San Jose to provide nearly 70,000 housing units by 2031

- San Jose to provide nearly 70,000 housing units by 2031

- Please like, and share!

- Freddie Mac Tightens Lending Rules In Bid To Detect Fraud

- Landlords cry foul as more states seal eviction records

- San Jose Hopes High-Rise Development Will Ease Housing Crisis

- Register to vote today

- REO of the Week

- Homes for sale near Apple

- Mountain View home of the week

- FREE HOME BUYER CHECKLIST HERE https://abitanogroup.com/Homebuyerchecklist

- Home Inspection CHECKLIST HERE https://abitanogroup.com/homeinspectionchecklist

Introduction and San Jose Housing Plan

San Jose to provide nearly 70,000 housing units by 2031

Please like, and share!

San Jose to provide 70, 000 housing units by 2031. Freddie Mac is tightening the lending rules to detect fraud. And we'll go into that real quick. And then landlords are complaining.

Because states are sealing eviction records registered to vote bank-owned property of the week, Apple Home of the Week Mountain View Home of the Week, and the 40-day market report. Lots to go over here. San Jose is trying to develop 70, 000 units by 2031.

So there you're seeing a lot of buildings, a lot of different things that are coming along. Now, we don't know where this is going to be. The Aquino, maybe you do. I don't know. I haven't seen it yet. 70, 000 units. That's a lot. And it's going to be a huge burden on our infrastructure, on the roads, on utilities, on water, etc.

It's going to be really tough for us to put this through. But what you're going to see is a lot of Older buildings getting demolished and more high rises coming. And I know you see it when you go to Sunnyvale Cupertino and Mountain View. This is just one of the places that we need to put more units in.

And yes, they're going to be rentals. Some are Market rates, which are below market rates for low-income, and it's a good thing. It's gonna be tough, it's gonna be dirty, and it's gonna be a lot of construction. Slow driving for a long time in the next few years.

Just gotta put up with it.

Freddie Mac Tightens Lending Rules

Freddie Mac Tightens Lending Rules In Bid To Detect Fraud

Freddie Mac tightens lending rules in a bid to detect fraud. This is mostly on appraisal fraud, it's. Pretty widespread. There's a lot of pressure where lenders are putting pressure on the appraisers to bump up the numbers Freddie Mac is going to require that loan docs come directly from borrowers. Lenders will take that loan application and mark it up or modify it, which is loan fraud. It's illegal. Certain businesses are not allowed to even do Freddie Mac loans anymore, which is. Meridian Capital and there's another couple of them here too. If you want to read more about it, the link's going to be in my blog.

Challenges for Landlords with Eviction Records

Landlords are making it more difficult to be a landlord today.

Landlords cry foul as more states seal eviction records

They're going to start sealing eviction records. Now, part of the problem is when a landlord. Submits an eviction claim. There's not a lot of closure to it. And very ambiguous information comes from it, And it's a tough thing. But what they're doing is making it much more difficult.

If you're a serial evictee, meaning you get into a contract. An apartment or a house and then you stop paying and then you get evicted and move on to the next house. One, shame on you. Two you're taking away from a small business and you're defrauding. You're actually a criminal at that point.

The way the rules are set up to protect the tenant and it's not just California, it's multiple states, actually 17 states that they're working on right now to make it even more difficult for landlords to screen for tenant eviction history. It's difficult for everybody to do it.

What happens if you have the Scarlet E on your credit report? There's not much you can do about it. First of all, you should be paying your rent no matter what. This started being an issue when COVID happened. We put a moratorium on evictions and bank-owned properties, which made it really difficult. There's a huge quagmire. Right now there's no easy way to be a landlord. There's a lot more fraud happening on the tenant side.

Home Inspection Checklist

Home Inspection CHECKLIST HERE https://abitanogroup.com/homeinspectionchecklist

The segment is brought to you by the home inspection checklist. If you're thinking about selling your house, lots of people have downloaded it.

This is great for people to go through and check off. What's right and what's wrong with their house. No house is ever perfect. So you go through and fix your refrigerator or your dishwasher or your electrical system and get things fixed before you put it on the market. We always suggest you do a professional home inspection in the first place.

FREE HOME BUYER CHECKLIST HERE https://abitanogroup.com/Homebuyerchecklist

they're trained to look for certain things that your eyeball probably won't catch since we're all considered laymen. So this is just a good first step and always disclose what you've done to your property.

40 Days on Market Report

Homes for sale near Apple

40 days on the market. This guy right here caught my eye. It's been on the market for a really long time. 115 days, I believe.

