🚨 🔴🎧 Cash Flow King' Motil charged in $11 million Ponzi scheme State of the Market SAN JOSE 40DOM. 🦅 🌎 ⚓️

- #REWTF of the Week

- Fraud on the rise

- http://blog.abitano.com/2023/08/title-theft-is-on-rise-what-is-it-how.html

- Homes for sale NEAR APPLE CAMPUS

- New home construction down

- https://fred.s

- tlouisfed.org/series/HSN1F

- Cash Flow King' podcaster Matt Motil is charged in $11 million Ponzi scheme

- inventory is climbing even faster than last year

- FinancialIntelligence

- https://bit.ly/AbitanoHomeValuation

- NAR.Realtor Stats

- .

- https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales

- https://www.onereal.com/vito-scarnecchia-1

Three things you need to know living in Silicon Valley or @SiliconValleyLiving. Hey, I'm Vito with Abitano. Today we're talking about three things you need to know about living in Silicon Valley when it regards real estate. One thing you need to know is that new construction homes across the nation are down to cash flow.

Cash Flow King' podcaster Matt Motil is charged in $11 million Ponzi scheme

King Matt Motel is under investigation, if not arrested already. And then inventory is climbing even faster than last year. Let's get into it. All right. Today we want to go into, we're also going to talk about what's going on and a little snapshot of what's going on in the. World of San Jose real estate.

So nothing too crazy to talk about right now. Let me move this over. The numbers are down. Not like it was back in 2005 with crazy numbers, right? This is a new construction. It's down, they're settling down. And I know it's a tick, it's a small tick right now, but what you're having, what you're, what you need to understand is you have to keep an eye on this to see the trending as it goes down.

New home construction down

https://fred.stlouisfed.org/series/HSN1F

We're seeing it go down since 2020 since the peak we, as an industry from new home construction to resale, to lending, to everything that's revolved around it, we're getting ready for a. Pullback that we've been talking about. That's what I've been talking about for the last, I don't know, two years So just be prepared and understand that this might be a good time to look into getting into a purchase of some sort whether it's whatever.

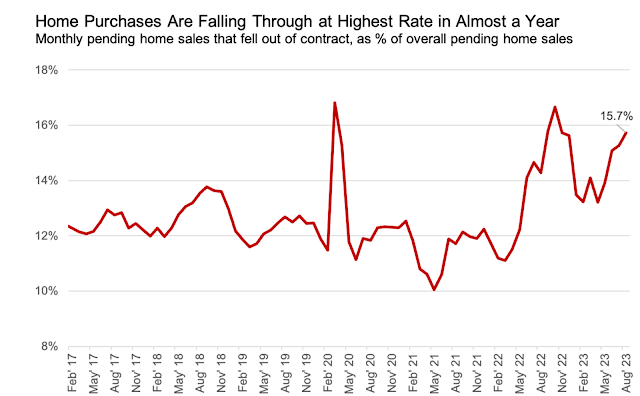

Real deal. This is reported from, I think Redfin,

but it's all over the place, right? So you look everywhere, 60, 000 home purchase agreements canceled. These are new home sales contracts that are being sold. So they're saying, you know what I don't qualify for it because the rates are so expensive and I just can't afford it. I've just, and you know what? I might be losing my job.

I'm fearful that I'm going to lose my job. So pull it out. Sorry. Goodbye. And yeah, it's a lot of money that we're. Missing out on the new homes, but I tell you new home construction companies, the new home builders like DR Horton, et cetera. They see this coming. They have economists that they work with.

They know what's coming. So their stocks may hurt a little bit in the short term, but long term, they're in for the long haul. It's the small mom-and-pop builders that you have to look out for. And I know you send out the REWTFs or I send out the REWTFs every week or every day. And crappy stuff like this coming in and, you just got to be aware of what you're looking for.

And I said, there's a ton of inspectors that are on TikTok today that really bash on new home builders. It's a very few home builders that are. That offers poor construction quality. So just be careful know what you're getting into and use a realtor to Confirm the process and that they protect you with inspections third-party inspections Okay, cash flow King Podcaster Matt Motel.

