🔴 Santa Clara County Tops $14BN in sales | Legislation to ban hedge funds from buying houses | Bay Area 10 County Report

- Luxury HOMES

- Luxe 30500 Aurora Del Mar

- The legislation would ban hedge funds from the housing market

- There's Never Been a Worse Time to Buy Instead of Rent - WSJ

- Santa Clara County Tops $14BN in sales - Bay Area 10 County Report

LINKS

Blog http://blog.abitano.com/2023/12/santa-clara-county-tops-14bn-in-sales.html

Price Reductions

Your Local Housing Market Report

Money Smarts Starts Here: https://financiaintelligence.blogspot.com

Homebuyer Workshop https://event.webinarjam.com/register/6/8oz4kcg

Find your next home here: https://www.onereal.com/vito-scarnecchia-1

🔴 Santa Clara County Tops $14BN in sales | Legislation to ban hedge funds from buying houses | Bay Area 10 County Report

Luxury HOMES

Luxe 30500 Aurora Del Mar

Santa Clara County home sales, top 14 million, $14 billion. Luxury home sales legislation would ban hedge funds from buying houses. I think that's actually a good thing. We'll talk more about that in a minute. And then there's never been a worse time to buy if you're a renter. Let's get going into this a lot more to talk about than that, but.

The legislation would ban hedge funds from the housing market

The legislation would ban hedge funds from the housing market. Hedge funds have to sell off single-family homes that they own. Stiff tax penalties for hedge funds that fail to comply with the self-sell-off. And should companies be banned from buying homes?

So we're in a quandary, right? Because The American dream is to buy property, buy a house, live in it, and pay it off. And then some people are using that as a business as a side business or even a full-time business. And where does a hedge fund differ from individual investors or a real estate investment trust or that kind of thing?

So I think this thing is just, it's a It's still a proposition. It's just legislation that's been presented to Congress. But what happens if this passes? That means there's going to be a glutton of properties in the market. That means we're going to have an oversupply with Basic demand.

I understand that it's unfair and I see both sides of this, right? We just have to be aware of what's going on. If this does happen, what's going to happen is that there'll be an oversupply of inventory buyers get to Decide what kind of houses they just they will buy and houses will sit on the market longer and prices will reduced which does make sense.

I totally understand that I don't have a problem with it because it frees up the inventory problem, which is keeping our prices unaffordably high and a very small portion. I talked about it last week. A very small portion of people can actually afford to buy homes right now because interest rates are so high.

Houses are very expensive and This whole process would allow us to drop the values of home inventory, and the home prices, which, I'm not going anywhere. It's okay. It doesn't matter to me. The only people now who would be hurt are people who are leaving a house for legacy. In a trust or a probate or if they're divorcing or if they're getting relocated, those are the, typically the people that I'm working with right now anyway because the other part is a lot of these houses are being bought up for Airbnb.

So that's keeping people off the market, keeping rents. Artificially high. So that's the other thing too if this does happen and rent home prices do go down, rents will come down as well because there's gotta be a parody of making sense for, Hey, you know what? You're charging me 4, 500 on this house. I can just go buy a house for 3, 500 a month and everything's equal, right?

Some people are lifetime. Homeowners who never want to get into it But some people have missed out on wanting to buy a house but could never afford it or they just got outbid By 20 other offers, etc. So will this be a good thing? I think it'll be a good thing. It'll hurt Homeowners values, but I think they're artificially high anyway

I think it'll allow for more competition and it'll really take into attention home Owners who aren't taking care of their houses expecting houses their house to sell for what it did back in April, right? It's a good thing all the way around will it pass that's up to Congress and the divisiveness of what's going on right now.

It really depends on a lot of things. I don't know if it will happen. They just announced it, I think, on Friday. Did this happen on Friday? Yeah. Let's see what happens in three months. Alright, next thing title fraud. I keep talking about this guys. I've only had one person take me up on this. I promised you I'm not gonna sell you anything.

