Agent Fined $15,000! $375000? Santa Clara County Hi's and Low's 🔴[LIVE]

Agent Fined $15,000! $375000? Santa Clara County Hi's and Low's 🔴[LIVE]

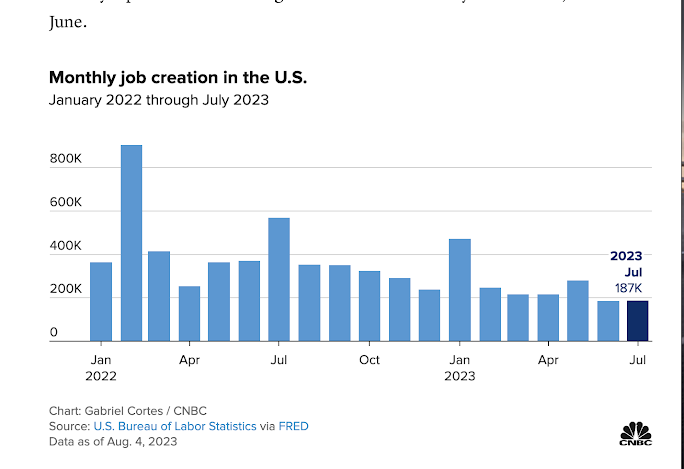

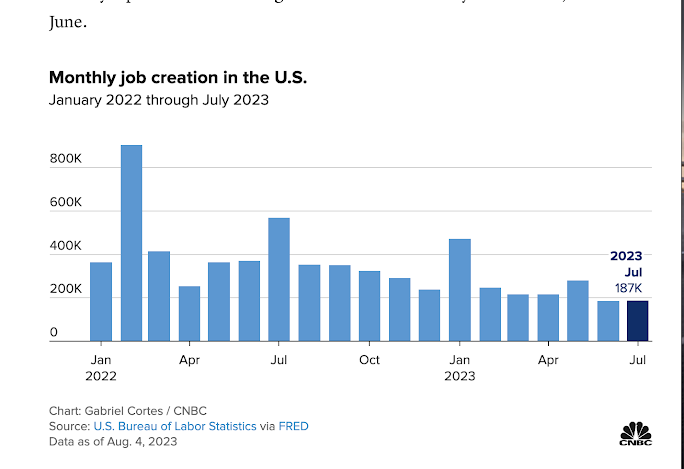

- July jobs report misses estimate

- US inflation data may offer some comfort to the Fed

- Real estate agent fined $15k for drinking milk out of a carton from a seller’s fridge

- Homebuyer Workshop https://event.webinarjam.com/register/6/8oz4kcg

- https://www.onereal.com/vito-scarnecchia-1

- Philz original cafe, closed

Inflation chart https://www.usinflationcalculator.com/inflation/historical-inflation-rates/

Pod

That's great I haven't had a corporate job in 20 years. So what do I know? Not trying to push people out of California or out of a high, living cost of living place, but. To me, a place is a place, right? And some of us are fortunate enough to have the forethought or we're in the right position at the right time to be able to buy a house.

That's great I haven't had a corporate job in 20 years. So what do I know? Not trying to push people out of California or out of a high, living cost of living place, but. To me, a place is a place, right? And some of us are fortunate enough to have the forethought or we're in the right position at the right time to be able to buy a house.

Good morning. It's Tuesday, August 8th, at 7:00 AM and I'm going to make this as quick as possible. I promise I need to get my big butt into the gym. Today we're talking about three things you need to know about living in Silicon Valley and buying houses and where the market's going. Today we're talking about jobs.

July jobs miss the reports more. Reports a miss of a hundred. 85, 000 and then U. S. Inflation data may offer some comfort to the Fed, and then real estate agents find 15, 000 for drinking milk at a listing. That's awesome.

US inflation data may offer some comfort to the Fed

Also, we're talking about fills too, which is a little bonus. So stay tuned right now.