I tell you this guy he's charged for scamming real estate investors and blowing the cash on himself in a Ponzi scheme. Is it true? I don't know. We'll find out more, but there are so many, it happens all the time. And look at this guy. He's a young guy. He's 30, 40 years old.

Man made me feel a little right there. You can't expect people who are, who have not experienced the last couple of downturns to know how to create wealth for you. You have to look towards the wise and the experience. And that's why I'm doing these videos to prevent this type of crap from happening.

And if this guy's, if this guy's for sure guilty, shame on him. I hope he goes to jail for a long time. His wife is actually a part of this indictment and investigation as well. And maybe they thought they were doing the right thing. Who knows? We'll find out more later as we move along. I'll let you know more.

This is from Alto's research inventory is growing faster than ever. Again, I think it's more headlines than anything, because if you look at where we are right now. That's pretty much where we are. We still have a short of shortage of inventory across the nation and tomorrow We're talking about it across the nation today.

We're talking about what's going on just in San Jose And today we're seeing that the numbers are taking up just slightly not even as hot as Volatile as this but they are coming up We expected this to happen. We expect it to churn, but we're also seeing a delay in how things and pending or contracts are being signed or agreed to what's happening is because rates are seven and a half, 8 percent now people are holding back saying, you know what?

I don't need to buy a house right now. Let's just see what happens to the market. And if I pounce on a house right now, it's going to be a good deal for me because I don't care. It might still be a seller's market technically, but I don't have anywhere to go. My lease is still good for another three to six months.

I don't need to buy. Let's just check and see what's going to happen. So they're going to wait for the market to slow down, maybe see prices reduce. And when the rates come down, prices will go back up. So there's a fine point where you have to figure that out. I know we talk about this all the time.

I go back to it. Oh, not this, but this right here, right? We're right at the precipice. We're actually probably right here, right? So this is what happened in the last couple of months from April to March this year. And we started going up again, not to this degree. I can tell you that right now. It's probably more like this, but we're right at this precipice.

Prices are going to go down because rates are too high. We're coming into a recession, blah, blah, blah. So people are holding off. Rates are going to come. Prices and home prices will come down incrementally because supply will increase, but not base, not surpass demand. We still have a lot of demand out there.

People are still looking. I'm looking at buying places, right? And don't fool yourself into thinking that you're going to wait for the recession to hit because that's what everybody else is doing. And what happens when everybody else does the same thing? And then the trigger gets marked. People come into the come into the market.

The only time in the last 80 years that prices went down during a recession was in 2008. And that was caused by Wall Street lending and real estate. And that was only caused by 5 percent of the population of mortgage holders. It's crazy, right? But anyway, you look at all the history and see prices continue to go up because when recessions happen, that's when investors hit the market.

So there's a fine time to buy a house either here or here. But what happens is if you buy here, it doesn't matter if you lose money in the short term because in the long run, just like when you buy stocks and bonds, you buy for the long term, you're going to make it right. So I'm actually putting offers on apartments and houses and all that right now is what my guru says, insulting Lilo, but You know what?

I don't care. I'm not here to make friends. I'm here to create the legacy.

Where else in the world can you buy a bedroom, one-bath, 800-square-foot condo for 500, 000, half a million dollars. I actually sold a house in this complex before. It's a nice little complex. Yeah, every, everything's condos here. Let's look to see what's high, the highest price

here is 5 million for brand-new construction. So that's the trend here, right? You take an old house, tear it down, and put it on there. You can buy a new older house, the original house for two and a half million, 2 million,

right? Tear it down and put these McMansions up for another million dollars. And you're cruising in with a million-dollar profit. That's what people are doing around here. It's crazy, right? It happened in Willow Glen, it happened in Almaden, it happened in Saratoga and Las Gatos, and it's happening now around here, and I think it's a great boom for this little area.

I just don't have four million dollars to spend.

So there you go. All right. Quick note, financial intelligence is way underway. We have a lot of people watching this. It's a different channel altogether. There's no sales pitch. It's just raw education on raising your bar of financial intelligence. Take a look at it when you have a chance.

