🔴[LIVE] Loan Originations tick up | Bay Area Luxury homes | Bay Area 10 County Report

- Loan Originations tick up https://fred.stlouisfed.org/series/RCMFLOORIG

- Fraud on the rise

- How the NAR Lawsuit Verdict Could Impact Home Buyers

- Will mortgage rates go down in 2024

- Homebuyer Workshop https://event.webinarjam.com/register/6/8oz4kcg

- Bay Area 10 County Report

- https://www.onereal.com/vito-scarnecchia-1

🔴[LIVE] Loan Originations tick up | Bay Area Luxury homes | Bay Area 10 County Report

https://www.onereal.com/vito-scarnecchia-1

I think I just got a little gift. The thing about marketing is, you're always reinventing yourself. And,

These are new signs.

This is an unboxing. It's not as exciting as you might think it is, but it's an unboxing. Today we have a lot of talk about what's going on with the NAR lawsuit loan originations are up,

mortgage rates fall, lots of supposition, lots of salacious news headlines that we're going to be talking about.

Homebuyer Workshop https://event.webinarjam.com/register/6/8oz4kcg

Oh my god, it's not light. We also have a nice luxurious home to go look at, and title theft, and a homebuyer workshop. But you already know about that. If you're going to do it, you're going to do it. Ready? Let's see how this looks.

In case you haven't noticed or heard recently, I switched brokerages yet again. I have a new for sale sign. They don't have the grommets. Dagnabbit. It's a good thing I have a drill. There you go. For sale sign. All right. Okay. There's your unboxing. All

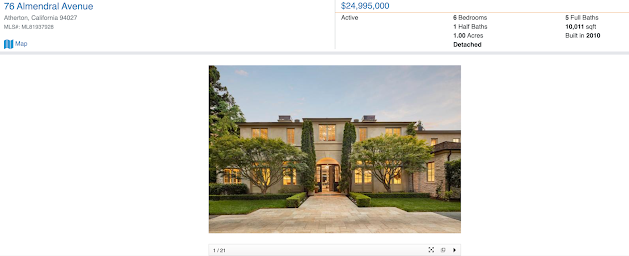

So let's get into it. We already talked about what we're talking about. So let's get into it. I'm in a draw. Now, this is not my listing. This is a compass. Company I used to be with, but this is a beautiful house, six beds, six baths, one acre, 10, 000 square foot house. It's gorgeous. This is like the Prince of Bel Air.

Gorgeous. Look at that Casita. I don't like those glasses. This house is a statement house guys. This thing's beautiful. See if I can get this thing out here. Just beautiful. Love the wood grain there

and notice the walls aren't gray. Notice the floors aren't gray, right? That's cute. Have a little patio there. I would never leave that house so big. You get a. An exercise room. I actually like going to the gym.

You can spend hours there. I would never leave. I would, but that's beautiful. And it, where is it? See if we have a map. Oh yeah. It's only a hundred thousand dollars a month in case you want to know what it would be like on this thing. Okay. So there you go.

Will mortgage rates go down in 2024

Will mortgage rates go down in 2024? Some would say we've already reached the top of the market. I think we've curtailed enough of the inflation and we've seen it so that we made it really impossible for Homebuyers to buy at 8%. And I think what we're seeing is we expect consumer says five, five and a half, right?

But because of the market, the way capitalism works, it has to have something, right? You have to see what the market will take. And look, there are still houses that are selling in a couple of days off the market. It just depends on how you market it how you put it on the MLS and where you rate sell it My opinion is they should stay high as long as possible.

I know it seems counterintuitive, but that's because People are still buying people are still buying houses They're not slowing down. They're still buying the supply that we have. That's the problem. We have a low supply, so we have to make it painful to keep prices up. Now in a perfect world, I'd love to make it easy and affordable for buyers to be able to buy.