Have your title Looked at or at least let me do a quick research on who owns your property if it's you great No problem. If you have older parents, make sure that they're protected. Okay, make sure that their title is Protected you should do this every six months but if you haven't seen this video do so right now and the link is down there and below.

There's Never Been a Worse Time to Buy Instead of Rent - WSJ

Okay, we'll go into that There's never been a worse time to buy instead of rent Right now it absolutely is that kind of goes into what's going on with this legislation that's trying to be passed It's expensive to buy right now. There's no reason for you. If you're a renter, there's no reason for you to go out and buy a house.

Typically, let's just say something in this area, you're paying about 4, 500 to 6, 000 a month for rent. If you bought a house right now on a standard conventional loan, 20 percent down, whatever, you're going to be paying about 14, 000 a month. So it doesn't make sense for renters to buy a house just yet here in this area.

Or even in San Mateo San Francisco Oakland or wherever it's unaffordable. And it leads into this whole thing. Now, is this a, is this something that's going to change? Yeah, this will always change. There will always be changes in the market. We're going to see highs and we're going to see lows.

Two years ago, we were at a firestorm. We saw the end of the firestorm and we saw a little correction and now we're coming back up again and values are continuing to come up. So there you go. I think that's the whole thing. Okay. So

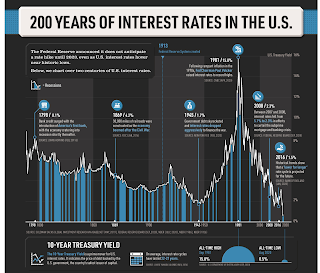

Will the interest rates come down? I think what we're going to see is interest rates are going to come down to maybe five and a half six percent There's been a lot of news about that lately. I don't think what? I don't think we'll ever I don't think we'll see Low rates down to zero two and a half percent for a very long time.

It could be You know, start a world war two or a world war three. It could be a massive economic, global economic catastrophe. It could be all sorts of stuff. So I don't know if that will happen, but in the near term, if rates get down to five and a half worth, we'll see the market pick up and demand. So I heard something where every time it goes interest rates go down 1%, and 8 million buyers enter the market.

So if you buy now, not pitching you on anything, if you buy now a million dollars, then the rates go down 1%. Your house will automatically jump in equity because more people mean more demand based on supply, unless we go into a glut of inventory, just like the legislature wants here, there's going to be a slow, there's gotta be a slow uh, drip, what happened when Obama took over from Bush.

And we had 2008, we had a landslide, gluttony Of listings we had a gluttony of supply and it was impossible to close on a house because Lenders were like, oh, we're caught we're screwed. We didn't know what to do and people were very slowly buying houses waiting for the banks to provide the loans because Back then you could just fog up a mirror and you would get a loan after everything slap got slapped down And the market started turning banks realized that they were in the wrong.

So they started crossing their T's and dotting their I's and making sure that they were selling good loans back to the tertiary market.

I don't know what's going to happen here. If they can trickle these houses in maybe like 20 percent every quarter over so many years, then that would be great because that would be that would stabilize, keep the market stable. That makes sense. So 15%, I don't think we're going to see anything crazy like that.

We did see prices go up to 8%. Interest rates go up to 8%. When you look at all the history, that's not a bad thing. 1945, right after the war happened, funny how that happened. We reduced rates because. We had to make money cheap enough to get back in from production for wartime materials to houses and finances and getting back to normal and all that other stuff.

So interest rates were down to 1. 1 and 1. 7%. Here we saw 1. 5%. It is actually free for a while. Okay. Santa Clara County is at 14 billion, but Let's take a look real quick. Let's take a really quick look at 2022. We had 18, almost 19 billion. At the end of the year. So we still have two weeks, three weeks. We're not going to get anywhere close to that, but we know that because we're still 25 percent down in volume, even though prices are going up, we're still markedly under where we were on the average price in 2022.

However, we're still a strong market because there's a lack of supply. See how it just rolls in and rolls in. It all ties together there from hedge fund owners owning 40 percent of all the houses that were sold. What was it? In Phoenix 35 percent in Atlanta and 24 percent nationwide.

