🚨 🔴🎧 State of the Market SAN JOSE 40DOM. 🦅 🌎 ⚓️

- British Virgin Islands https://www.islands.com/island-living-how-to-move-to-british-virgin-islands/

🚨 🔴🎧 State of the Market SAN JOSE 40DOM. 🦅 🌎 ⚓️

State of San Jose real estate market today in 15 minutes, three things you need to know about living in Silicon Valley and 40 days on the market. Let's check it, and take a look. Welcome today, by the way, September 6th, it's been a unique couple. Days now, I know that we had Labor Day. I know that we had Labor Day and I understand that's a Big issue when it comes to sales, but sales are slowing down.

We'll talk about that in a minute but today we're talking about six red flags on China mortgage rates falling and here's why And British Virgin Islands, but let's talk about real estate wtf of the week This one got a lot of No, that's it. That's not it. That's not it. There it is. I have no idea what that is.

This one has a ton of movement on it. I thought a lot of people liked it. I thought it was pretty funny. I have no reason, I have no understanding as to why people would do that kind of thing. Why would somebody,

I have no idea. I'm befuddled. Anywho, there you go. R E W T F. If you have a great comment, jump on, hit that hashtag, and let's see some of your comments because we've got a lot of good comments today. Talk that one out. Here's the reason why mortgage rates are going. Actually mortgage rates are coming down and we're assuming that it's going to come down by the end of the year.

6 red flags on ChinaWe'll talk about that in a minute but today we're talking about six red flags on China mortgage rates falling and here's why And British Virgin Islands, but let's talk about real estate wtf of the week This one got a lot of No, that's it. That's not it. That's not it. There it is. I have no idea what that is.

This one has a ton of movement on it. I thought a lot of people liked it. I thought it was pretty funny. I have no reason, I have no understanding as to why people would do that kind of thing. Why would somebody,

I have no idea. I'm befuddled. Anywho, there you go. R E W T F. If you have a great comment, jump on, hit that hashtag, and let's see some of your comments because we've got a lot of good comments today. Talk that one out. Here's the reason why mortgage rates are going. Actually mortgage rates are coming down and we're assuming that it's going to come down by the end of the year.

The reason why rates are going up is because we need to slow the economy down. We need to go into this recession and reset things and see some kind of deflation. Now, deflation is good in a sense. We see China doing it. We see Japan doing it. We see a lot of different countries going into depression or Yeah.

Depression instead of inflation. And this actually is healthy.

Mortgage Rates Falling

Rates are going up simply because we need to slow down the process. And you're going to see in a couple minutes why our numbers are going down. There's another REWTF. This was my old boss. I used to work for him.

There's the reasons why right and we're talking about more. It's real estate, but it's not just real estate guys. It's everything it's sandwiches. It's cars. It's Banking and gas and everything inflation is out of control right now And I know what they're saying is Oh close to 2% but it doesn't matter because over the last year and a half, We've seen it go all the way up and it's more like a factorial, right?

So One month it goes up 2%, then 3%, then 4%, 9, and then it continues to go up, and now instead of paying 3 for a gallon of milk, you're paying 5. And that's the new normal. That's the same thing with sandwiches and everything else. So one thing you have to be aware of is if you're living in California, it doesn't matter if you're a property owner or not, they're trying to put Proposition 13 on the voting block again, and trying to get rid of it.

This is one of the only bashes that make California somewhat affordable. Proposition 13 keeps property tax increase to only 2%. Year after year. The reason why that's good is because like in Texas or every other state, when you're how, when you buy a house for 250, 000 and all of a sudden there's a massive wildfire of houses housing sales, and all of a sudden you're valued.

Value goes up to 500, 000. Now you're paying five taxes on 500, 000 in California. That's not the way he goes, if you bought a house at 250 and it goes up to 500, you'll go 250, 000 plus 2% every year. And that's a huge bastion and boon to our affordability. I know it's not affordable. It is in certain areas.

For example, Napa. Monterey Bay, right? You live in Silicon Valley, and you're making big money. If you're not making big money, then, I don't know what to tell you.

