🔴 yield spread to forecast recessions. 🚨 Inventory Watch

- The Great Deceleration, as told by one chart

- the epicenter of institutional home buying

- yield spread to forecast recessions and recoveries

- Inventory Watch

- What you get for $1MM Santa Clara County

5 things you need to know about Title Theft. Cyber Crime https://youtu.be/X1is7wVyeAA

start your home search here: https://www.onereal.com/vito-scarnecc...

I guess I'm starting early. Here we go. Three things you need to know living in Santa Clara County, Silicon Valley the great Deceleration is told by one chart. What does that mean? The epicenter of institutional home buying. And then yield spread forecast, recessions, and recoveries. And what you get for a million dollars in Santa Clara County.

The Great Deceleration, as told by one chart https://www.resiclubanalytics.com/p/g...

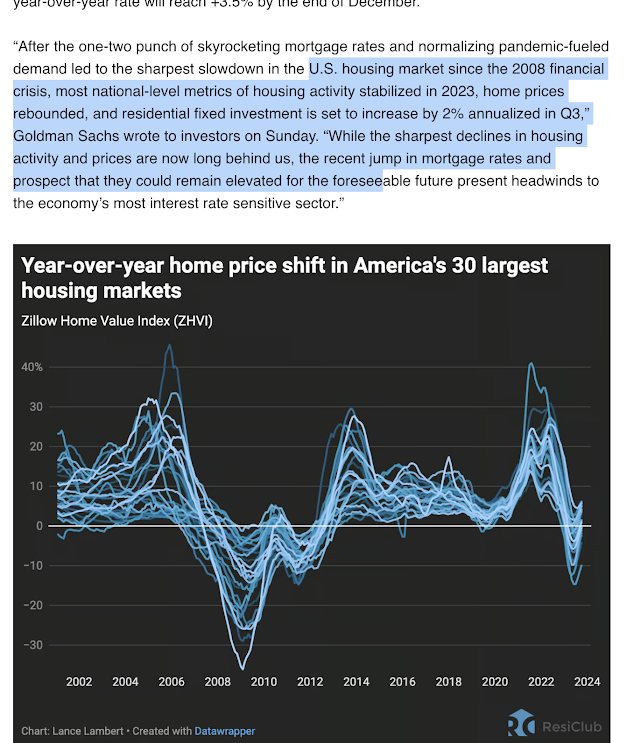

Give you my charts real quick. There we go. All right. Let's go into this. The great deceleration is told by one chart. We're seeing a deceleration in home price decline. If you look right here, you're seeing that prices are going to go up. Remember 2022, in April of 2022, rates went up to 7%. Shocked the market.

Everybody stopped buying. Everybody's freaking out. I'm going to wait until rates go back down to 3%. It's not going to go back down to 3%. It's Yeah, it's not going to go down to 3%. I hate it, I don't know how to explain it to you. It might be four and a half at one time. That's a great time to buy or refinance, but expect it to go down to maybe five and a half, 6%, maybe five on a good day, but prices remain stable.

Why? Because there's a lack of inventory and a growth spurt. We're having, our population is growing, although it's not growing like you think it is. It's growing. More and more people are trying to move to the U. S. In certain parts, which we'll get into, we're seeing declines and increases in other places.

epicenter of institutional home buying https://www.resiclubanalytics.com/p/r...

These are different places where institutional buying is happening all the time. However, Tampa is seeing an increase in inventory, which we'll get into in a minute. Phoenix is seeing an increase in inventory. Atlanta I think is seeing an increase. We'll see that. But here's the thing.

Institutional buyers will always be your competitors. Especially these days in the next couple of decades putting money in real estate is what people are doing That's what this is saying right here. And in 2021, we saw a lot of Institutional buyers we're talking about Blackrock and Vanguard as well as mom and pops that own less than a thousand units They're buying property To stave off inflation and increase their holdings.

And as part of their diet, what do they call it? And investing anyway, they, they spread load their money so that stocks and bonds, when they take a hit, they don't lose that much money. Using the yield spread to forecast recessions and recovery. We've talked about this over and over again. This is from the Federal Reserve.

yield spread to forecast recessions and recoveries https://journal.firsttuesday.us/using...

First Tuesday is a company that. Helps us with continuing education and they do a lot of great content. But every time we see the yield spread, the 10%, the 10-year and the two-year, three-year go below zero. That's when we can expect a recession. If you look historically speaking, that's where you see dips.