But because we're in this conundrum, we had 2 percent interest rates for so long. We had a firestorm of home buying for a year and a half and rates went, prices went crazy high because of that. Because they're like, forget it. I can just buy it. If I don't buy it now, I won't be able to buy it later. And a lot of those people that own a house right now are thinking about their God or their universe that they could, that they bought when they did, it might not have been the perfect house.

It might not have been everything, but people are. Still buying. Why? Because they know that they'll be able to refinance later. So you buy what you can afford now. It is sustainable because it could go up to nine or 10 percent or 14 or 15%. We don't know. We don't want you to get stuck in a position where you have to sell it in distress, right?

I and our loan officer will have a conversation to ensure that we know what we're talking about and that you're in a position where what you can afford is sustainable. I don't think rates will go back down to 3%, not for, not until there's a global collapse of some sort. And that might be used to start the economy again.

Should you wait, you go ahead and wait. If you're in a position where you can wait, go ahead and wait, but understand that when rates drop, the competition will get heavier. That's all I'm going to sell you because you know how painful it was back in 21 to buy a house. There were 25 offers on every house.

And every house went from a hundred to 400 to 500, 000 over the list price. And if you want to be in that position again, go right ahead. I'm not here to convince you or tell you what you should do or what you shouldn't do. If it makes sense to you, do it. If it makes sense for you to hold and wait, I have a lot of people who are still saving money, right?

There are a lot of formulas out there saying if you bought now and you waited three years, you could have saved this much money, whatever. Totally up to you how you want to do it, right? If you need counseling or need to bounce ideas off of me, What you can and can't do, or whatever. I prefer I turn a lot, I don't turn people away.

I turn people in the direction that they need to be turned to. It's my job to make sure that if they're going to buy a house they know what they're getting into. I want to make sure that they're in a position where they'll be comfortable for the next 15 to 20 years. I'm just grateful. I bought 20 years about this house 20 years ago, seven years before that I bought a house, right?

Loan Originations tick up https://fred.stlouisfed.org/series/RCMFLOORIG

So I'm just grateful that I'm in a position where I don't really have to worry about that kind of stuff. However, prices popped down. I think from the shock of it going to, because back here we were at six and a half, seven, seven and a half percent, and now we're at 8 percent, and yet originations have popped up.

Loan originations are me submitting a loan application, and having an underwriter look at it. That's a loan origination. They're not closures. They're not completions. So maybe there's a lot of people that are out there. So there you go. Let's talk about our lawsuit.

How the NAR Lawsuit Verdict Could Impact Home Buyers

So my opinion on this lawsuit is it's a class action lawsuit. I have a poor opinion of lawyers that befuddle others, and get them to join in anger for a lawsuit so that they can make. They're a bunch of money. Here's the problem with this right? He, apparently 000 sellers are going to be, that is part of this class action lawsuit.

Now uh, Missouri found against NAR and Keller Williams and they're appealing. So we'll see what happens there, but let's just say that this happens, right? Let's say that they actually follow through and they, the NAR have to pay that 1. 5 billion. The lawyer is still going to get 20, 25, 30%, maybe 33%. Who knows, right?

They get theirs. Now, who's going to pay that? The plaintiff technically it's the same situation. He's just being hypocritical. Mike, to me, it seems hypocritical that he, this lawyer is suing and making the plaintiff pay like a. buyer's agent getting paid by the seller. I don't know. It just seems hypocritical to me.

a Video. We have something on Citizens Bank too. A couple special reports. Feds also eyeing, eh, bullshit. So what happens? What happens now, right? Let's say that this becomes part of a rule. Now, nothing's changing, right? There's never been a rule stating that the seller has to pay the buyer's agent.

You've always paid the seller's agent, the listing agent. Technically what we do is we split it 50-50. Sometimes we take a little bit more if it's a large problem or we give a little bit more if it's going to be difficult to sell, it depends on how they set it up, but it's always been negotiable.

And many other companies out there are part of that offer a separate scheme. You can do a flat rate, there's help you sell, assist to sell, there are 1 percent guys. There's Redfin where you can work with 15 different people and never really know who you're working with. There are high-end client sales agents, right?

