The 5 Most Common Home Seller Lawsuits, Silver Tsunami changing the housing market? Los Gatos Home of the Week

- The 5 Most Common Home Seller Lawsuits

- Los Gatos Home of the Week

- Will a Silver Tsunami Change the 2024 Housing Market?

- Price Reductions

- Santa Clara County High and Low's

The 5 Most Common Home Seller Lawsuits, Silver Tsunami changing the housing market? Los Gatos Home of the Week

Welcome and Overview of Today's Topics

Hey, welcome back. What a crazy day it's been lots of stuff to talk about. The first thing we're talking about is lawsuits since the NAR is settling a lawsuit. I thought I'd talk a little bit more about common seller lawsuits. Their errors are fraudulent, et cetera. We have a little home buyers checklist that I'm working on.

I want to share that with you and the Silver Tsunami. Again, we talked about it last week and whether will it make a dent or a change in our current high housing process market and list price reductions, the Las Gatos home of the week, and Santa Clara County highs and lows. Let's get going. Let's move it. Let me do this real quick.

Okay. We're going to go back and forth with this.

The 5 Most Common Home Seller Lawsuits

Diving Deep into Seller Lawsuits

The first thing I want to talk about is the lawsuits. Let's talk about that real quick. Lawsuits. Sellers get sued by buyers quite a bit. Not like every other thing, like once every blue moon, every couple of thousand listings, there's a lawsuit, right?

But that's because we're not just the litigious state, but it's also the United States. And a lot of this stuff could be prevented just. Opening up your brain saying it's better to over-disclose than not disclose at all. I always tell my sellers it's better to scare away the nitpicky buyer or the frigid buyer and disclose everything you can think about.

In your house and because in real estate we have guides and we have forms and we have all sorts of stuff to open it up. Sometimes sellers want to keep stuff away. So let's just get into it real quick. If you bought the house 10 years ago and you knew that there was a foundation issue and you haven't reviewed it or mitigated that problem, you still need to disclose it.

Even if your current inspector doesn't disclose it. There's a crack in a tile. A chip in the tile, a chip in the wall, a chip in the window, crack in the window. There's a socket that doesn't work. If there's an appliance that doesn't work that great, disclose it. Why? In real estate, you need to disclose everything, every material fact that has to do with the house the neighborhood, and the area.

And all sorts of stuff. We also,, in one of the farms, ask, has anybody died on the property in the last three years? I don't care if it's been 20 years and you don't even know who died there, somebody died because you bought it and they told you. Disclose it because why not? It's just anything that has to do with the house.

You have to disclose what could happen, or they find out about it, and wasn't disclosed. And all of a sudden my religion or my ethics or my whatever says I can't live in a house where somebody died. You know what? Here in California, especially people are choosing to stay in their homes until they pass away.

And a lot of times they pass away in the house. It's okay. It's a normal process of life. It's the Hakuna Matata. Of life, right? It's part of, what happens. Do you have to disclose if a dog died in it? You could, but it's not really material right now. If you have a dog, or your family pet buried in your backyard, you'd probably want to disclose that just to alleviate any issues.

I know somebody who owned a house in Cupertino when I was a kid. And we dug a hole cause we had a little fort and we pulled out a bag. It was a dead, it was gross, a dead cat. It was pretty nasty. What are you going to do, right? It's just part of life back then. It wasn't as litigious, but it is what it is not thinking through fixtures.

Now, what is a fixture? It's not a, there's a faucet. Anything that's attached to the house is considered a fixture. Chandelier curtains. Ovens, a refrigerator isn't considered a fixture because it's still movable. It's not placed in, even though a stove is not placed in and screwed in, it's still considered a fixture.

Any kind of appliances that you think you might want to take along, make sure it's not only written in the listing agreement and in the marketing but in the purchase agreement. And if it's not written in the purchase agreement, right? It is a counter or an addendum saying, this is my chandelier. It's a family heirloom that is coming with me.

