🔴[LIVE] Volume is off 39% Bay Area WIDE Monday Bay Area Reports Sales Price last 12 months. 10 Bay Area Counties

🔴[LIVE] Monday Bay Area Reports Sales Price last 12 months.

10 Bay Area Counties

2 more rate hikes coming-

Fed’s Barkin Says He’s Willing to Raise Interest Rates Again If Needed Sales

Volume is off 39% Bay Area WIDE

HOMEBOT https://hmbt.co/bT7qRJ

Pod

Yesterday was crazy warm. One of those beautiful days. So grateful that we have this amazing weather today. Woke up a little bit chilly, which is good. Got to the gym and yeah, great weekend. Did nothing. I absolutely did nothing. I relaxed, hung out with the daughters a little bit, and had a really good relaxing time.

That's it. Some news to talk about. Last week I was talking about a beautiful day. And I had a quandary as to which way I wanted to go, do I want to go to work at an elementary school that I went to when I was a child, or did I want to take on a big project Emma pr. And really I, thought about it a lot, talked to a lot of people about it, and what I decided was I'm pretty busy with work, so as much as I can chew off I'm going to do, I decided Emma PRUs was too large of a project for me and I am helping out.

I'm a sub lead on LaMer, which is a small elementary school in the Camel Union School District, and I went there for a year before. Long story, but when you show up, Love to do it. We've got a lot of little tiny tasks to do. You don't need skills, just need hands, need some backs, need some strength, and some people want to have community, and I would love to have you be a part of a beautiful day.

If you're interested, gimme a call, text me, and let me know. All right, let's get into the nitty-gritty. Three things you need to know today. We understand from news reports and the fed that we have two more rates, rate hikes coming. Now, that's pretty arduous concerning the fact that we're looking at 7% right now.

These are non-quoted rates. These are just the average of what we're seeing. 6.9, 6.55 for a 30-year jumbo. Even VA is 6.5, which you would think slows down the market. I don't think that's the reason why the market is slow. And as you can see in my headlines, I said that,

that our sales volume is down. Now, I don't think it's because of the rates. I really don't, not from the deals that I'm doing, the transactions I'm seeing a lot of volume. I'm seeing a lot of interest in people. We have multiple bids on pretty much everything we throw out there unless it's overpriced or it's in a crappy condition or it needs some work or it's in the wrong location.

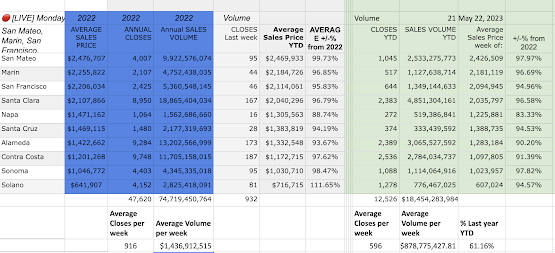

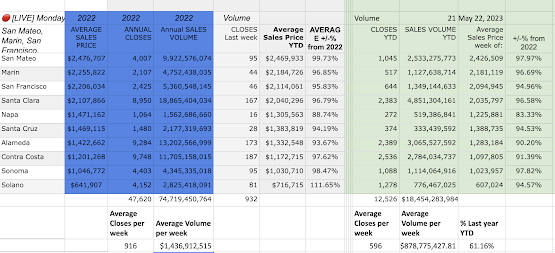

Houses here are selling, they're selling fast, and I've been telling you that for weeks. I wanted to show you some extra numbers I threw out. So this is here in green. These numbers right here are the last week's sales results and year-to-date for the 10 counties of the Bay Area. Right now you're looking well, veto prices are coming down.

Prices are coming down based on last year. Absolutely. And there are still deals to be had. Absolutely. But for the most part, homes are selling. As a matter of fact, over 60% of the houses we saw close in the last few months sell for over the list price in Santa Clara County. I can't tell you what the other ones are cause I'm not tracking that.