Boutique firms and boutique groups that, that's all they do is sell multi-million dollar homes. And I can tell you that looking at the back end of that, they don't necessarily pay the agent two and a half, the buyer's agent two and a half percent all the time. Sometimes it's 1%, sometimes it's 2%, sometimes it's 3%, sometimes it's 4%, right?

There are agents out there that will put it on the MLS for 5, 000. The co-op commission is 5, 000. It's part of the marketing scheme, right? How are you going to compensate the agent that represents the buyer? This guy's saying that we're ripping off the seller But the seller has to buy a house with an agent and the agent is going to be compensated in some way So let's say that you sell your house and you have to pay five percent or six percent to an agent And then the buyer's agent gets half of that, right?

So now you're 6%. And then this lawsuit goes through and the appeal goes through. And now you have to pay an agent to help represent you to buy a house. You get screwed three times, right? Could that happen? It absolutely could happen. That's still just a supposition. The other problems are a 0 percent down like a VA loan.

Now I'm a veteran. I just went to the VA clinic in Palo Alto to see a friend of mine. He's been there for the last couple of weeks. There's 0 percent down. You can ask the seller to pay for closing costs for repairs. They can have them pay for points to buy down the loan percentage, the APR.

And now on top of all that, you have to ask the seller to pay. Fires agent commission.

It's just no matter what the seller is going to have to pay it in some way some form Let's just take another example. Let's say we're selling a 100, 000 house, and this and the traditional wherever you want to call it that the old way was 6 percent and then you sell the house and You sell for 100, 000.

So that's 6, 000 out of your pocket or you can say you sell it for a hundred thousand, you pay 3%, you get 3, 000 out of your pocket. But then this buyer comes back and says, Hey, I can't afford to pay the commission on top of everything else. Can you help me with closing costs? Can you help me with this?

Can you help me with that? And I need you to pay the buyer's commission. We're still paying the buyer's commission. You might not pay it. You might get a little bit more for it, but not that much more.

A lot of things are being worked out. We don't know how this is going to land. I still think it's a good thing that we're, that this is happening. I think it's good that we smack NAR in the face a little bit, not a huge fan of the union concept and how strong of a lobbying force they are. And I think this is good.

I think it's really good that we're. Going through a process to look at us from an outside point of view, maybe not litigiously, I think it's good that we're taking a look at this. What's going to happen is there's a lot of agents that have come in, uh, to make a quick buck that are going to get out.

I think that's good. It's been my position that selling real estate should have at least a master's level degree in real estate to be able to practice real estate, just like a lawyer needs a JD or a doctor needs a medical doctorate. medical degree to practice medicine. That's the same thing here.

We're talking about millions of dollars of other people's money. It's just like a financial advisor should be a master's level. Degree, right? Anybody that can pass the test 70 percent or better can become a real estate licensed, real estate agent. That doesn't mean that they're going to be good. Doesn't prepare them to be good or great marketers or great negotiators or great people.

They teach you that stuff, but there's no way to really get you through the process unless you go through and last five years in the market, in the business. We have a large portion of people that are going to start retiring in the next five to 10 years. You're going to see all the older people retiring.

Hopefully me too. We can have a lot of new guys coming in, new people coming in and they need to be taught the right way, how to ethically deal with a client, how to ethically. Negotiate with a real estate agent, how to care for and service a client properly. Those are guidelines that are loosely drawn out and aren't really enforced.

And I was talking to a friend of mine, we're going to have them on a live here pretty quick. I've had problems with agents in the past where they have gone up against our code of ethics and clearly crossed the lines. I've talked to the people on the code of ethics, and my feeling is that. They don't want to punish the people who do the wrong things because they're all about the subscriptions.

They're all about building up the subscription base as much as possible so that their association, whether it's an MLS, an association of realtors, a local county, whatever, or a state or the national, they want to build their subscription list to make them as powerful as possible. I think that's a horrible way to go to business.

