Residential Sales Volume Over $1BN

Residential Sales Volume Over $1BN

- Sales volume over $1BN this last week

- 5 Solid Reasons To Buy a House Now, Despite High Rates—and 2 Reasons To Wait https://www.realtor.com/advice/buy/should-i-buy-a-house-now-reasons-to-buy-vs-wait/

- Historical Inflation Rates https://www.usinflationcalculator.com/inflation/historical-inflation-rates/

- NPR: Experts say don't wait for interest rates to drop before you buy a house Buying a House in 2023 - Should you WAIT Until After the Crash? https://www.youtube.com/watch?v=ch7Bic3Ggc4 Homebuyer Workshop https://event.webinarjam.com/register/6/8oz4kcg

- http://blog.abitano.com/

- https://www.onereal.com/vito-scarnecchia-1 #

best time of the year to buy a house, next housing crash prediction, housing market projections, Should I Buy A House Now Or Wait?, should I buy a house now or wait until 2023, Why You'll Regret Buying A House in 2023, Housing Market 2023: 5 Options If You Regret Buying a Home

Three things you need to know about real estate today, especially here in Silicon Valley. It's important because there are a lot of different factors that are going into the decision to make a home purchase.

The first thing we're going to talk about is five solid reasons to buy a house now despite high rates and two reasons to wait. And then the second one is we're going to go over historic inflation rates, and then we're going to jump back into buying a house, why experts say, don't wait for interest rates to drop before you buy a house.

And then we're going to talk about the billion dollars. Volume this last week. All right, let's get going.

All right, five solid reasons to buy a house now despite high rates from real true. com first one is there are more homes for sale. Not necessarily. We're down about two-thirds about 30%, and 33% is roughly missing from the inventory. So there's not a whole lot more homes for sale, but that also doesn't say anything about the demand.

Demand has waned. However, it hasn't come back down to that level. That's meeting or lower than the inventory, so there's still more demand for the houses. That said, there are still houses, there are still a ton of houses out there that are for sale, right? I think these, this is my, yeah. What is that's, these are bank-owned properties, so you're like, holy crap.

How can there be so many houses for sale, but there's not a lot of inventory? These are less. They're either overpriced or their condition or their location like this one right here a million dollar want to call a single-family house, right? Hello, and we'll come back to that. Yeah, it's old this one here in santa cruz I've looked at for the last couple of weeks.

It's A really odd lot you don't have much of a backyard and I can tell you straight up You don't have a garage. So why would you pay a million dollars or 1. 1 at that point for a house in Santa Cruz? I think people are just realizing that there are certain deals that you can look at And certain ones that can't.

Home prices may be heading south soon. Don't count on it for the Bay Area. Even during our downturn, we did drop back down over the last year and a half. Remember, we did see housing go down. Where is that?

This, these prices did go down quite a bit in 2021.

They did. That's only to bring it down to normal rates because we explosively and unnaturally expanded our, home values.

5 Solid Reasons To Buy a House Now, Despite High Rates—and 2 Reasons To Wait

So let's, do this one real quick. Experts say, don't wait for interest rates to drop before by before you buy a house. Now this is an interview and it talks about a couple of different people looking at buying and why they didn't buy and they feel like they missed the boat. Yeah, they missed the boat.

They absolutely did. And I said this for the most part, for the last couple of years, I've been saying there's when the market is high. Let's see if I can get

it now when the market is high when the market's going fast and there's a ton of homes for sale But there's a ton of competition means prices are going up. It's going to plateau which is what we saw And then we saw the dip now We don't know if we're going to see a major crash or just a correction or what have you?

But chances are we're going to see it come back down just a tad bit, right? So when the market does come down that means fewer people are buying For whatever reason, they're uncertain, which is one of the reasons right here. Interest rates are poised to decline this year too. I don't see that happening.

NPR: Experts say don't wait for interest rates to drop before you buy a house Buy

Maybe, when the election cycle starts, we'll see prices come down, but I think they're being left high for a reason. I don't care what they said back in 1981. That's old ancient history. I get that we use that as a marker As a point to jump off the conversation. That's pretty much it We're not going to see 16 It's not possible But what I can tell you is that in the election cycle as it comes in we're going to see rates come down Are they going to be down to 2%?