All those houses are going to come back on the market, meaning we're going to have to find buyers for that, which means affordability will have to come. Back to normal, which means rates are going to have to come down and we'll see what happens. Now, again, this is just hedge funds. No, it's not just hedge funds.

There's a real estate investment trust. There's mom and pop. And I showed you a graph a couple of days ago, how mom-and-pop investors, which tie up most of the market own eight to 10 houses. So that's not just the answer, but it's got to be looked at a little bit differently from smarter people than me.

Santa Clara County Tops $14BN in sales - Bay Area 10 County Report

So we're still at a billion dollars average over the 10 counties and last week we sold 150 houses right now this last week we actually were 100 houses over for the 10 counties over our last are the average closes which is good we still have demand we still have a ton of demand houses are selling off the hook the house that I have oh I don't have it here listed it's A fixer upper.

It's a three bedroom, one and a half bath under a thousand square feet listed at seven, 700, 000. I have three offers on it already. I have investors calling me every day. I've agents calling me every day. There are 23 downloads. We had 20 people come through the open house and I understand we're going to have another two or three offers come in.

So yeah, the man is still there. Even for fixer-uppers turnkey, pricing is important. You can't just go out there and manby pamby throw out a crazy number. Like it was back in 2022 because we have price productions. Not every house sells right away. Right, take Arabian. No, let's take a look at Cayuga this house.

I think we looked at that one Let's take a look at Little Falls.

This is it last thing. So stick with me guys. This house was updated I'm gonna sneeze here crosses a park is very nicely updated Pretty house has nice brown beige tones that show a little dark.

There's a nice picture nicely done This looks like it was painted a taupe kind of color Originally that was probably a maple or a toffee color.

So this house was Either flipped or it was updated by an agent and there's nothing wrong with that. This is a beautiful house in Almaden. It's right near Castellero. It's been on the market for 42 days. Mostly because you had it listed way too high. Again, you're chasing the market. If you're, don't be a market maker, bring the market to you.

And one of the ways to do it is keeping the house listed low. Buyers will tell you what the house is worth. And when you have multiple buyers, you control the tempo. It's very simple. It's very simple. On the last house I sold, we had 12 offers. We got 80, 000 over more than what we expected. It's closing in a couple of days.

It's been a very smooth transaction outside of the house being, a vacuum being misplaced. So anyway, there you go. This is a great house. Today we talked about 14 billion in sales across the 10 counties. The local, it's never been a worse time for buyers to buy and legislation will ban hedge funds from

buying houses. I think that's a good thing. What do you think? Let me know. I'm Beto with Abitano. We'll see you out there.

Price Reductions https://search.mlslistings.com/Matrix/Public/Portal.aspx?ID=0-1014877641-10&eml=dml0b3NjYXJuZWNjaGlhQGdtYWlsLmNvbQ==&L=1#1

Your Local Housing Market Report https://hmbt.co/bT7qRJ

Money Smarts Starts Here: https://financiaintelligence.blogspot.com

Homebuyer Workshop https://event.webinarjam.com/register/6/8oz4kcg

Bay Area 10 County Report

Find your next home here: https://www.onereal.com/vito-scarnecchia-1

Vito Scarnecchia

Realtor®, Broker, Veteran, Dad

DRE#: 01407676

408-705-6817

Vito@abitano.com

Website: abitano.com https://www.onereal.com/vito-scarnecchia-1

update your home value: https://hmbt.co/bT7qRJ

FREE DESKTOP APPRAISAL https://www.propertyrate.com/agent/vitoscarnecchia

If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents! Fraud, Homebuyer workshop, Bay Area housing stats, Veteran Home, best time of the year to buy a house, Bay Area Luxury homes, next housing crash prediction, housing market projections, Should I Buy A House Now Or Wait?, should I buy a house now or wait until 2024, Why You'll Regret Buying A House in 2023, Housing Market 2023: 5 Options If You Regret Buying a Home San Mateo, Marin, San Francisco, Santa Clara, Napa, Santa Cruz, Alameda, Contra Costa, Sonoma, Solano

Comments

Post a Comment