But here's, what my mindset is, right? Santa Clara County, we're at 96% San Mateo, or 97% where's Alameda? 90%. You're getting good deals in Alameda. You're getting amazing deals in Napa. And take a look at, what was it, Contra Costa. There's a ton of volume going on in Contra Costa. All of a sudden, they popped up 187.

They're strong, they're affordable, all things considered. They're affordable. It's affordable to live in Contra Costa. Yeah, it's a little bit of a hike. Let's see if I can find that map for you. I don't, there it is. Contra Costa is right here. It's next to Alameda County, but at the same time, if you drive a little bit more, you're going to get a great deal.

Same thing with Napa Solano. Let's take a look at Solano.

Solano. The volume's down The cost of a house is down $600,000. If you really need something super, super affordable, that's where you're going to go. Yes, you're going to commute, but maybe you can telecommute two days outta the week, three days outta the week, and then drive in. So there you go. All right.

Want to highlight this real quick and why this, is important. I'm bringing this up. I added, these two numbers, these two columns right here, so we can get a. A pulse on where we are for the counties, for the different counties, and you can compare and contrast volume, the end of 2022 versus the year to date.

And you can see that we're so far off. If you considered, we're roughly about half. We're not right, it's we're week 21, so we have a couple more weeks before we're actually in the half, but we're nowhere near half of that volume. San Mateo had almost 10 billion in sales volume. At the end of the year, we're at two and a half.

It's so far. Year to date, Santa Clara had 18.8 billion. We're not even at five. Sales volume is down because inventory is down. Inventory has been hurting for a very, long time. I've been telling people that for a long time. If you look at the chart, I sent it out on Facebook and I can send it to you again.

I don't wanna spend time looking for it. I just popped in. My little brain housing group. Volume is at about 60, 50 to 60% of where we were last year, which is telling, and that's why prices are going to stay. My thoughts are my belief. Until we have a massive recession or an eco-economic crash or what have you, our vo, our prices are going to stay pretty, pretty set.

I don't think we're going to see these numbers go down too much more again unless there's a global catastrophe or something. Last year, to date, we had, in 10 counties we had 74.7 billion in volume. Right now we're at 18, and if I break this down to 52 D, divide that number into 52, which is per week, right?

You're at 1.4 billion per week versus 800. I'm sorry, 800 million. Yeah, 800 million now, almost 900 million. So the delta is 61%. We're 40% off, 39% off. Of last year's sales volume, year-to-date on average,

mostly because of inventory. I think. I think we've pushed people out of the affordability index. We have a lot more serious buyers out there. We're seeing fewer homes cancel out because the buyer didn't qualify. We're coming with people that have taken money out of the stock market, out of their employee purchase plans, and putting that money into real estate.

If we had more inventory, maybe the prices would go down a little bit, but I see demand is still pretty damn high, especially in our counties, especially in San Mateo, Santa Clara, and Alameda, which is, you see these numbers backing up here, right? Barking. He's the Richmond president and he is saying that he's willing to raise, rates again.

Again, this is what they're saying. They're saying that they're willing to raise rates, they're talk, talking tough to slow down the inflation. However, oh, where is this? I saw it over here. There. This is called Tru if. Inflation's back down to normal, right? We're going to find out next week what unemployment is, and again, it's probably not going to be that bad for right now.

We're still marching into a recession. Everybody's talking about it. Everybody says this is going to be worse than 2008. I don't know if that's going to happen. Honestly, I don't think it's going to happen. And even if it doesn't matter. Real estate is a good place to park your money, and that's pretty much it.

I kept it. Easy for you. I didn't, yes, no.

So that's it for now. I kept it easy. I, something happened in my little softw

are here, and I didn't know what was going on. I kept it as quick as possible. Hope that makes sense. If you have questions or comments, or you think that I'm full of crap, let me know. I'm Vito Scarnecchia with Abitano. We'll see you out there.

are here, and I didn't know what was going on. I kept it as quick as possible. Hope that makes sense. If you have questions or comments, or you think that I'm full of crap, let me know. I'm Vito Scarnecchia with Abitano. We'll see you out there.

Comments

Post a Comment