That was foolhardy for anybody to put it down to 2% for any reason. Homes are taking longer to sell. It's true. We measure that every day. We measure that through this right here, days on markets. Over the last year, we saw rates, almost our days on the market, almost double on average. We're back down.

We're actually inverted over the last couple of months. You see that was taking less time for us to sell than it did the same week last year. Meh, I think we're back at this. Now, this was written two months ago, right? At the end of two months ago. A month and a half ago. Homes are taking longer to sell.

It's the right time for you and your family. Now, look, that's the only time, the reason why you should be buying a house. It makes sense for you to buy a house. You got your landlord selling you, rent at the place you're living at. You're relocating. Whatever, your divorce, it's the right time for you and your family to buy a house.

Don't buy it based on what the market's telling you. If it's the right time because you're done being a renter, buy a house. What happens if the market crashes? It'll crash, right? Chances are the market is going to crash. And then what happens? Try to buy another house or two or put money into your stock market and, then write it out.

And then when the market cuts back up again, you sell. But your house shouldn't be an investment vehicle. And then reasons why you shouldn't, you haven't controlled your button your, budget, which is an excellent segue for us to talk about financial intelligence is something that we're putting together where we have a series of service professionals, financial service professionals, insurance lawyers, all sorts of different people and talk about what their thoughts are on.

Making a living, living out your life, living within your budget, living within your means, and becoming a financial powerhouse instead of living paycheck to paycheck. Okay. And the third one is your future is uncertain layoffs. You don't know where it is. You, yeah, don't know what's going on.

You have bad credit. You, yeah, you bought a 1, 500 a month car. Those things are going to hold you back and we went back into this whole thing experts say Don't wait. I agree. Don't wait if it's time for you to buy your landlord's kicking you out or your landlord has increased your price Your rent again Maybe it's time to look at purchasing a house.

So you get out of the rat race You have less uncertainty as a renter. You don't know if your rent's going to go up or if they're going to evict you or if your air conditioning goes out in the middle of a heat wave and they're, they take weeks to fix it. You don't know what it is. You don't know what your, certain, future is.

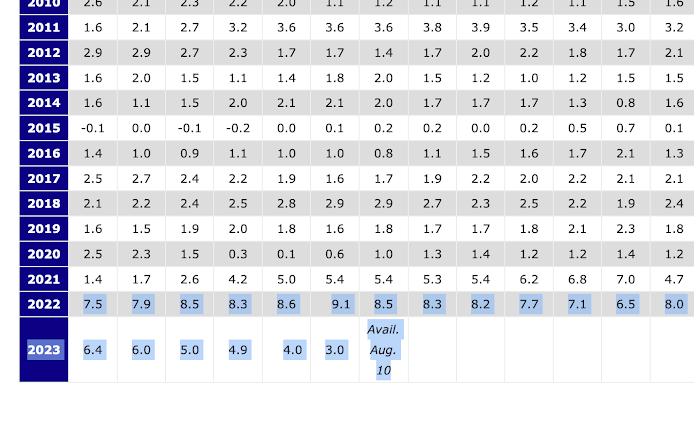

So when you buy a house, you actually take control of that. All right. I want to talk about this real quick. Two minutes. All these numbers don't mean a lot except for when you come down here, right? Last year, we saw a crazy amount. I can't say unprecedented because we're going to go back up to 45, 46 50 years ago, 60, 70 years ago, right after World War I, we went into a massive build-out, suburban sprawl, and all that stuff.

We're seeing this happen. Yes, we're under control again. However the price of bread still keeps going up, it's still expensive. The price of food, the price of chicken, and the price of gas are still super, super expensive. And I think that's going to become our new normal. So the only thing that's going to offset that is in, in, what's this?

Historical Inflation Rates

Oh, look at that. Milk prices. Ooh, I want to check that out. The only thing that's going to change that is increasing wages because that was set into motion when President Biden came in and he set something where it was 17 an hour. I can't remember. It pays your people more. I understand that.

