🔴[LIVE] Monday Bay Area Report | Insurance Companies Are Abandoning Homeowners

Sales volume over $1BN this last week

5 Reasons to sell your house now https://www.realestatewitch.com/should-i-sell-my-house-now-or-wait/

Insurance Companies Are Abandoning Homeowners https://youtu.be/Gitg4yIsqVQ

When is the Best Time to Sell a House?

Buying a House in 2023 - Should you WAIT Until After the Crash? https://www.youtube.com/watch?v=ch7Bic3Ggc4

Homebuyer Workshop https://event.webinarjam.com/register/6/8oz4kcg

http://blog.abitano.com/

https://www.onereal.com/vito-scarnecchia-1

http://blog.abitano.com/2023/08/live-monday-bay-area-report-insurance.html

5 Reasons to sell your house now

Insurance Companies Are Abandoning Homeowners

When is the Best Time to Sell a House?

And here we go again. Three things you need to know about Silicon Valley, living in Silicon Valley on the real estate side. Five reasons to sell your house now. Insurance companies are abandoning homeowners and when is the best time to sell a house? All right. First and foremost, I wanted to talk about when rates went up again last year in April, March, and April timeframe.

We knew the market was going to crash a little bit. We knew it was going to slow down, meme.

Remember, I'm not paying in 7% interest on a mortgage. Lots of people are, and they're seeing the houses increase in value all over the place. I understand affordability. I understand it's ridiculously expensive right now, but everywhere you go, things are ridiculously expensive. If you can't afford it, I understand, but if you want to be beholden to a landlord

and have uncertainty about how much you're going to pay rent. And how much, or if you're going to live there at all, or if you have things that are not working like an air conditioner that goes out when it's 90, 95, 100 degrees out, I understand that's, your choice. And I understand that 7% is ridiculously expensive, especially for houses that are expensive right now.

But people continue to buy houses. So I'm going to say, so I don't know if it's ego or fear or what have you homeownership rate here is it's not going down. It's that's where it normally should be on the arc. I think we're going to see it go up over time. All right. Now, let's take a look at all this real quick these numbers are in orange and green They're just the weekly reports, right?

They don't really mean anything other than these are the closes year to date And this is the volume year to date and the average sales price over the last Year. Year to date. And this is the value versus last year's price,

which is this guy right here. See, this adds up.

5 Reasons to sell your house now

Insurance Companies Are Abandoning Homeowners

When is the Best Time to Sell a House?

Actually, it didn't. This last week, 06. You can see me do my, little calculations now. Here you go.

There you go. That's the real numbers, except for this one, because that one's Jaded from last month, last year, one thing I want to point out is Napa. Look Napa, I think Napa is going to be our first one to fall out of all of these. As far as pricing is concerned, I think we're already seeing a pricing decline.

I don't know. I was just looking at this before and looking at all these houses. They're still stupidly expensive. There's not a whole, the only, I only a lady who works in marketing and for one of the wineries. I went to high school with her, right? We're not friends or anything. We're just, I just happened to know her.

I saw her at a reunion last year and we started talking, right? So

other than the wine industry, I don't know why anybody would want to live here. Other than the fact that it's beautiful. It's amazing. Calistoga is gorgeous, right? There's no business is what I'm saying. There's no venture capital. There's no, not a massive amount of tech, right? I don't know what the industry would be.

There to support it. So maybe one day I'll go up there and instead of going to Carmel and doing a little hike, maybe I'll jump over here and take a look at the different markets, the different industries, but like everything's very, expensive. That's probably why people just can't afford it versus Santa Clara County, Alameda County.

And Redwood County, yeah, San Mateo County, there's an industry all throughout here. It's nothing but industry. Being so far away, maybe that's why it's so much more expensive. Fairfield, Boxville, Davis. This area right here probably never caught the wind that this did because most of these homes are Airbnb or second homes, people that can actually afford it, right?

5 Reasons to sell your house now

So when you see houses selling, you're seeing them sell less of them sell mostly because there's probably no industry. I'm talking out of hand here. I'll tell you straight up. Maybe I don't know. Maybe I'm full of crap. Just looking at this. And then Marin. Same thing. Marine County is probably pretty small though, too.

Right now I get San Francisco, right? People want to get out of Cal out of San Francisco, out of the downtown areas. It's not so bad in some of the suburban areas. Contra Costa, Santa Clara, San Mateo, Alameda. We're all doing really, well. The numbers keep on going up. You're seeing Alameda still selling at 93%.

So the most affordable place to live in the Bay area is Solano. Let's see if I can get that. Solano is this area right here, right? The Vacaville Fairfield is because it never caught wind. It never caught. It never caught fire like Napa did where people started spending a lot of money. So you're not going to see that kind of contraction there.