Every time we see a dip, we see a recession coming. That's why we're saying that there's a recession coming. Don't think for half a second that

Mortgage rates are going down eventually to bring it back up. But look at the pricing. This is the national house price index. Pricing goes up when, except for in 2008 when there's a recession. It's not a jump like we've seen in the last few years, but we're going to see rate value, and home values continue to rise.

What you get for $1MM Santa Clara County https://search.mlslistings.com/Matrix...

It makes it even more unaffordable for those of us who can't afford a 5 million house. What do you get for a million dollars in Santa Clara County? This one is in Almaden Valley. This one just popped up today. I just took a look at it I was going to look at it as three bedrooms, but then I jumped on really quick on accident.

This is actually scheduled for 745 anyway 990, 000 first day on the market was an open house today's Wild Creek Drive. I'll show you the map of a second three bedroom two half bath built in 1985 I'm, not a fan of 80s-built homes simply because of the materials that they use but this floor plan I think is pretty decent-looking.

Wow. Look at those old I mean at least I would have painted those guys, but for a million bucks, what do you expect now? Should you expect this to go higher than a million dollars? More than likely. Look, it's in pretty decent shape. There's nothing hugely wrong with it.

Hey Joe, if you're listening you just heard me mumble. So it's a standard home, right? And these homes built in the eighties they're tighter, smaller.

Lots, but it's the sense of patio living, right? These are called zero-lot line homes. My house is a zero-lot line home that was built in the sixties and let's see, there's an attached garage, but you see there's your back. That's your neighbor's fence right there. Is that a bad thing? I don't think it is because honestly, I have three walls to paint when I'm Painting my house and my neighbor's wall is built.

I have a Trellis in front of it. So you don't even know that it's my neighbor's wall. So it doesn't bother me at all Alright, there you go. And here's where it is. Let's take a look at it On a map, it's in South Almaden. So you have to go through the entire Almaden Expressway, but it's on the west side of Almaden Expressway.

This is where we live right here in Blossom Valley. This is Blossom Valley. Santa Teresa, Almaden. I have a house coming up right around here. Yeah, Estrade is right there. It's coming up right there. I showed you pictures of it a couple days ago. So that's what you get for a million dollars. This episode is brought to you by Know A Vet if you know a veteran.

And we're actually opening this up to seniors. So if you have, if you're having problems talking with your senior, how to say it to seniors. This book by David Soleil is amazing. I'm still chomping through it. If veterans are having problems with PTSD, drug abuse, homelessness, or whatever, this portal can help you help them, as well as help them.

Does that make sense? You can go there and ask for help, and get information on how to say it, and how to have a discussion with the veteran that you might be having problems with. Like I think I have PTSD longer story, but I just realized it over the last six months. So I have to go to the VA clinic and get diagnosed and see if that's actually an issue.

Now is that going to hurt me long-term for any other prospects for jobs? That's something that. We're talking about here at NOAA vet, right? And if you get lost or confused, there's a champion who can call you and help you get through this process. And all these different processes, all these different issues are there to help you help the vet.

And help seniors. This is actually, we're breaking this out to be more for seniors as well. All right.

Inventory Watch

Numbers aren't spiking. Inventory numbers are not spiking. As a matter of fact, San Jose's down a little bit.

Cupertino's down. Las Gatos is down. Saratoga's up just a little bit, but even across the nation, we're seeing houses increase. In, in, in numbers, but not dramatically. So I'm pointing out these two right here, Cape Coral. Let me see if I can open this up so you can see it better. Cape Coral has 54 homes per square mile.

There are 29 homes available per a thousand people versus San Jose, where it has 0. 28 homes per people. Are they going to see a crash? Probably not because of the ebb and flow of and since the seasonality of Cape Coral is snowbirds tend to fly in, buy homes now, and then in the summer they tend to sell off.

That's just the routine. But also Cape Coral has been hit by a few different hurricanes, so something to keep in mind. Probably why the inventory is going up. Same thing with Vegas. We're going to see a contraction of values here in Vegas. And one day I'll get my chicken sister to come on video and we can have a discussion about that.

All right, that's it for this weekend. This week I have a couple of things planned this weekend. It's homecoming weekend for Santa Teresa last weekend sounds like a state homecoming. I have some other things going on and I'll send you pictures about it. So make sure you come and watch. I'm Vito with Abitano.

Have a great weekend. We'll see you out there.

Santa Clara County property tax,Aalto, Expired, Canceled, Withdrawn Listings, Say it to Seniors, The Great Deceleration, institutional home buying, yield spread to forecast recessions, Inventory Watch, What you get for $1MM Santa Clara County, Title Theft,Santa Clara county real estate,Santa Clara county news

Comments

Post a Comment