Going back to this whole thing, we need to keep it going up. So going back to Proposition 13 They're trying to chop it off and here's why that's back and you got to call your legislature and senate and say no do not put this on the block. We were going to vote it down etc They're trying to tell you that we're going to go industrial Oh, we're just going to get rid of proposition 13 for industrial property or commercial property or whatever.

That's a Bullshit ploy and let me tell you why let me jump off this real quick. Let me go full screen Let me tell you why that's bullshit because Proposition 13 is there to save money for everybody. Let's just say that there's a strip mall down the street. It happens to have a subway In that strip mall, right?

We're already paying 17 an hour for making those sandwiches for each person there. I have no problem with that. I understand that's the cost of living and whatever. I don't think it's a smart ploy because every time we increase the labor rate, our cost of goods goes up, everything goes up, gas, groceries, everything.

Let's just talk about that one place, right now, a subway. I can tell you, for example, that the owner of that subway there. Their margins are about 50, 000 a year. So they buy into a franchise, they rent out a place, they hire people, and they have to buy subway materials to make those sandwiches. And it's all a big thing, right?

And their job is to make 50, 000 profit the entire year. Their mindset is you should open multiple units. When the cost of labor goes up, so does the cost of that sandwich or it pinches that margin. Because Subway doesn't give a shit. They don't care. They're still gonna charge you 20 cents for Oliver whatever,

I don't know how they figure it out. So Proposition 13 goes away and that commercial strip mall goes from, I bought this house this strip mall for $500,000 back in 1975. So they're paying, 2% over years to, oh, now it's worth $13 million. Now we're gonna reassess it at $13 million and you have to pay the property tax on that.

The landlord can't pay that out of their profit because they're not making any profit they're making some money, but they're not making it as much as you think. So where does that go? It goes to the subway Franchisee, which means their margin gets squashed. So instead of making only 50, 000, they're gonna make 30, 000 a year So more and more companies are going to collapse more and more resident retail outlets will just disappear more and more companies will move out of California because they just can't afford the rent anymore.

So proposition 13 keep it in place vote no against whatever measure that is that's coming down the pike. Okay, enough of that

later. Six red flags. That's my Halloween shopping. Okay, China is, I talked about this yesterday with Patrick McAndrew on financial intelligence. Will China collapse? It's very possible. It's very possible. Here are the reasons why it may, right? Their GDP is slowing down, right? Since the early 2000s. Now this should have been like...

Going back to the seventies to get a little bit more of a better view of this, which I don't really appreciate, these numbers because 2020 to 2023 means nothing. You have to look at the historical factors and numbers, right? Their GDP is slowing down. Granted everybody's GDP is slowing down, right? Exports. Yes, because we're slowing down. People are buying less stuff, right? Even though our economy, even though we've,

Rates are going up simply because we need to slow down the process. And you're going to see in a couple minutes why our numbers are going down. There's another REWTF. This was my old boss. I used to work for him.

There's the reasons why right and we're talking about more. It's real estate, but it's not just real estate guys. It's everything it's sandwiches. It's cars. It's Banking and gas and everything inflation is out of control right now And I know what they're saying is Oh close to 2% but it doesn't matter because over the last year and a half, We've seen it go all the way up and it's more like a factorial, right?

So One month it goes up 2%, then 3%, then 4%, 9, and then it continues to go up, and now instead of paying 3 for a gallon of milk, you're paying 5. And that's the new normal. That's the same thing with sandwiches and everything else. So one thing you have to be aware of is if you're living in California, it doesn't matter if you're a property owner or not, they're trying to put Proposition 13 on the voting block again, and trying to get rid of it.

This is one of the only bashes that make California somewhat affordable. Proposition 13 keeps property tax increase to only 2%. Year after year. The reason why that's good is because like in Texas or every other state, when you're how, when you buy a house for 250, 000 and all of a sudden there's a massive wildfire of houses housing sales, and all of a sudden you're valued.

Value goes up to 500, 000. Now you're paying five taxes on 500, 000 in California. That's not the way he goes, if you bought a house at 250 and it goes up to 500, you'll go 250, 000 plus 2% every year. And that's a huge bastion and boon to our affordability. I know it's not affordable. It is in certain areas.