All right,

let's see. Should I sell my house now? If you're at 2%, you're probably never going to want to sell it. So rent it out. I understand that unless you're completely underwater in it or you just can't afford the payments. I understand. Look, we're humans, right? We make mistakes and housing isn't a perfect thing, right?

It goes up, it goes down. People can afford it. Some people can't afford it, right? If you have an Airbnb and it's not performing like you thought it would, perhaps maybe it's time to sell it. This is a great time to sell. There are fewer buyers in the market, but there are also fewer sellers in the market, and outside of Napa, they're holding, the prices are holding their own in the Bay Area, right?

Now, if you need to upsize or downsize. I understand. That's where you go. It's time for me to sell because it's just time for me to sell, right? Whether it's divorce, upsize, downsize, or death in the family, what have you, I understand. That's where I do most of my business.

Or you get transferred or you're selling an investment. Airbnb or vacation property. Your kids grew up and you don't use your lake house anymore. Or you're in Napa, second home. Maybe it's time to sell. And, or you need the money for a cashout. There you go. Homeownership rates were going up and down. Let's see.

What was the other thing we're going to talk about? When's the best time to sell a house?

When is the Best Time to Sell a House?

Yeah. Okay. So this kind of goes into everything, right? And that's the second part of this conversation is when is the best time to sell a house here in Santa Clara County. The best time is March, April, and May, and then it goes into September, October, and November, and then that's the best time, right? That's our local housing.

The season for selling is March, April, and May is when we sell, we've always been, like that during COVID. It was a wildfire. It was a firestorm for two years. So we just didn't have a season. We just kept on selling for a long time and we didn't have any time off, which is why I'm enjoying this slowdown right now.

For me, I'm actually slowing myself down. So I don't work as hard. Yeah, that's regional, right? You could be in, I don't know, St. Louis, Missouri, and March September, October, and November is the time for you to sell. I know in San Francisco, the best time for you to sell in September, October, and November is in the fall when kids get back to school just happens to be that way in Santa Clara County where March, April, and May are.

What does that mean? That's the best time to sell for whatever, but here's the deal, right? If you go up 5% in March, April, or May, it might go down to 4% during the summer, but guess what? September, October, November is going to tick back up. So you don't know, you don't know what's going to happen. And we don't know if the market's going to crash in three months, six months, nine months or a year, or 10 years.

We just don't know. So the best time to sell the house is when you're ready.

That said, you can't come back to me and say back in April, my house was worth 1. 6 million and now I show you where the numbers are and it contracted because everything, it's a living organism and things breathe, exhale, inhale, exhale. Contract expand. It's just a normal part of the market.

Insurance Companies Are Abandoning Homeowners

So anyway, there you go. The last thing to be aware of is insurance companies are bailing. Now we have Chubb, Liberty Mutual, and AIG. We knew about AIG state farm. And there was another one that was that bailed out.

And it's not just California guys. It's in Florida too. Places where there's massive weather and natural disasters that are happening. Let's go to. Destroy the insurance companies and they have to pull out and I understand where they're going with this. And is it fair? It's not fair to the consumers, but it's just a fact of life.

And there's got to be another way of us going to attack this.

I think DeSantis, I didn't see anything. This is what I was told DeSantis put a moratorium on anybody, any company that left. You have to pull out all of their insurance offerings. Meaning that if they pull out on housing, they're not allowed to do automotive or health or a business or life or what have you.

I don't know a whole lot about insurance other than it's a necessary evil, just like real estate. But it is what it is. So there you go. Part of one of the things that I talk about is not here.

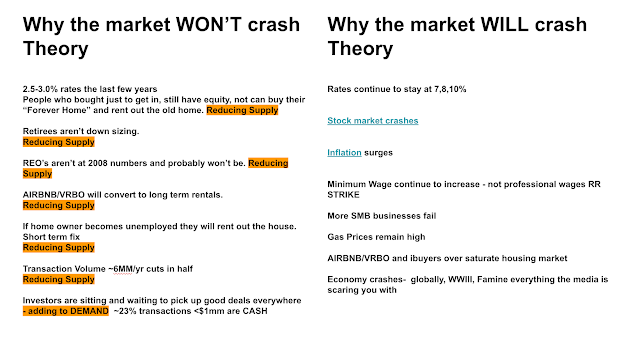

One of the tipping points that I have not added is insurance. Insurance could very well be one of the tipping points. It absolutely can be, right? I'm thinking it's going to be automotive, starts it, right? But it could very well be insurance. We don't know. And what I'm saying here is we're stacked on a house of cards.

Real estate is one part of the massive GDP of the United States and the global economy. So what are some things that could do it? With all these things here, commercial real estate energy could be world war three. It could be economic. The collapse of Europe. It could be a multitude of different things.

I'm laying my bets on these three, on these six things. And the more I look at it, insurance probably is one of those things I want to add. Will the market crash? I don't know. We've been expecting the market to crash for the last eight years.

