Financially secure? Santa Clara County Hi's and Low's 🔴[LIVE] Tuesday Highs & Lows

Financially secure? Santa Clara County Hi's and Low's 🔴[LIVE] Tuesday Highs & Lows

- Santa Clara County Hi's and Low's 🔴[LIVE] Tuesday Highs & Lows

- Shortage =no crash https://www.tiktok.com/t/ZT88GfULM/

- Housing inventory Shortage https://www.tiktok.com/t/ZT88GvRdk/

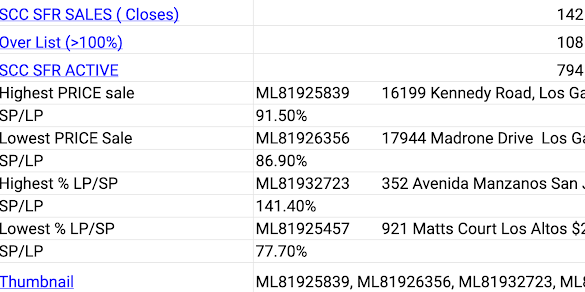

ML81925839 16199 Kennedy Road, Los Gatos $6,850,000

91.50%

ML81926356 17944 Madrone Drive Los Gatos, $650,000

86.90%

ML81932723 352 Avenida Manzanos San Jose, $1,400,000

141.40%

ML81925457 921 Matts Court Los Altos $2,550,000

77.70%

these are not my listings: ML81925839, ML81926356, ML81932723, ML81925457

Good morning, Monday. No, it's Tuesday, August 1st. Happy August. Holy moly. Can you believe it? Almost 55. Hey, three things you need to know. Plus this weekend, this week's highs and lows in Silicon Valley or Santa Clara County. Let's take a quick look. I was just looking at the numbers at the listings and I want to make sure that we spend some time going through this real quick.

Cool. Hang on. All right. This one is Kennedy Gatos. It's the most expensive house sold this week. 91% of the List price. So originally listed at 7.5, stood on the market for a couple days, a couple of months, and then went down to 7 million and then sold for 6.85. Five bedrooms, seven and a half baths, or five and a half, five and two half baths.

5,300 square feet. Beautiful house. Yeah, it's beautiful. French

Tudor style. It feels like I've seen this one before. The last couple of years, but yeah, really nice. See, look at those colors. Grayish is still a thing like gray, like bait, like grayish, I guess you can call it hardwood floors, original wood cabinet tree, not original, but those, that this was updated.

Wonder what it'll look like in six months. Yep, that one's the most expensive house sold. The least expensive house sold is also in Los Gatos. This one looks like it was a mobile home stacked on top of a foundation or just shacked together. I'm not sure why or how they would have designed something like this, but it looks just like an alleyway, an alley house, it's nice enough, it's just the problem here is you have to go halfway to Santa Cruz to get to your home, right?

A third of the way, at least. Okay, the least, the most, the highest list price to sales price ratio, Avenida Manzanos. List price 9. 90, sold for 1. 40 in our very own Blossom Valley. This one is Marshall Cottle Road, our park right here. 85, Blossom Hill, 87's right here. It's a very standard house. I could tell you for a fact.

They did this as a strategy. It wasn't anything magnificent about this house at all. It's nicely updated, but it's just a standard house and it sold for what it should have sold for 1. 4 in that range. And then this is the lowest list price-to-sales price ratio of 77. 7%. Matt's court in Los Altos is totally overpriced.

They figured they see what they can get for it, but it just sat on the market and they kept on lowering it and lowering it because they just overpriced it. That's what happens if you overprice a house. Now, this is nice. It's nice, but it's not completely updated has older windows I don't know if they're dual paint or not.

The floors look like they need a little bit of love, right? Nice photography

There you go. Nicely staged Original count kitchen was just painted put a new can lighting some new lighting. That's what we call frosting on a cake Original list price is 3. 28 So for 2. 55 after almost two and a half months. So there you go. All right, so Financially secure. I think this is a big topic. We have to talk about it here

Financial security is a big thing and I know we talked about affordability a lot and how it's almost impossible to buy a house here in Silicon Valley Most people if you're making money have to make at least two or three hundred thousand dollars to make it affordable in the United States period Right here.

You need to be they're saying that you can qualify for 250 to 300, but I think you need to be well over 300 as a family income, or household income to feel secure here. That's why people are shacking up, staying up, staying in apartments, or continuing to rent. The problem is you have everything else going up.

We have gas going up. Car prices are going up. Groceries are going up. Insurance is going up. And when you're a renter your, household security, Isn't a hundred percent because your rent is going to go up every year.

You might have a bad landlord. You might have somebody that just doesn't take care of their house or your air conditioning breaks down and it's up to you to fix it, but you can't really afford it. And the landlord is not going to take care of it because they're just jerks, right? I know that there's the legality part of it, but people are going to get away with it.

This.

Shortage =no crash https://www.tiktok.com/t/ZT88GfULM/

Buying a house now isn't a smart thing because the prices are so high and insurance rates are insurance interest rates are so expensive. And the common thing that most of us real estate agents and lenders are saying is to buy now because there's less demand. Or less competition and The price will go up.

