Mortgage rate declines | Inventory 19% higher than a year ago | Housing Snapshot 🦅 🌎 ⚓️ (Mountain View home)

Mortgage rate declines | Inventory 19% higher than a year ago | Housing Snapshot 🦅 🌎 ⚓️ (Mountain View home)

Introduction to the Housing Market Update

Mortgage rate declines

Mortgage rates decline a lot, but it's still something worth news, but then we also have inventory increasing by 9%, 19 percent over last year, which is good. We'll do a quick home housing snapshot and mountain view home of the week and REO of the week. Let's get started. Let's get this moving here.

Diving Into Mortgage Rates and Market Dynamics

So the first thing I want to look at is these rates. Everybody's all crazy about the rates decreasing by 0. 15%. That's an eighth of a point

that really isn't much to write home about, but it's something to look at because when you look at the total numbers over time, We'll see it subtly come down over the next couple of months. Now, why is it going up? The 10-year treasury has a lot to do with it and it's all about The flow of money coming in and the value.

Rent vs Buy Calculator

So when that goes down, ours goes up et cetera. But right now we're priming the pumps for the selling season period. We're looking at March, April, May. This is the selling season. We want to make it painful so that there's not a glut of inventory and a glut of buyers out there pumping values up, right?

Gone are the days of having 35, 40 listings or offers on every listing and three or 400, 000 over list price. It still happens, but not as frequently. Mostly because the rates are up. Now, what's a good rate? What's a rate that will bring enough buyers into the market, and enough competition into the market to flatten out pricing?

They say it's five and a half percent, but I really think that would keep it enough so there's enough competition to keep prices at bay and not increase prices like we're seeing. We already just, I just, I told you that.

That's from last week.

Inventory 19% higher than a year ago

The Impact of Inventory Levels on the Housing Market

I saw this one right here, inventory is 19 percent higher than last year. That's not a lot. That's one out of one more out of every five. So we have six instead of five, we have 10 instead of 50, right? Or sorry, 60 instead of 50, not a whole lot more, right? We need hundreds more. We need thousands more to increase the supply to match the demand, even though rates are up.

So when we see prices rated at 7%, we're thinking, Oh, that's painful. Oh, that hurts.

Exploring Home-Buying Strategies in a High-Rate Environment

But it's mostly because people know you can go in and buy down the rate. Now, if you look over here, this is with one and a 1. 6 rate points. What's the point? If you have a one-and-a-half million dollar loan, you're paying 24, 000.

That's based on the size of the loan. So if you have a million dollar point, a million dollar loan, and you're paying one point, it's 10, 000 roughly that brings the initial rate down. So when we go to negotiate with sellers. I'm representing buyers. I asked for a credit of one or two percent so we could take that money and put it towards points. Lower the rate and that helps the buyer on the affordability side a whole lot more yes it does matter how much You pay for the house and how much you put down, but every time you bring it down a certain percent, it helps you out in the long run a whole lot more.

I hope that makes sense. So if you brought it down 10, 000 or ask for, in this sense, if you ask for 17, 000, that's one point that goes towards the point that the loan, it would go down like six and a quarter instead of six and a half. And that difference is 500, 400, 400 times 30, 360. That's a lot of, that's a lot of money, right?

That's how much money you would save.

Homes for sale near Apple

Sunnyvale Home of the Week: A Closer Look

Sunnyvale Home of the Week. Now this is actually Apple. I wanted to look at this because this is really worth it. This is the Apple Home of the Week. The houses that are close to Apple. This is almost 3 million and it's in Eichler. An Eichler, an odd looking Eichler.

This is 2. 7, 2. 8 million dollars, guys. I have nothing against the house. It's just I always imagined paying 3, 000, 000 for a house that would be more like a castle or a mansion, not 1960, 73, 3 bedroom, 2 bath, 2, 200 square foot house that has flat roof issues and no insulation on top. Not typically my cup of tea.

I tend not to sell those houses, but that's that. There you go. Okay, I didn't look into that.

Analyzing Inventory Trends and Market Predictions

Inventory is up 19%. Whoop dee freakin do! We have to go back to the 20, 30, 40-year look and see where we are compared to where this is. Now, if you look back here, this is January 6th which doesn't even work.

The numbers we need to see are what we need to have for San Jose, we need to have about a thousand. And for Santa Clara County, we need to have about 2000. Right now we have actively for sale 722. So we're so far off. Yes, pricing is going, and our inventory is going up compared to last year, but it's not. And remember, I lost my spreadsheet so I can't go back and show you what we had last year.

Nobody cared anyway. Alright, now we have 300 houses for sale. These are single-family houses. 300 houses for sale. We need around 1, 000 to make it healthy. Not even a balanced market, it healthy 1, 000. So we're 30 percent of where we need to be. Plus or minus. That makes sense.

Oh, another thing.

Election Cycles and Their Effect on the Housing Market

Typically we see during election cycles every four years, we see a little bit of a power outage in the market. I don't know. It's almost like a plateau because people go, my president doesn't get elected. It doesn't matter if my president doesn't get elected.

The whole market's going to crash and everybody's going to move to Canada. And it doesn't matter. I don't care what side of the aisle you vote on. I don't care if you're blue or red or halfway in between. I don't care. It doesn't matter. People always have a hiccup with election cycles. So you're going to see the market slow down a little bit, but then I'll take right back off.