And I think that's going to be the end of a lot of things. So I am tentatively waiting. I think it's a good thing. I hope it helps everybody because at the end of the day, what we want is to raise the tide. And raise all the boats and make service better for the consumer. Make the consumer better educated and let them know what their choices are and let them make choices, not force them into something and then screw them over.

I've never been for that. And that's that. So love to see what's going on. We'll be talking about this once a week or so until it is finalized. There's another lawsuit coming down the pike and I'm really excited to see what's happening with that. So we'll keep you on top of that. And yeah. Okay. So let's get to title theft.

Fraud on the rise

Big, huge problem right now. People are coming in, especially with your elders. If you have parents that own property. I don't care if it's in California or not. They own property. Have them check the title. People can come in and fraudulently transfer titles. It's been happening a lot. So if you're worried about it, I talk about this all the time.

Give me a call. I'm not going to try to sell you anything. I'll just do a quick title search for you. Kick it down, right? And send it over to you. Because at the end of the day, I'm not here to push you into anything. I'm here to serve. and educate and help people understand the entire process from start to finish.

Give me a call. I'm not going to try to sell you anything. I'll just do a quick title search for you. Kick it down, right? And send it over to you. Because at the end of the day, I'm not here to push you into anything. I'm here to serve. and educate and help people understand the entire process from start to finish.

That's why I do this. I know sometimes, I only have five or six people watching this video, but at the end of the day, I'm hoping that I help one person from the buyer's workshop.

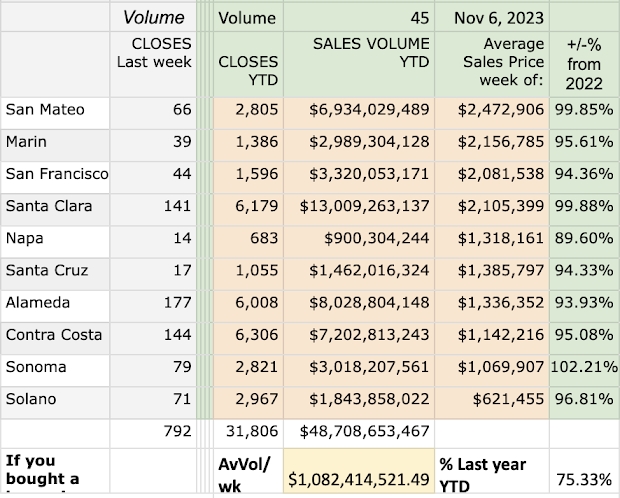

Bay Area 10 County Report

So nothing major happening here. Santa Clara is still far ahead in value. Contra Costa is almost half a little over half.

Of the sales volume but way over in units. So what does that tell you? It's a good place to buy Another good place to buy is Solano if you can't afford a house a million 1. 5 million dollar house Actually Santa Clara county is 2. 1 million now 2. 1 million dollar house go to Solano county It's not that far away.

It's not that much of a drive and you can telecommute three days a week Or you can go to NAPO where you can find a good deal for a million dollars and houses are selling it 90 cents on the dollar on the average. There you go. All right. I think I talked to you. I think I talked your ear off enough.

Today we talked about loan originations coming up mortgage rates coming down and The NAR lawsuit lots of stuff coming around the pike guys. I think this is an exciting time to be in real estate I know some people are touting doom and gloom, but I think this is great I think you know, I think here's the thing if you're not afraid to change if you're sorry If you're afraid to change you're gonna get broken Right?

I'm trying to teach myself Portuguese. I'm trying to manage a nonprofit to help my fellow veterans, right? I'm trying to do all these things and it's uncomfortable. I'm always in the zone of being uncomfortable because change is inevitable. And if you're not ready for change, you're going to be bounced out.

I'm Vito with Abitano. Hope you have a fantastic week. We'll see you out there.

Comments

Post a Comment