🔴[LIVE] 🚨 Days away from a Real Estate Crash? How Low will prices GO?

Hi's and Lo's Santa Clara County

ML81937357 22000 Rolling Hills Road Saratoga $7,700,000 96.40%

ML81938643 1550 Rosette Way Gilroy $599,900 100.00%

ML81938887 13499 HAMMONS Avenue Saratoga $3,960,000 41.40%

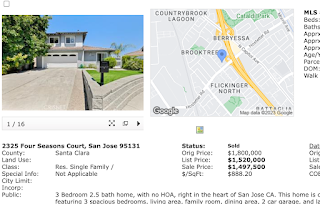

CRSR22135695 2325 Four Seasons Court San Jose $1,497,500 83.20%

ML81937357, ML81938643, ML81938887, CRSR22135695

🔴[LIVE] 🚨 Days away from a Real Estate Crash? How Low will prices GO?

3 Things you need to know about Silicon Valley Real Estate:

- A Grim Warning To ALL Homeowners

- Zillow offers a 1% down payment loan program

- Warren Buffett: "A Storm is Brewing" in the Real Estate Market

- This Week's Highs and Lows

- Probability of a Recession

- HOME SEARCH https://www.onereal.com/vito-scarnecchia-1

- TITLE THEFT IS ON THE RISE WHAT IS IT, HOW DO YOU PROTECT YOURSELF AND WIRE FRAUD http://blog.abitano.com/2023/08/title-theft-is-on-rise-what-is-it-how.html

3 Things you need to know about Silicon Valley Real Estate:

Are we days away from a real estate crash? How low will housing prices go? Let's get into that. There are a few things that you have to be aware of, but in the end, I will tell you why I don't think that's all that you have to worry about, or it's not as bad as you think it might be. All right, let's get into it three things you need to know grim warning to all homeowners Zillow offers a one percent down payment program and Warren Buffett a storm is brewing in the real estate market It does sound pretty gloomy let's get into it.

Warren Buffett: "A Storm is Brewing" in the Real Estate Market

The first thing I want to say is Warren Buffett there's and all these links are available on the blog. If you can't get to it from whatever channel or pro platform you're watching, go to my blog and there are links there for you. So I don't know if you can hear this or not. You can read it.

if you read that, there's going to be a large exchange of commercial property in the coming years. What happened was just like everything else, just like Airbnb gurus, people come in, investors come in and sell quasi-investors on the idea of buying into a market. Buying into a product buying into an investment and these investments are high risk But they don't sell them that way as high risk and when you go into commercial real estate You have to have millions of dollars to put down on multimillion-dollar investments, apartments, strip malls commercial property, industrial property, what have you.

And what happens is you don't get a 30-year fixed mortgage, you get a 5-year mortgage. Five-year loan period and oftentimes it's interest only What's going to happen and it's happening right now is all of the residents or all of the retail Commercial properties are emptying out in the big cities, which means there's no revenue coming in for landlords Which means your investment whatever money you sank into it.

It's probably gonna disappear

and which means When it comes time five years into It comes time to refinance they can't refinance on that Specific property because the value is gone and there's no equity. There's going to be something called a capital call Because let's say they bought something for 10 million dollars and now it's worth 5 million dollars they have to make up that difference somehow some way that means it has to come out of the investor's pocket Or the principal's pocket principals, meaning it's the hedge fund manager, whoever's managing that investment.

Typically what's going to happen is they're just going to put it up for sale, fire sale it, try to get rid of it as quickly as possible for as little as possible. And. Hope for the best on top of that interest rates are higher They're much higher than they were five years ago Meaning that somebody else is going to have to take it over and that's where I'm looking at buying property right now, right?

Awful, it says often involved a different set of owners. I'm looking at buying some apartments right now hedging my But I'm looking, I'm keeping an eye out on things and there are people out there, there's hundreds of other, thousands of other, hundreds of thousands of other people that are out there looking right now.

Apartments are still being bought. Commercial property is still being bought. Real estate is still being bought, right? Just at a lower volume.

Zillow offers a 1% down payment loan program

Okay. Zillow offers a 1 percent down payment program. It might seem like a great idea. Because right now you could either do a 3%, a 3. 5 percent or 5 percent or the conventional 20 or 25%.

While this might seem like a great idea, it really isn't, because right now we're at artificially inflated prices for homes, and two, your your interest rate is artificially high, not artificially, it's purposefully high, and it's unaffordable, it's affordable, quasi affordable. They're trying to find the square peg that fits in the square hole and they might be able to do that.