Since 2016. 'cause when the market crashed, the time before that was 2008. And if we know anything about the history of real estate, we were expecting an eight-year cycle, eight years. I don't know, 16, 17, 18, 19, 21, 22, 23, 24. Maybe next year at the 16-year cycle. Who knows? Maybe we did see a turndown in 16, 17, 18.

Who knows? But here's the thing, right? Here's the reason why. Oh, sorry. Probably won't see a crash. And I'm not saying that we're going to see this or not. I'm just saying these are the facts that I see continuously. There's a low supply. Mostly because two and a half percent, 3% rates, everybody bought into it that could.

And a lot of people bought extra and then a corporation spot. So there's zero supply. There's not a whole lot of supply, even though you look over here and then you look at Napa County, there are 240 houses, single-family houses, by the way, for sale, and you can get it for as low as 450, 000. Now this is in a resort area.

In the mountains, right? It's not necessarily here in what you think of as Napa in the wine country. This is up in the Lake Berryessa area.

Retirees are stopping, not wanting to downsize. I get that because I don't want to live in a retirement home. I am tempted to look at the villages, but then the villages are 1, 000 a month just for the privilege of living there on top of your mortgage and your property tax and your utilities. So I don't know.

As of right now, we're not seeing any bank-owned properties. REO is real estate owned. And that's a term that banks use for bank-owned properties. We're not seeing that. We're just not the whole Bay Area is 32.

We're not seeing it. It used to be 3200, not 32. We're not seeing that. That's not going to happen. Airbnb VRBO converts the long-term rentals versus them getting off the market because Airbnb VRBO Airbnb specifically makes it really hard for the hosts to do business. They're, making it more and more difficult.

I see tons of reports all the time on Airbnb. Screwing over the hosts the, homeowners, not the guests. If the homeowner becomes unemployed, they will rent out the house, and that's a short-term effect. When you were laid off, you would sell your house and move in with your parents. Again, it would be foolish for you to get, walk away from it two and a half percent.

Rate. So that mindset is further reducing transaction volume. We're going to see closer to 5 million versus 6 million in the United States this year. That's reducing the transactions. A lot of real estate agents and lenders are getting out of the market. They're going to find a j o b Investors are sitting and waiting to pick up good deals everywhere.

Every day I get calls and I know people I know get calls from investors bugging them and cold calling them.

Okay, I said this six months ago when we first about a year ago when we first encountered 7% rates again I don't think that's slowing us down But if it gets up to 10% it could be could slow us down stock market crash inflation surges Although I already said that we're there and factorially we're not at 3% inflation.

We're at inflation month over month which continuously leads up. So when you're used to paying, I don't know, 3 for a loaf of bread. Now you're paying 5. You're paying 50% more overall for everything. The minimum wage continues to increase. Small, more small businesses, small and medium-sized businesses. I see a lot of franchises folding now.

I don't know if we've talked about that. I know we've talked about that. Gas prices will remain high. That's just part of life. Oh, sorry. Airbnb, VRBO, and iBuyers oversaturate the market. So if there's a massive collapse of Airbnb or VRBO and people start throwing those houses on the market. Yeah, we're going to see an oversaturation of the market.

And when supply is high and demand is steady or lowers, prices will contract. The economy crashes globally world war two famine, everything that the media is scaring you about scaring us about we're seeing fires in Hawaii. We're seeing. In Jersey, I think there were two all over the place. There's crazy weather on the East Coast.

You just don't know what's going to happen to trigger something with a manager crash. Those, are the reasons why things could crash. But again, I'm not seeing it happen. I'm not seeing it happen here other than in Napa, mostly because I don't understand the market. I don't sell in that area.

Sonoma, Solano County, right? Solano County,

still the least expensive place to live in the Bay Area on average, because it never caught fire. More and more people said, no, I don't want to move all the way over there. If I'm going to move there, I want to move to Napa, or I'll move to Sonoma, or I'll move to San Rafael, Marin County.

South Bay is the word place to be if you're going to be in. Tech, which is why you see San Mateo, Santa Clara, Contra Costa sorry, Alameda. Doing really well. Those are the three counties that surround the South Bay, right? You can go to Santa Cruz, but that's quite the drive and very difficult to get through this 880 or 17 depending on who you're looking at.

All right. Those are three things you need to know It's Monday, August 14th. Happy birthday to my cousin Chris. Happy birthday, Chris I'm Vito. Hang on a sec. Let me do this properly. I'm Vito with Abitano. We'll see you out there

#best time of the year to buy a house,

next housing crash prediction, housing market projections, Should I Buy A House Now Or Wait?, should I buy a house now or wait until 2023, Why You'll Regret Buying A House in 2023, Housing Market 2023: 5 Options If You Regret Buying a Home

Comments

Post a Comment