For example, Napa. Monterey Bay, right? You live in Silicon Valley, and you're making big money. If you're not making big money, then, I don't know what to tell you.

Going back to this whole thing, we need to keep it going up. So going back to Proposition 13 They're trying to chop it off and here's why that's back and you got to call your legislature and senate and say no do not put this on the block. We were going to vote it down etc They're trying to tell you that we're going to go industrial Oh, we're just going to get rid of proposition 13 for industrial property or commercial property or whatever.

That's a Bullshit ploy and let me tell you why let me jump off this real quick. Let me go full screen Let me tell you why that's bullshit because Proposition 13 is there to save money for everybody. Let's just say that there's a strip mall down the street. It happens to have a subway In that strip mall, right?

We're already paying 17 an hour for making those sandwiches for each person there. I have no problem with that. I understand that's the cost of living and whatever. I don't think it's a smart ploy because every time we increase the labor rate, our cost of goods goes up, everything goes up, gas, groceries, everything.

Let's just talk about that one place, right now, a subway. I can tell you, for example, that the owner of that subway there. Their margins are about 50, 000 a year. So they buy into a franchise, they rent out a place, they hire people, and they have to buy subway materials to make those sandwiches. And it's all a big thing, right?

And their job is to make 50, 000 profit the entire year. Their mindset is you should open multiple units. When the cost of labor goes up, so does the cost of that sandwich or it pinches that margin. Because Subway doesn't give a shit. They don't care. They're still gonna charge you 20 cents for Oliver whatever,

I don't know how they figure it out. So Proposition 13 goes away and that commercial strip mall goes from, I bought this house this strip mall for $500,000 back in 1975. So they're paying, 2% over years to, oh, now it's worth $13 million. Now we're gonna reassess it at $13 million and you have to pay the property tax on that.

The landlord can't pay that out of their profit because they're not making any profit they're making some money, but they're not making it as much as you think. So where does that go? It goes to the subway Franchisee, which means their margin gets squashed. So instead of making only 50, 000, they're gonna make 30, 000 a year So more and more companies are going to collapse more and more resident retail outlets will just disappear more and more companies will move out of California because they just can't afford the rent anymore.

So proposition 13 keep it in place vote no against whatever measure that is that's coming down the pike. Okay, enough of that

later. Six red flags. That's my Halloween shopping. Okay, China is, I talked about this yesterday with Patrick McAndrew on financial intelligence. Will China collapse? It's very possible. It's very possible. Here are the reasons why it may, right? Their GDP is slowing down, right? Since the early 2000s. Now this should have been like...

Going back to the seventies to get a little bit more of a better view of this, which I don't really appreciate, these numbers because 2020 to 2023 means nothing. You have to look at the historical factors and numbers, right? Their GDP is slowing down. Granted everybody's GDP is slowing down, right? Exports. Yes, because we're slowing down. People are buying less stuff, right? Even though our economy, even though we've,

There it is. Okay. I lost my monitor for a second, even though, I'm buying stuff, You're buying stuff on Amazon or wherever exports are slowing down, mostly because we're seeing chipsets slow down mostly because we see all this other stuff slowing down and that's natural progression. We're trying to slow down the economy, right?

CPI. This is always a good indicator. There's a lot of stuff that's going wrong with the real estate business or industry in China. That could be slowing down that cause CPI, but also they're not buying cars like you think they're buying cars. So be careful about those numbers that you're seeing.

Youth unemployment. I don't like this number. I think because we have nothing to compare it to. We don't, I haven't seen it. If you happen to see something that talks about youth unemployment in the U.S. S then we can pair apples with apples. Yeah, they're probably all going to college. I mean went from 15% to 21% to 22% Yeah Okay, some more people are going to college.

Maybe I don't know. I don't listen to me What do I know the value of the one is going down But not that much. We're talking about tenths of a point, hundreds of a point new loans are completely down. Same with us. Our refi boon is gone. Just like they had a reef. I don't know what kind of loans they had that are gone right now.