Whether you like it or not, it was posted in the disclosures. It was posted in the marketing. It was posted all over the place and you didn't put it in the buyer's agreement, in the purchase agreement, it's now part of the agreement so that we know that my chandelier has been with my family for 20 different generations, and is coming with me, right?

And if they walk away, at least it's not a lawsuit once you walk away from it. Here's a big one. Saying the wrong thing to the buyer. Now, I always say sellers, when you know that there's a viewing the hell out of the house, get out of the house, walk away, go for a drive, say hi to them, and just keep moving.

If they start asking you questions, you can say, this is a great neighborhood. We love this place, but that's pretty much it. And then you bolt, you have to say, you know what? I need your agent to talk to my agent about those kinds of questions. And then bolt the best thing for you to do is stay at least one arm's length away from that buyer because they can ask a question and it might not settle with them.

And five years down the road, they're like, I'm going to go find out about. That thing that was really bugging me and now they have four years to go in and do that investigation and they can sue you for that, whatever it is, right? Just let it all be in the documentation. Covering up problems, property problems.

I had somebody who said that they remodeled a bathroom. Whereas they only liked the paint and the new toilet. And I think it was new, the tile around the bathtub and yeah, and then the tile on the floor and the vanity were still original and older. And they said it was remodeled. I'm like, I'm not putting that in my marketing.

I'm absolutely not going to do that. And I'm going to have to disclose that tile floor. Just put a carpet over it or put a rug over it. No, because they can come back to you and say. That you didn't tell me about this crack in the tile. You owe me 500 to fix the tile floor. Cause I can't find that tile anymore.

It's just alleviating that tension from that problem. And here's the way it works with us. We want to disclose, that we want to have all the reports documents, and inspections done ahead of time. So the buyer has it in their hand when they write their offer. So there you go. Disclose, scare away the wrong buyers because the wrong buyers are going to be a pain in your butt 5 to 10 years down the road.

It happens. Not disclosing neighborhood issues. You live next to a rowdy neighbor who has parties on Saturday night until 2 o'clock every morning. Or you live underneath a flight path or you're a mile away from the train tracks and you can hear it. You can hear it twice a day, especially when it's really quiet.

You can hear the train tracks, but it's a mile away. It's still a material fact. You still have to disclose that. I live about half a mile away from the flight path and sometimes planes come over my house. So I disclosed that. Why? Because it just is. I know that there's a crack down the street, not that I have a crack down the street, but whatever.

I have rowdy neighbors that are six doors down. Absolutely. Tell them because. If they didn't, if you didn't tell them that. And they come back and say, blah, blah, blah. You could be in a lawsuit. You could be in for a lot of pain and hurt and stress. And that's not what the whole disclosure system's about.

So again, I always tell people we have ENO insurance. It protects us and it protects you a little bit. If you defraud the buyer in any way, shape, or form, knowingly or unknowingly, they have the right to sue you. So why wouldn't you want to? Disclose every material fact, everything that you want with that property, everything that just disclosed it over-disclosed, scare away the wrong buyer.

And you're going to find the right buyer because the universe is going to give you the right buyer. If you do the right things, if you try to hide things, you're going to come back and there's going to be a lot of problems. So just open up yourself to that. Okay.

The Essential Home Buyer's Checklist

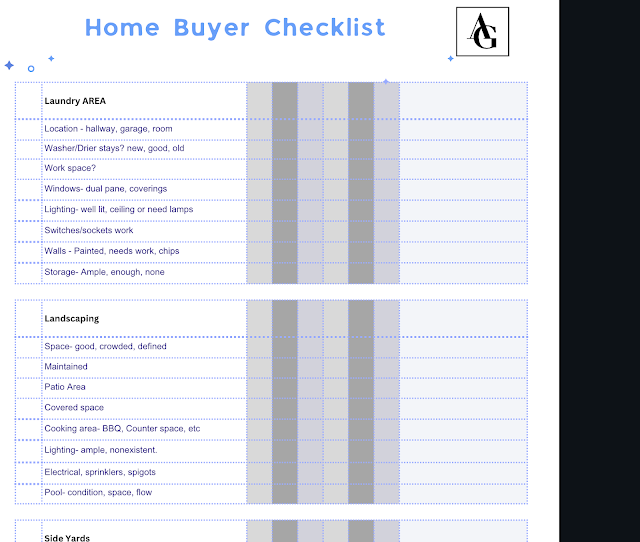

Buyer checklist. I just spent a few, minutes creating this.