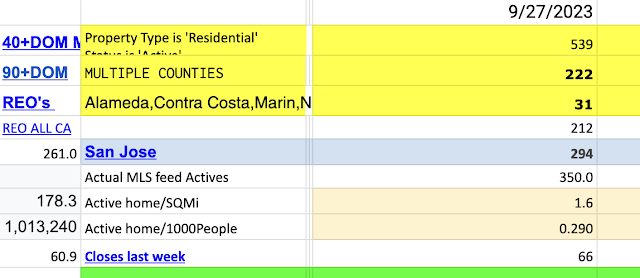

All right. 40 days on the market in Santa Clara County, houses are increasing. That is increasing. People are being pickier. So if your house is overpriced, your house is going to sit on the market for a little bit longer. Normal, right? Cause the market's slowing down. Same thing with 90 days on the market. That number's rising as well.

Nothing to be concerned about yet, but it's just a precipice of this what's going on. REOs are all down because they haven't released this last month or the next month, which is coming up. San Jose has 350 actual live homes for sale. These are single-family homes in San Jose that need to be about a thousand To make it a balanced market 700 to 1000 to make it a balanced market for the demand that we have and yet we have Santa Clara County.

This is multiple counties. I think. Yeah, I know. It's Santa Clara. That's a lot, right?

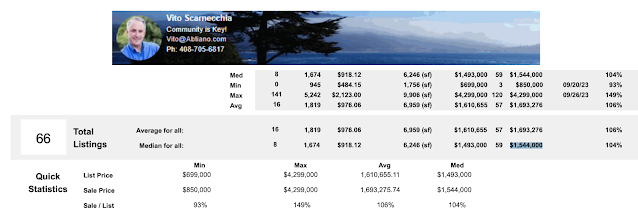

Transactions are down by a third of last year. These are closed, right? Our top of the, our last year average sales price was 1. 6. Average sales price this year is 1. 7. So we're well above just this week. But if you look here, this is the averages over the last year and the last. The previous year, we were still 64, 000 away from the peak average.

Nothing else to be concerned about here. Everything else is really generally okay. These numbers are really healthy. So there you go. Oh, we did report. Median value home prices went down just a tad bit. I went up a tad bit. Sorry. Last week, the last time I looked at this, it was different. That's right. We're right on.

Yeah. It went up basically 14, 1, 300. There you go. All right, that's it for now. Three things you need to know. Home contracts are canceling home construction. New home construction contracts are canceling cash flow. Cashflow King is under investigation and inventory climbing even faster, but don't be worried about the faster because it's just a salacious way to get you to click on it.

I'm Vito with Abitano. We'll see you out there.

Campbell, San Jose, Silicon Valley, retirement, empty nest, Financial Intelligence, Best Realtor Santa Clara County, Google Jobs, apple careers, Apple Jobs, meta jobs, Hewlett Packard, Oracle, Intel, Cisco, Facebook, Broadcom, Adobe, eBay, Willow Glen's five most expensive homesWillow Glen's five most expensive homes https://youtu.be/3A_E2ck0ePg

🚨 🔴🎧 Cash Flow King' Motil charged in $11 million Ponzi scheme State of the Market SAN JOSE 40DOM. 🦅 🌎 ⚓️

https://podcasters.spotify.com/pod/show/siliconvalleyliving/episodes/Cash-Flow-King-Motil-charged-in-11-million-Ponzi-scheme-State-of-the-Market-SAN-JOSE-40DOM-e29rtsp

https://youtube.com/live/xxLM3I7QRcU

http://blog.abitano.com/2023/09/cash-flow-king-motil-charged-in-11.html

Listen to "🚨 🔴🎧 Cash Flow King' Motil charged in $11 million Ponzi scheme State of the Market SAN JOSE 40DOM. 🦅 🌎 ⚓️" by Silicon Valley Living. https://t.co/apFMYZvJds

— Vito@Abitano (@VitoScarnecchia) September 27, 2023

Comments

Post a Comment