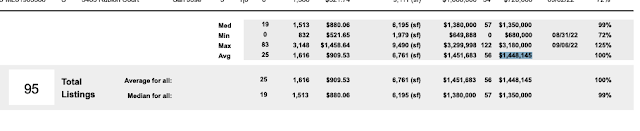

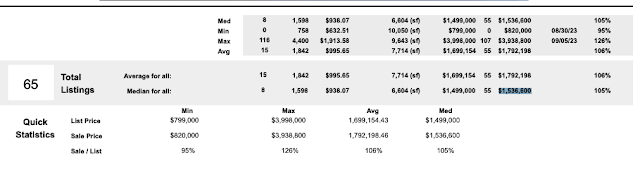

It's because We're trying to slow down the economy. Their rates are going up, right? Their interest rates are going up just like in Japan, just like in Australia, just like in the United States, and Mexico, and their new loans are slowing down. Just like us last year, we had 95 closes last week. And this last week we had 65 closes.

This last week it's slowing down inventories down, but also rates are up. Okay.

British Virgin Islands

I'm towing with the idea of going on a sailing trip. I'm actually going sailing this Saturday, so you're not gonna see me hiking this Saturday. I'm going on a on the bay. I'm going to do this. But I've been invited to go to the British Virgin Islands to spend 10 days on a catamaran. So I'm looking at this thinking, wow, this is pretty amazing.

Look at that. There's so much stuff to do there. You can actually have a pretty decent living. Most of it is tourists. It's all tourist-based or virtual tourism, right? Or. where people can have a life living wherever you don't have to live in Silicon Valley to make a living here. I do because I'm in real estate to be boots on the ground, but some options are out there.

Look at that. There's so much stuff to do there. You can actually have a pretty decent living. Most of it is tourists. It's all tourist-based or virtual tourism, right? Or. where people can have a life living wherever you don't have to live in Silicon Valley to make a living here. I do because I'm in real estate to be boots on the ground, but some options are out there.

You don't have to live in the Silicon Valley to make it happen. Now I have, I listened to a Y Combinator podcast and there's a reason why people live here and it's because of the network. The network of people runs very deep. The network of talent runs very deep. And when you get networked in, you get to know people from all walks of life on all different talent bases, from different industries.

And that's why people flock here. You're not going to see that, in a desert, on an island and the beach and the sand, you're just not, right? So that's the one thing that you're walking away from. If you move to an island or Mexico Central America South America or somewhere like Europe, you're walking away from such a massive talent pool which is why the cost of living here is so expensive.

For example, last year our houses were worth 1. 4 This year they're worth 1. 7. The average is 1. 7 last year. So we're seeing these numbers go up, right? The cost of houses is going up again on average, but look, we're still 100, 000 Delta from last year, right? And the average list price of the sales price is 20, 000, 25, 000 different.

It's not that big of a difference. So things are structurally getting better for buyers. However, 60. Oh no, 75%, really 60%. But last week it was 70%, 75% of the houses closed over the list price, right? Those numbers, but you can see that this is last year's numbers. So I just take this number right here, go over here, and get the 29.

It was actually 49, but there you go.

We're having a growing number of houses stay on the market a little bit longer, but those prices, those homes tend to have something wrong with it, whether it's location, price, or condition, right? The hubris of the seller says my house is worth 1. 6 when it's really worth 1. 3 1. 4 depending on the day, right?

Don't listen to yourself. Listen to what the buyers will make offers on. That's how that goes. And a lot of these houses are just overpriced right now, which shows we're seeing our numbers of cancellations grow to 23, which isn't huge, but it's just something to keep an eye on. And it's taking less time to sell than last year, but it's, Still on average, a little bit longer this year than it was last year to sell houses.

That's pretty much it. I'll get this number for you next week. I have just been busy going around. I have a couple of meetings that I have to go to and yesterday I did a lot of video meetings. So there you go. All right. Financial intelligence. We did another podcast yesterday, so be on the lookout for that.

Love to send that over to you. There's a form on the blog to go and jump on that.

I'm Vito with Abitano. We'll see you tomorrow and we'll see you out there.

View on Facebook (Vito Scarnecchia) https://www.facebook.com/vito.scarnecchia/videos/673886921041621

Comments

Post a Comment