But when you pay people more, inflation goes up. I understand we printed trillions of dollars, right? But when you pay people more the cost of sandwiches goes up the cost of dry cleaning goes up the cost of gas goes up The cost of everything goes up and we're stuck. It's not gonna come back down. So come back here to the 70s we saw inflation here.

We saw inflation in the 80s, right? Right after World War two we saw 18, 19% inflation, 14%, 17, 18% inflation, 1946, right after we call it peacetime, right? We call the truce right before the war started or right after the war started, right? 1942. That was December 10th, 1942. Or 40, 42. So right before that, they brought us into the war, right?

Same thing here, 1980s. We had I think it was Jimmy Carter and the hostage and the gas prices, that time frame. And then we're seeing it again. I think this is just a normal thing. We're catching up. And this is our penance for printing up all those trillions of dollars. So there you go. That said, I highlighted this over the last couple of months.

Residential Sales Volume Over $1BN

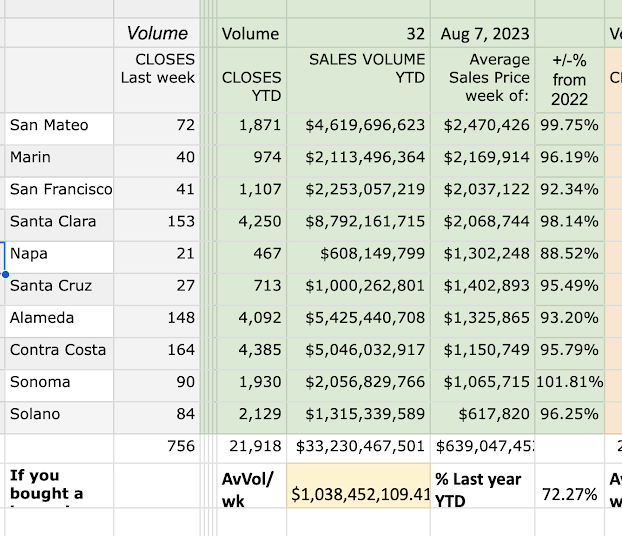

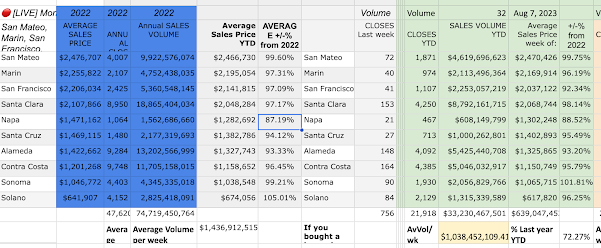

I think it's important for us to see this. Last year, our weekly average was 1. 4 billion dollars a week. We, in 10 counties, 10 counties, right? Right here, these 10 counties right here. Now let me see if I can make it bigger for you. There you go. These 10 counties, San Mateo all the way down. Not including Monterey, which I should last year, In 2022 we averaged 1.

4 billion a week in sales. So we're still at 72%. We've topped A billion dollars over the last month and a half. It looks like yeah, right? So July 10th, we were just under a billion dollars, but now we're back up. We're continuing to climb 1. 17 1. 017 1. 026 1. 031 1 billion dollars so we can say oh, the economy is not doing that great.

Yeah, you know what? It's not hurting either, right? So we did 31

Yeah, so what this is is it takes this number divided by the week number and that's how you get it So and we're all doing very healthy, right? We're all coming right back up to those numbers that we saw last year these numbers are right here in blue The average sales price right here. So just take Santa Clara for account 2.

1. We're almost at 2. 1, right? We're hovering at 2. 06. Looks like. Yeah. 2. 06 for the last three, four, five,

six. So we're hovering right there. We're probably going to sit there for a little bit until the market chirps. So

that's it. So we talked about oh, wait, there's one other thing. 1 billion dollars There's some other stuff I want to talk about. Nope. That's it five reasons to buy a house two reasons to start to not historical inflation rates and what that really means and then expert says don't work wait for interest rates

And then there's also this other thing. We'll talk about that tomorrow. I'm Vito with Abitano. We'll see you out there

Comments

Post a Comment