I thought it was really important for me to show you this because if you see it and you're like, Hey, you're missing this. I thought about a lot of different things. Restart. So it's just, I have different things here. You can create it yourself. You can absolutely copy it. I'll have a link down below in my blog, so you can check it out if you want if it's viable, but it goes through every little nook and cranny of the house.

Going back to the disclosure thing as a buyer, you want to know what you're buying, right? And I have it. So you have six houses you can go to in one day and print this whole thing out and make little notes. Even at the end, there's the notes thing, right? I have a whole paper page on the back where you can actually write notes and, keep memory.

Because when you go to six houses, even three or four houses, things get jumbled. You forget what the kitchen looks like, et cetera. So it's nice to have, and it's free for you to have. Download it. Okay.

Understanding the Silver Tsunami's Impact

Will a Silver Tsunami Change the 2024 Housing Market?

Silver tsunami. We keep talking about this. It's a thing that's going to happen. And I reminded you in the first part of this in the first segment, we talked about disclosing.

If anybody ever dies on the property, more and more people are deciding to stay on their property and live the rest of their lives on their property. It's the house that they raised their children. It's a house where they feel most comfortable. And if they're completely physically and mentally with it, they're going to stay there until their body fails and they pass on.

And that's a normal thing. It's becoming more and more prevailing. It's happening, but some are deciding to move. To empty the nest. And that's been a term that's been around longer than I've been in real estate. It's something that people will take a five-bedroom house, sell it, and move down to a two-bedroom or a one-bedroom house because they don't need that space.

They don't want to take care of the maintenance. They don't want to go up the stairs. Like I hate going up my stairs every day. When I turn 65, I'm probably going to get a smaller house because even though I raised my children here, I don't want to go up and down those stairs. And my stairs are like a ladder.

While it's steep I'd rather not have the problem of me slipping and falling and breaking my hip. And then two years later, I'm dead. So I'm alleviating that problem by moving. So there you go. 60 percent of the people want to stay in their, residence. Some are going to different communities. Some moved to a different residence within the community and some are unsure.

And. Believe it or not, there's a huge tidal wave tsunami, a tidal wave of people that are moving out of the United States. They're called expats and they're going to Portugal, Italy, Costa Rica, all over all the Caribbean islands to the Asian islands, like Philippines and Laos and Cambodia and all over there.

And they're just spreading out and exploring the world and doing things that they never got to do because now they're retired and their children are working all the time and might as well go do that. And it's a fun thing to do. I plan on doing that for a little bit. So just keep an eye. Will this affect us in 2024?

It will start to affect us. The number, year that this is really going to start taking effect is 2030 because that's when the baby boomers start really retiring and moving on and deciding what they're going to do with their hopes.

Navigating List Price Reductions

Price Reductions

List price reductions. I don't even know why this one popped in. All of these should be list price reduced right here. If you're looking for a house and you don't want to play the competitive game of overbidding 40%, we saw one, house went for 40 percent over the list price. We'll see that in a minute.

Look for a house that's been on the market for over 30 days and then you can go and work with them a little bit. Let's just take this one right here. Six bedrooms, three full baths. These are not my listings. They're not on the market for 47 days. They just dropped the price from 1. 6 down to 1. 5 so they dropped it a hundred thousand.

That's a little bit of motivation. It's a great house. I'm going to show my client this house.

So a smaller house, but you get a little bit of land. You get a little bit more than an acre and you could probably put an ADU on it too. So there you go. All right. Let's price reductions. There were 86 76 price reductions. That's cumulative, not just this last week. So just keep that in mind. All right.

Exploring the Highs and Lows of the Housing Market Highs and Lows.