If you're planning on buying. Now's the time to do it because the market's getting into the hot season or you wait until September, October, or November, when it completely dries out until November 10th. And then afterward people forget that they were holding off on buying a house. Because until the election was over and then they go back to work and forget, Oh my God, the market's going to crash.

No, it doesn't matter who's in charge. I don't care what you say. It's happened over the last 20 years that I've been in real estate. It's happened over the last hundred years that real estate has been tracked. It happens. There's always a little plateau, a little power outage, and then it returns to normal.

So don't think that primary election matters. In anything. We could go into World War Two or World War Three, right? Some say we already are, but there you go. All right.

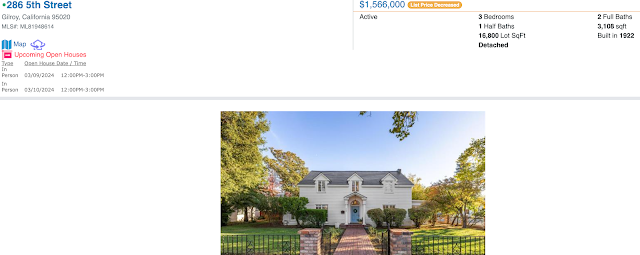

Mountain View Home of the Week: Affordable Options

Mountain View home of the week

This is Mountain View Home of the Week. And the reason why I picked this one is because it's moderately priced. Three bedrooms, one full bath, 888 square feet.

Still over 1. 5 million dollars. 1. 62. It's just below the median price. Of Santa Clara County, which is crazy to think because look at this now Mountain View is beautiful I have nothing wrong. I have lunch there once or twice a week with My nonprofit that I work with and it's a beautiful town.

There are amazing people there. Look at These are foil-wrapped. I shouldn't be these are foil-wrapped cabinets. They're all beat up I'm going to track this I can almost bet you somebody's going to buy this in a heartbeat And they don't buy it for this they don't buy it and then they tear it down And build up a little McMansion.

Look in the next door, that's what they did there. Do you think that was there back in 1946? Someone's gonna move in there, live in there for a little bit, and then they'll tear it down and put a McMansion on there. There you go. Okay. Again, these numbers are hard to see, I understand. I have to start over again, but just comparatively speaking, nothing's changing.

Our inventory is going up just a tad bit. We did see a big jump from February 21st to February 28th. However, I don't think that's going to get much better. So for the amount of buyers that are out there, it's a fair amount of competition for the lack of supply, which means that. Inventories or pricing is going to go up, period.

There's just not enough supply out there for people to be picking.

Understanding Market Conditions and Pricing Strategies

REO of the Week

Now, some houses sit on the market for 90-plus days. Yesterday we saw that. Wait. I think I have it right here. 90-plus days, right here, right? We have 30 total listings in Santa Clara. These are less than 3 million, so these are real assets.

These are houses that are, everybody buys in Santa Clara County, right? Not the 30 million houses that take Two years to sell. So there are houses. 30 houses are up for sale overpriced over something based on condition. Maybe that like this one right here, that's beautiful. 1. 56 million, right?

This price decreases. You can take a look at that. I want to look at that. No, that's up on holiday days. Forget that. See, that's a nice colonial-looking house. It's close to downtown,

right? That's where all the food trucks are. That's where they have the auto show. That's downtown Main Street, USA. So you can walk there, have your dinner, and walk back. So it's nice. It's a really nice place. And it's nice. It's large. It's older. It's 101 years old. And it's been on the market for 100 days. So pricing is important.

I'm telling you that it'll probably sell for 1. 25, 1. 3. So if you're thinking about it, there's a good opportunity for it.

Conclusion and Final Thoughts on the Housing Market

Alright, today we walked through a lot of different things. If you're interested in selling or buying a house, I'm happy to talk to you about it. This is a great time to sell. The big question is where are you going to move?

Nobody knows. I'm Vito with Abottano. See you out there.

Vito Scarnecchia Real Estate Broker, Veteran, Dad DRE#: 01407676 We’re Hiring! 408-705-6817 Vito@abitano.com Website: abitano.com https://www.onereal.com/vito-scarnecchia-1 update your home value: https://hmbt.co/bT7qRJ RELOCATION@ABITANO.COM FREE DESKTOP APPRAISAL https://www.propertyrate.com/agent/vitoscarnecchia If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents! Book appointments here: https://calendly.com/abitano/15min Home Buyers Course YT YouTube.com/SanJoseLiving IG https://www.instagram.com/abitanogroup/ FB https://www.facebook.com/vito.scarnecchia/ LI https://www.linkedin.com/in/vito-scarnecchia/ Blog http://blog.abitano.com/ POD https://spotifyanchor-web.app.link/e/oxdH1Hwfcvb Professional Photography by Kim E https://photosbykime.com / Local Real Estate Market and Home Value Report https://hmbt.co/bT7qRJ Financial Intelligence https://docs.google.com/forms/d/e/1FAIpQLSc0R5pjHIAPguZ5GDEB-fTbGJXKpWK3coK9Khymv_GTWkMnyQ/viewform?usp=send_form https://www.onereal.com/vito-scarnecchia-1 Willow Glen's five most expensive homes https://youtu.be/3A_E2ck0ePg

youtube youtube

Comments

Post a Comment