Los Altos Hills. Wish this was my listing. It's a beautiful house. There's nothing wrong with this at all. Look at this thing. Every nook and cranny, detail is well thought out, very well planned, done up beautifully, and very well manicured.

How can you say no to this? So if you have 37 million, just lying around, itching to do something, let's go take a look at this.

I'm Vito with Apetano. Thanks for watching. We'll see you out there.

Vito Scarnecchia

Real Estate Broker, Veteran, Dad

DRE#: 01407676

408-705-6817

Vito@abitano.com

Website: abitano.com https://www.onereal.com/vito-scarnecchia-1

update your home value: https://hmbt.co/bT7qRJ

RELOCATION@ABITANO.COM

FREE DESKTOP APPRAISAL https://www.propertyrate.com/agent/vitoscarnecchia

If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents!

Book appointments here: https://calendly.com/abitano/15min

Home Buyers Course

YT YouTube.com/SanJoseLiving

IG https://www.instagram.com/abitanogroup/

FB https://www.facebook.com/vito.scarnecchia/

TO https://www.linkedin.com/in/vito-scarnecchia/

Blog http://blog.abitano.com/

POD https://spotifyanchor-web.app.link/e/oxdH1Hwfcvb

Professional Photography by Kim E https://photosbykime.com /

Local Real Estate Market and Home Value Report https://hmbt.co/bT7qRJ

Financial Intelligence https://docs.google.com/forms/d/e/1FAIpQLSc0R5pjHIAPguZ5GDEB-fTbGJXKpWK3coK9Khymv_GTWkMnyQ/viewform?usp=send_form

https://www.onereal.com/vito-scarnecchia-1

Willow Glen's five most expensive homes https://youtu.be/3A_E2ck0ePg

Silver Tsunami, 2035 Housing, 2025 tax lien investing, Jason Walter, home staging kitchen, Cost Of Living Calculator, Fraud, Homebuyer workshop, Bay Area housing stats, Veteran Home,t this time of the year to buy a house, Bay Area Luxury homes, next housing crash prediction, housing market projections, Should I Buy A House Now Or Wait?, should I buy a house now or wait until 2024, Why You'll Regret Buying A House in 2024, Housing Market 2024: 5 Options If You Regret Buying a Home, when will the housing market crash again

<div id="homebot_homeowner"></div> <script> (function (h,b) { var w = window, d = document, s = 'script', x, y; w['__hb_namespace'] = h; w[h] = w[h] || function () { (w[h].q=w[h].q||[]).push(arguments) }; y = d.createElement(s); x = d.getElementsByTagName(s)[0]; y.async = 1; y.src = b; x.parentNode.insertBefore(y,x) })('Homebot','https://embed.homebotapp.com/lgw/v1/widget.js'); Homebot('#homebot_homeowner', '4d693c9051284a64d2ea56e95dfa5feb652a864126615eac') </script>

Comments

Post a Comment