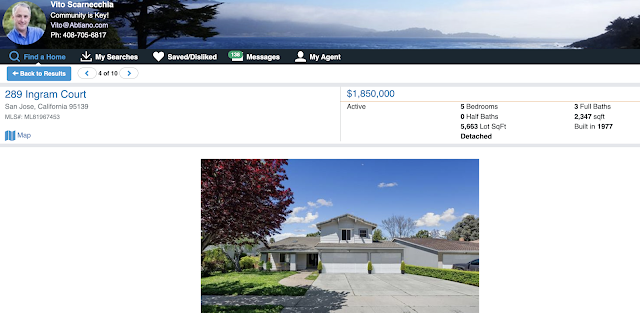

Oh no, 40 days. 40 days right on. Six bedrooms, three and a half baths, 3, 500 square feet in Morgan Hill. Guys. If you're thinking about buying it, this one might be an issue because of tenants or something. I looked at Ingram Court, which is here in Blossom Valley. This is the one that's 112 days on the market. I wonder why this one's been on the market for so long. Maybe it's overpriced. Maybe they think that this was last year.

But it's a pretty-looking house.

I sold this unit a few times. It's a nice big open, plan. It's 2, 300 square feet, five bedrooms, three baths. The third bedroom is downstairs near the family room. And yeah, it's a good unit. It's good. Setup. Let's see. We'll get into that in a minute.

Bank Owned Properties

Mountain View home of the week

Oh, this one right here.

This is a bank owned right down the street. It just flipped six days ago into a bank-owned property. This was on a short sale for 364 days. Couldn't sell it for 1. 3 million. And now it's for 1. 619.

I don't think they did anything to it. Let's see if they actually have pictures. Nope. They took all the pictures down. It looks like maybe they cleaned it up a bit. Yeah, they cleaned up the front, but I couldn't tell you what it looks like inside. This one's going to sit for a while.

This is in North Blossom Valley of San Jose. I can tell you that it's not going to sell for one-six. Considering this one over here, which is a little bit further away from central, Silicon Valley, it'll be a while for this one to sell. This one's a five-bedroom, 2, 300 square feet.

And this one is 2, 500 square feet, three bedrooms, and four baths. Yeah, this one needs a little bit of work.

Encouragement to Vote

Register to vote today

.Hey, if you haven't registered to vote, register to vote. I don't care which side of the aisle you vote on. It's our duty and our right as American citizens I am a naturalized citizen.

I was born in Canada, and came here, when I was in third grade, in 1975. Became a naturalized citizen after I joined the Marine Corps. Served a few years, got out, and now I get to serve jury duty, but I also get to vote and pay taxes.

Market Trends and Conclusion

REO of the Week

And then the last thing is this 40 days on the market report, 198.

It's gone up a little bit. So that means the market's slowing down. Not by a whole lot, but it's slowing down, and then 51 units for 90 days on the market. All of California went up just a tad bit and went up by 13. So we're seeing more REOs come and many people are saying more bank owners are coming.

There's a shadow inventory that's popping in. We're not going to see a lot here. California, not like what we're seeing in Texas and Florida So just be careful. For sale, we have 484. We need to be about a thousand in San Jose and in Santa Clara, we need to be about 2000.

There's been a lot more units put up in the last week. Which is good. We need to get that to be a balanced market. That's our 40-day on-market report in Santa Clara County. I'm Vito with Abitano. We'll see you out there.

Vito Scarnecchia Real Estate Broker, Veteran, Dad DRE#: 01407676 We’re Hiring! 408-705-6817 Vito@abitano.com Website: abitano.com https://www.onereal.com/vito-scarnecchia-1 update your home value: https://hmbt.co/bT7qRJ RELOCATION@ABITANO.COM FREE DESKTOP APPRAISAL https://www.propertyrate.com/agent/vitoscarnecchia If you are moving ANYWHERE in the world - Let me know! I know a LOT of AMAZING Agents! Book appointments here: https://calendly.com/abitano/15min Home Buyers Course YT YouTube.com/SanJoseLiving IG https://www.instagram.com/abitanogroup/ FB https://www.facebook.com/vito.scarnecchia/ LI https://www.linkedin.com/in/vito-scarnecchia/ Blog http://blog.abitano.com/ POD https://spotifyanchor-web.app.link/e/oxdH1Hwfcvb Professional Photography by Kim E https://photosbykime.com / Local Real Estate Market and Home Value Report https://hmbt.co/bT7qRJ Financial Intelligence https://docs.google.com/forms/d/e/1FAIpQLSc0R5pjHIAPguZ5GDEB-fTbGJXKpWK3coK9Khymv_GTWkMnyQ/viewform?usp=send_form https://www.onereal.com/vito-scarnecchia-1 Willow Glen's five most expensive homes https://youtu.be/3A_E2ck0ePg

Comments

Post a Comment