We're going to jump into today's highest and lowest. So standby. All right. Here are the numbers right now. Let's go. Jump in real quick and check this out. Full page. This one. No, we're not doing this one. We're doing this one. Can you believe that somebody actually bought a house for 375, 000 in Silicon Valley?

It's true. It's very true. All right. So this one is the highest price listing sold in the last week in Santa Clara County. It is in Palo Alto. Now, again, these are not my listings. These are on the MLS, but beautiful little houses. It's more colonial, updated, and nicely updated. I love the floors.

Yeah, there you go there now switch it up so it's a little bit larger for you to see

I do it this way there That's much better. It's

funny. It's remember a couple months ago. We were talking about colors These are the colors that are really in vogue right now that the green and the miss green look at that beautiful countertop and Awesome kitchen. Yep.

This house just you can smell the old world in it, right? It's just gorgeous.

What in the world? That's a tower of books. My daughter would freak out. That's a funny-looking ceiling. Semi-tray ceiling.

This is what I think of when I think about beautiful homes, right? Mostly because my aunt and uncle lived in a nice house. All right, so the next one is really easy to do. This one actually wins twice. So we do this every once in a while where we have the lowest list price and the lowest list price ratio as well This is Croix and not very many people know but three hundred seventy-five thousand dollars for a house I don't know if it's actually a house because there it is That's all you get the little tiny house right over there.

It's seven and changes acres out in Croy Road, which is up by Uva's Canyon. So there you go. Not much to really look at, other than, let's take a quick look, and see if we can break this down so you can see it.

Yeah, it's Uva's Creek, but Croy Road, and then I'll also take you to Canyon Road. And there's Morgan Hill. And San Jose. So you're out in the way, place, but let's take a look. It was originally listed at 475 took quick 57 and

sold for a hundred thousand dollars less, which is 78. 9% off of the original list price. It doesn't sound right, but that's okay. All right, let's go to Gaston real quick.

It's the lowest, highest list price to sales price ratio. So let's see if we can back this out.

Yeah, Gascon to

there. Cupertino right by Lawrence Expressway.

Yikes.

Yeah, I don't know about that. That's just really weird. Let's get a nice artsy photograph of the mailbox in case you need to know what address it is because there are two of them right there. And by the way, the four are out of line. Not to be a prick or anything. That looks like a living room, maybe.

So that's nice.

There we go. I can actually see the monitor now. It's nice. Not my, I wouldn't do it that way. It looks like it was actually done by Ikea.

Okay. All right. There you go. The most expensive house is on Martin Ave. The least expensive house is in Croy. The most expensive list price to sales price ratio was Gascon. And again LaCroix, now let's talk about gas prices are up 20 cents from last week and rates are up a few percentages of last week right here, right?

Everything's getting more expensive yet. Inflation's coming down. It doesn't really matter. Inflation, the reports that you're hearing from inflation aren't, Oh, it's more expensive or It's less expensive to live here. It's just inflation's up here and it's not going up any further. So we're stuck at the high expense of inflation.

What we need to see is deflation. If you want to get back to normal and that's probably not going to happen. So we have 133 closes in Santa Clara County so far in the last seven days. We have 81 of them that are over 100% of the list price, right? So if we looked at this thing right here, oh no, I didn't want to do that.

July jobs report misses estimate

This 134, just one just extra close, so there you go. And then SF, Santa Clara County, the active single-family homes is 815. Again, we're about half I want to say about 60% of where we need to be. We need to be about 16, 17, 1800. So we're probably actually a little bit low. All right, let's talk about the jobs report.

We're a few thousand off. Actually, I was wrong. We're 23 off, 23, 000 off of the jobs report, which was the estimate for Dow Jones, which hurt the Dow Jones a little bit. We're still at an all-time low for hourly earnings. Makes it less affordable, right? I'm seeing a lot of people here You know, I do a lot of tick-tock and video surfing because I'm trying to figure out what content people are watching And I'm hearing a lot of people saying I can't afford it it's not up to Anybody but you to change that if you're in a position where you're uncomfortable In living you need to make the change whether it's you can't afford to live in that city Oh, but I need to be by my parents I understand that but there are certain things you need to make a living and if you can go to another place You keep the same job.