Santa Clara County High's and Low's

Let's get into this. I didn't get a chance to look at this. This is the highest-priced listing sold. $17.9 million worth every penny. Wow. This thing's beautiful. That is a gorgeous house. Holy moly. That's the one kind of house I want. Okay. So there you go. It's a semi-colonial country, with six bedrooms, six and a half baths, 8, and 500 square feet on a full acre of lot.

And it's 12 years old, 17. 9 million. And it's sold. In 22 days. These are not my listings. Okay. It's the lowest list price in Columbia. And I think Columbia made it twice. Yes. The lowest list and lowest list price, the sales price, which is 73%, 725, 000. The original list price was 1, 000, 000, sat on the market for 124 days, overpriced based on the condition thinking, Oh, it's by the Apple thing and it'll be sold really?

No, it didn't. It sat when you overpriced the house, it's going to sit. It's important to know that. It's important to know that. Okay. And then boring waters. 606. That's the highest day on the market. Let's go to the highest sale price, the lowest sale price, which is lowest sales price is four to six right here at Columbia app. That's also the lowest sales price. And then the highest list price, sales price ratio, which was 140. Let's take a look at that two, three, this one right here. Wow.

Los Gatos Home of the Week

Santa Clara, Los Altos, seven days on market, three bedroom, two bath, quarter acre lot built in 1974, but it's Los Altos. So it's going to sell for a lot. This is what I talk about. You attract the market, not make the market. It probably had 20, or 30 house offers on this and that's what's going to happen.

Okay. And then the highest house for sale, which is three, three, six right here. Mulberry.

This is the highest sold price one. And this was in Los Altos Hills, five-bedroom, five-and-a-half bath, 5, 300 square feet on a quarter acre on a full acre built in 1961. Wow. This one's been updated though. That is gorgeous.

Wow. I'm dumbfounded. That's great, and that's a great price too for a house.

All right.

Wrapping Up: Key Takeaways and Goodbye

So today we talked about seller lawsuits buyers suing sellers. We talked about a home buyer's checklist the silver tsunami and the 76 price reductions. That's a great place to buy a house. It's been on the market for a long time and the highs and lows of Santa County.

I'm Vito with Abitano, we'll see you out there.

Vito Scarnecchia Real Estate Broker, Veteran, Dad DRE#: 01407676 408-705-6817 Vito@abitano.com Website: abitano.com https://www.onereal.com/vito-scarnecchia-1 update your home value: https://hmbt.co/bT7qRJ RELOCATION@ABITANO.COM FREE DESKTOP APPRAISAL https://www.propertyrate.com/agent/vitoscarnecchia If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents! Book appointments here: https://calendly.com/abitano/15min Home Buyers Course YT YouTube.com/SanJoseLiving IG https://www.instagram.com/abitanogroup/ FB https://www.facebook.com/vito.scarnecchia/ LI https://www.linkedin.com/in/vito-scarnecchia/ Blog http://blog.abitano.com/ POD https://spotifyanchor-web.app.link/e/oxdH1Hwfcvb Professional Photography by Kim E https://photosbykime.com / Local Real Estate Market and Home Value Report https://hmbt.co/bT7qRJ Financial Intelligence https://docs.google.com/forms/d/e/1FAIpQLSc0R5pjHIAPguZ5GDEB-fTbGJXKpWK3coK9Khymv_GTWkMnyQ/viewform?usp=send_form https://www.onereal.com/vito-scarnecchia-1 Willow Glen's five most expensive homes https://youtu.be/3A_E2ck0ePg

Silver Tsunami, Cost Of Living Calculator, Fraud, Homebuyer workshop, Bay Area housing stats, Veteran Home, the best time of the year to buy a house, Bay Area Luxury homes, next housing crash prediction, housing market projections, Should I Buy A House Now Or Wait?, should I buy a house now or wait until 2024, Why You'll Regret Buying A House in 2024, Housing Market 2024: 5 Options If You Regret Buying a Home, when will the housing market crash again

Comments

Post a Comment