Top Foreclosure States 2024

blog

podcast

Introduction and Overview

How is your state doing in home foreclosures? Realtors are suing the NAR for having to be a realtor. We'll go into that as well as REO of the week, homes for sale near Apple and Mountain View home of the week, as well as the 40-day on-market report.

Let's get moving.

Top Foreclosure States. 2024

Current State of Foreclosures

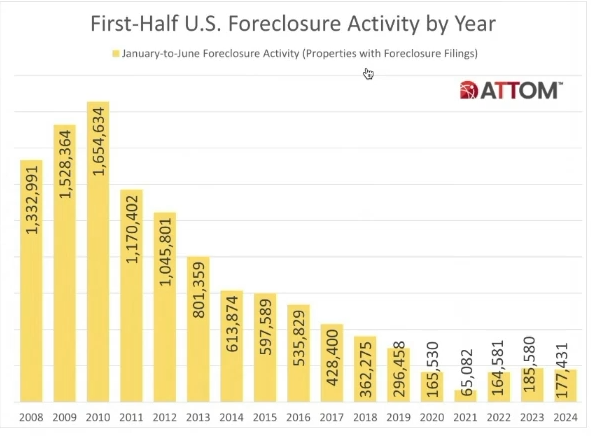

I want to dispel the idea that we're in a foreclosure boom. It's not really a problem right now, but some states are jumping up and I want to talk about that. This was 2008 to 2012. We had a huge glut of inventory and it was a buyer's market. If you remember back then.

We're nowhere near that. Some people are saying foreclosures or pre-foreclosures are up, which is called a notice of default or NOD. Every state will always have foreclosures and we're not as high as we were last year. So foreclosure filings are a little bit higher than they were last year.

Foreclosure Statistics by State

The states with the highest foreclosure rates in the first half of 2024 were New Jersey. Illinois, Florida, Nevada, and South Carolina. this document gives you all the rankings and California, in case you want to know, is 11th right here, 3, 900 units or almost 4, 000 units went into foreclosure.

Making it a foreclosure rate of one in every 3, 600 households. That's not a huge problem. And then the biggest one in California was Nice County. And then these are the other ones too. And the way I got tipped off on this was this guy right here.

I follow him for the commercial reports, but he thought he'd want to pop this in any way because what he does is sell notes. He buys and sells notes for profit. It's not something I'm going to put on this channel, at least not yet.

Antitrust Lawsuit Against NAR

Realtors Suing NAR?

We might do it in financial intelligence, Michigan, where real estate brokers file an antitrust suit against the National Association of Realtors. This is interesting. For the longest time, I've stopped using my brand, my moniker as a Realtor because I don't feel that they present themselves in what I want to be known as the real estate guy.

NAR is a giant union. It's the second most powerful union or lobbyist union, and they have always had their way. This last year has been a huge debacle, a circus of lawsuits. And we're talking about this fairly timely because, on August 17th, buyers now have to pay the buyer broker or buyer's agent, the commission.

There's a slew of ways to do that. We've discussed that it's all over the internet and we can go down that rabbit hole if you want one on one. I'm happy to talk to you about how that works, but we've basically decoupled. Commission so that now buyers are responsible for, compensating their agent who is taking them to all the houses, writing offers negotiating, and walking the process for them. Michigan's agents or brokers purport that the NAR hasn't really done anything good for them.

And they require us as real estate agents to become a member of an AR to use the MLS. So that's the lawsuit they're saying that is required. And every MLS, including our local MLS, MLS listings. com requires us to be a member of the California Association of Realtors and the National Association of Realtors.

It's just the way that works. And every other board that I know of requires us to be on NAR. NAR really doesn't do anything for us. They don't provide real-time stats. They don't provide local stats. They don't really help us with anything outside of them lobbying and bullying up Congress so that they can get their way.

California Association of Realtors offers a whole lot more services for us, including Legal advice. we work a lot closer with them and I'm much more comfortable being part of the California Association of Realtors we use them for the forms of legal compliance and all that stuff.

And every state really has its jurisdiction over how they go to business. But this one here in Michigan suing, not only a group of boards and Boards are generally say County, right? So Santa Clara County actually has two boards, the Santa Clara County Association, realtor, and Sylvar, which is the Silicon Valley Association of Realtors.

There's also real comp, which is the software they use, and that's the MLS that allows us to enter your home into the MLS to market it. We use Emma MLS listings, and there's also rapid Tony and a couple of other ones up North. And I don't have any problem with MLS listings, other than they're trying to get out of the nineties with their software, they finally dropped the Flash software and now they have an HTML, interface, which is, nice, but it's not great. we're in the middle of Silicon Valley high tech center of the world. And up until about five years ago, we were using Flash for our website, for our interface.