When the price goes down the rates will go down and the competition would be very hard for you to refinance. That's true except you can do low modifications or you can just be Reasonable and pay down your mortgage as much as possible And then when it does come down the rates do come down you can figure out how to refinance and there's a Parity point when prices come down, rates will continue to go down, but prices will start to go up because the rates will go down.

And right after that point, you'll be able to refinance, right? You don't do it the minute the rates go down. Because chances are the reason why rates go down is that the economy starts to stumble Which means housing prices will start to stumble but historically speaking during recessions house prices tend to go up except for 2008 and 2009, right?

So we don't know what's going to happen

this here. What I would suggest is I know it sucks to say this I even get stuck in this mindset too. If, you can't afford to live somewhere, move to a place you can afford to live because. All things, everything else being equal, housing is expensive, but your car is still going to cost the same amount.

The gas is going to cost relevantly the same. The insurance is going to cost about the same. Groceries are going to be a little bit the same, right? But housing is the big, chunk. So if you can't afford to buy a house here, find a house where you can afford to buy it. And that's why people commute.

People go to Livermore, Pleasanton, or Modesto and commute every day, which I don't agree with. That's a choice or you telecommute and you can buy in New Mexico or Arizona or wherever. So this is a true thing. I have the link to this. If you want to take a look at it, that's fine.

This guy is saying that we're not going to see prices go down mostly because this is what everybody's saying. This is what I say every day. This guy's talking about how the low prices and the low-interest rate that we have had for so long that the feds screwed us to get the economy back on the mark on track, which I argue was necessary, but I don't think we should have had it that low I think we should have had a little bit lower but not like devastatingly low to where now people can't afford to move, right?

They can't, they're like, why would I move? Why in the world would I move from a place where I can afford 3, 200, 3, 500 a month for my house to now be paying 7, 000 a month for the same kind of house. Or maybe, it's the house that I want, but now it's twice as much money for me to rent or buy it.

That's why people are not moving. Yeah, so the only people that I'm really focused on working with right now are older people that want to downsize. That's really who I'm focused on working with. There's divorces, there's relocation, there's all that other stuff. And I have those, that business as well.

But really where I'm focused at right now is we working with seniors that want to down downgrade their, living situation because you have a 23, 25, 3000 square foot house or even a 5000 square foot house you do and you only have one or two people living there. You don't need that. The only reason why you don't need to move or you don't need that is.

There are a lot of reasons And we go through the whole process and I'm happy to talk to people The elder parents and their children their adult children so that we have we're all on the same note right so that and probate and Trust sales are where I work at and this guy's in He's saying the same thing, guys.

I'll tell you straight up It's not going to be easy for a long time. Housing is not going to change. Even if the economy crashes, housing is the, the problem is we have a very, low inventory period. I don't see inventory increasing anytime soon. We're not building houses equal to the population explosion.

Housing inventory Shortage https://www.tiktok.com/t/ZT88GvRdk/

So we're not building a house for every new person being born. We just do not. And I don't know what the delta is. Think so many people die every day and so many people get born every day, but there's a delta. We're not even covering that. We're not getting anywhere near that. We haven't done that in 20 years.

We haven't matched the population growth in house building. And housing at all whether it's house or apartment or condo or whatever 20 years So we're just losing that's a losing battle plus that and then we have corporations buying houses So if you're thinking about long-term Strategies I'm not saying don't sink all your money.

I'm not saying sink all your money into real estate I'm saying have a conversation with your financial advisor and have it And we have a conversation with me or your real estate agent and your loan people and your insurance people and have an idea of what's going on because you have to be financially intelligent, which is a great segue into our program called financial intelligence.

I just I, ask my, financial advisor to buy like 500 of the yellow stock. Just see what happens. Who knows? We'll see what happens. But just be, aware that things are going to start changing, but not for the better for a long time. Focus on your career, focus on working, and focus on doing the best you can to get yourself situated.

Follow the money. I have a, my investment guru says, follow the money. If you're in a job where. You don't have control over the money you're in a precarious situation. So consider that

the last thing I want to talk about is my fitness journey.

I don't know if you can tell, but I'm still a little flushed from my workout today. And I was just thinking I almost passed out because I was just pushing it. I'm at the point right now where my. My muscles can handle more, but my heart,, my cardio stamina just can't handle it. And that's part of the reason why I'm doing the hiking two, three times a week.

Got to build that up. But I was doing legs today and I was just, I just almost, I almost gave up. It was. My workout partner has a new job. So Mondays and Tuesdays, he can't be there. So it was just me. And I saw somebody that just kept pushing himself. And I was like, I'm going to start doing that myself.

I gotta keep doing that. So I continued, I pushed through it. I slowed down a bit. I knew where my limitations are and that's what you got to do. You got to figure out where your limitations are. All right. So that one soul reading this, I know you're tired. I know you're fed up. I know you're so close to breaking, but there's strength within you and even when you feel weak, keep fighting.

I think that's the whole point of that conversation. Fitness after 50 fitness and flexibility after 50 it's I'm not going to show off and have you watch me on video doing the video doing my workouts. But at the end of the day keep it keeps, that, keep those plates spinning and it's going to get tough here in a little bit.

So keep moving forward. All right. It's Tuesday, August 1st, 2023. I'm Vito with Abitano. We'll see you out there.

Comments

Post a Comment