That's great I haven't had a corporate job in 20 years. So what do I know? Not trying to push people out of California or out of a high, living cost of living place, but. To me, a place is a place, right? And some of us are fortunate enough to have the forethought or we're in the right position at the right time to be able to buy a house.

That's great I haven't had a corporate job in 20 years. So what do I know? Not trying to push people out of California or out of a high, living cost of living place, but. To me, a place is a place, right? And some of us are fortunate enough to have the forethought or we're in the right position at the right time to be able to buy a house.If you can't afford to buy a house, you're going to be stuck buying or renting for a long time. And renting is just paying somebody else's mortgage off as far as I'm concerned. But if you can't afford it, you can't afford it. If you could afford to put 3% down or three and a half percent down in a house for maybe three or $400,000, maybe find a house or a place where you can afford to do that.

I know that one in LaCroix and Morgan Hill was not the, or. Croix Road is not the perfect thing, but it is what it is, right? All right. Inflation is not going away guys. It's going to be here for a while. It's a new thing. Inflation,

I don't again, we're talking about inflation. What this is saying is that inflation is leveling off, but we're already at an all-time high, right? We're all ready. At a place where we can't, I can't really afford it yesterday. We talked about this thing right here I want to show you where is it historical inflation rates

over the last two years? We've seen record high not record high but exceedingly high inflation which we've cut down but The damage is already done. We're you're still stuck paying for this, right? It's a factorial of last month and the month before and the month before and the month before So every time we see that it makes it really difficult for people to afford gas Which is now 20 cents higher across the nation.

It makes it more expensive for you to buy food. Where now you're paying about 400 bucks a month, a week to feed your family. I understand that. Sorry, let me get back to here. The damage is already done. What we need to see is a deflationary or we need to pay people more money. Period. Hate to be that, but that's how it is.

You need to make more money or you need to move to a place where you can afford to live. What I'm thinking about doing, honestly, I'm actually thinking about once the kids are in college, which is going to be expensive anyway, we're going to settle them in and then probably move to a place outside of the United States, maybe, or someplace that's a lower cost of living.

I understand that. It's not like I'm poor, I'm comfortable, but there is an affordability index where it's just going to continue to get more and more expensive here. So what do you do? We have a home buyer workshop link down below. If you're thinking about buying a house and learning more about it, can you do it?

Can you afford it? We go through a process of helping you understand that. And last but not least,

Philz original cafe closed

Phil's coffee. Oh, wait, What is it building? Housing fills original cafe, close release, nonrenewal owned by founder's son. I don't know why, people think that being owned by the founder's son is such a big deal.

That's not newsworthy. If I did things in a legacy mindset and I owned a business that became successful, I would make sure my children had enough to live off of, right? Or that they would grow up, hopefully, grow up to be financially smart people and not blow their money. My kids are young right now.

So every dollar that they get, they blow. I totally understand that because I did that too. But when you're legacy planning, when you get to a certain point in your life, you're going to do things for legacy purposes for making sure your children are well funded after you pass on, or after you stop earning money and you retire.

Right now, maybe the child. Could be a 35-year-old man or woman or whatever. They're at a point where you know, they don't need the money It's just part of their legacy, right? They don't have to worry about transitioning over to Like through a will or through a probate or through a trust or what have you is already in The son's name and by the way, the son makes a little bit of profit off of that.

That's landlord 101 So I don't think it's a bad thing what I do see though is that we're going to see a lot more Small companies and small businesses opt out of paying high rent. So you'll you're going to see that come up here pretty quick Anywho, that's it for now tomorrow. We're talking about what is it?

Tomorrow's Wednesday, we're talking about the 40 days on the market report, which is just to go through San Jose and where we are as far as last year, last week, and where we're headed. All right. I'm Vito with Abitano. We'll see you out there.

Comments

Post a Comment