Home Inspection CHECKLIST HERE

https://abitanogroup.com/homeinspectionchecklist

That segment has been brought to you by the home inspection checklist. If you're selling your home, this list will give you a comprehensive, list of things to look at for your home because no home is perfect and makes you look at it with a little closer eye and decide if you want to fix it or not, this is not a replacement for a home inspection. It's Designed for you to look at every nook and cranny of your home as a buyer would so that when you present your house for sale, it looks a lot better and it's ready to sell. And if you do any repairs, make sure you disclose it.

Homes Near Apple

Homes for sale near Apple

Homes near Apple. I wanted to compare and contrast these two right here. One is in San Jose, Santa Clara, and one is in Cupertino. One's a condominium, a two-bedroom condo, and it's 1. 5 million. And when you look at hundreds of thousands of dollars, this doesn't make sense that a house in Cupertino, a condo in Cupertino, two bedrooms three baths, 1400 square feet built in 2006. Mind you selling for 1. 5 million whereas for 400, 000 more, you get one more bedroom, about the same space, and a huge quarter acre lot built in 1956. Now the difference is huge because it's almost 500, 000 difference. 400, 000 difference point is that. Cupertino, this is the delineation right here of Cupertino. These houses are going to be a lot more because they're in Cupertino 2.4, 3.8, 2.3, 1.1, this one right here. This one's probably beat up and it's also a townhouse. So there you go. So there that's Apple Home of the Week.

Mountain View Home of the Week

Mountain View home of the week

This is Mountain View home of the week. It's a three bedroom, one and a half bath, 1500 square foot built in 1928 for 2. 6 million again, not my listing has a separate, garage or detached garage. The beautiful thing about this is it's within walking distance to Castro Street where you can have drinks, restaurants, shops, et cetera, and then catch a quick train to wherever you want to go.

So there you go. Fairmont Ave. If you're interested, let me know. 2. 6 million.

FREE HOME BUYER CHECKLIST HERE https://abitanogroup.com/Homebuyerchecklist

Bank Owned Home of the Week

And this one is the bank-owned home of the week. this is in Mill Valley up north of San Francisco. it's a four bedroom, three bath built in 1956. It's almost 3, 500 square feet, but everything on this is original.

So this is more like a beach house or a mountain house, but the rooms aren't very exciting. no staging, you're not going to get as much value out of it. the house hasn't been really, Maintained. There's an ADU on it. So this house right here, if you're interested in learning more about it, let me know and get you all the information, It's right here in Mill Valley and it's a beautiful place to live. Not necessarily what I would look at.

REO of the Week

Foreclosure Numbers and Market Health

And our foreclosures today, in California are 185, If you look, there are no bank-owned properties at all in Santa Clara County. There's one in Hollister and one in Salinas, but you'd have to drive quite a bit to find a bank-owned property.

So again, putting your fears at rest about the whole foreclosure issue. We're seeing. Numbers that are popping up, but if you look there's just not a huge jump in numbers even in California It's gone up just a little bit. if you look back at the beginning of the year, we're still at 153 So it's not like those numbers have really jumped And 40 days on the market over 184, which is down from last week, which was the high over the last couple of months.

And then 90 days on the market, 52 again, these numbers aren't spiking. So nothing really to be afraid of. I think the market's still pretty healthy here. This is Santa Clara, San Jose. we have less than 500 homes for sale You know that we have to be at a thousand to have a balanced market. So we're still under-supplied.

We had 84 closings this last week in Santa Clara County. We had 165 closings, which is healthy. and we need to have about 2000 homes for sale to make it a balanced market. There you go. I'm Vito with Abitano. We'll see you out there.

Vito Scarnecchia Real Estate Broker, Veteran, Dad DRE#: 01407676 We’re Hiring! 408-705-6817 Vito@abitano.com Website: abitano.com https://www.onereal.com/vito-scarnecchia-1 update your home value: https://hmbt.co/bT7qRJ RELOCATION@ABITANO.COM FREE DESKTOP APPRAISAL https://www.propertyrate.com/agent/vitoscarnecchia If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents! Book appointments here: https://calendly.com/abitano/15min Home Buyers Course YT YouTube.com/SanJoseLiving IG https://www.instagram.com/abitanogroup/ FB https://www.facebook.com/vito.scarnecchia/ LI https://www.linkedin.com/in/vito-scarnecchia/ Blog http://blog.abitano.com/ POD https://spotifyanchor-web.app.link/e/oxdH1Hwfcvb Professional Photography by Kim E https://photosbykime.com / Local Real Estate Market and Home Value Report https://hmbt.co/bT7qRJ Financial Intelligence https://docs.google.com/forms/d/e/1FAIpQLSc0R5pjHIAPguZ5GDEB-fTbGJXKpWK3coK9Khymv_GTWkMnyQ/viewform?usp=send_form https://www.onereal.com/vito-scarnecchia-1 Willow Glen's five most expensive homes https://youtu.be/3A_E2ck0ePg

Comments

Post a Comment