While this might seem like a great idea, it really isn't, because right now we're at artificially inflated prices for homes, and two, your your interest rate is artificially high, not artificially, it's purposefully high, and it's unaffordable, it's affordable, quasi affordable. They're trying to find the square peg that fits in the square hole and they might be able to do that.

But here's the catch. Here's something that people are not talking about.

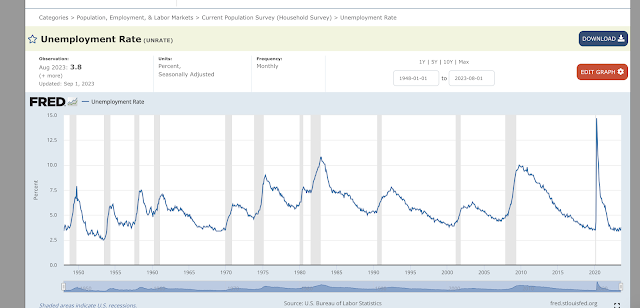

We're heading into a recession. We're heading into a recession. Right here. This is the article here. We're heading into a recession. And while unemployment is low right now, it's probably historic. No, it's not historically low it's very low right now. You can see, let me move myself over real quick.

So you can see, this goes back to 1948. You see all these recessions. Every time a recession happens, unemployment peaks, right? We had this, which was the COVID.

So you can see, this goes back to 1948. You see all these recessions. Every time a recession happens, unemployment peaks, right? We had this, which was the COVID.

We're heading into a recession, right? All articles that you read today are we're heading into a recession what happens when Zillow offers a one percent down and I buy into a house

What happens when you buy a one percent down payment? And by house with a 1 percent down payment, you have little blood in the process. And what happens if the market crashes? So why do you think Zillow is doing this? They're hedging their bets because just like BlackRock and Blackstone and Vanguard and all the big corporations.

Once you go negative on this, you're probably going to want to walk away and Zillow is going to have first right refusal or foreclose on you, or they'll give you an offer to buy your property so you can just walk away from it. Or maybe they'll just turn you into a renter. Is this a good idea?

Possibly, but not right now. I don't think it's a good idea. I don't think it helps anybody except for Zillow. I think Zillow is a corporation and they don't owe any fiduciary to you. They owe a fiduciary duty to their stakeholders and stockholders, which means that if they can buy something at 1%, turn you into a renter, and then you pay off the mortgage for them.

A Grim Warning To ALL Homeowners https://www.youtube.com/watch?v=Jq_6RKHJIIA

Everybody's going to be happy except for you. Just be careful about that. Let's go right here. George Gammon has almost 500, 000 subscribers. He seems to be chicken little talking about what's going on, but you read the watch what he says and we're playing. And what he's saying is we're sitting on a house of cards.

The CPI is low home prices are artificially high demand goes away and supply is going to go up. Because people stop buying houses. Here in Silicon Valley, it's a little bit different. But if you look at this on a. On the US or a global example, house prices are falling in specific areas, places that are not economically sound, such as China, and little places like Memphis, Tennessee,.

Mobile Alabama or, I'm just saying different places. I don't know where we're seeing it, but there are places in the United States right now where you see a price home prices falling. We always have prices going up in certain areas and we always have prices going down in certain areas. Why is this important for you to know?

Mostly because you need to know what you're buying into. If you're going to buy a house right now, you buy it, not for the investment. You buy it because it makes sense for you, for your family, for your lifestyle right now. If you're going to buy a condo, a single-family, or a one-bedroom condo, you're buying a house, a condo, because that's where you want to live.

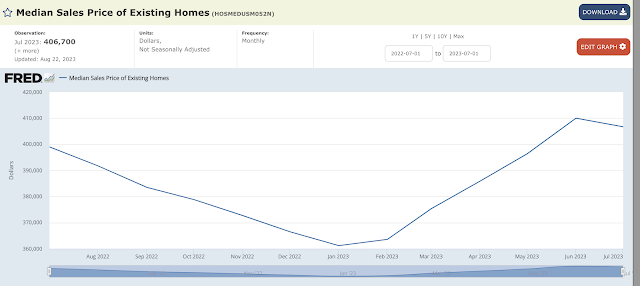

Convenience factor to your work, all that other stuff. Know that even if prices fall tomorrow, you're. Values will come back in years to come it's a cyclical thing and we consistently go up in price I want to pop to you the median price right now. We've seen a four hundred three a three thousand dollar Drop from June to July and it's probably going to go down a little bit more.

We'll find out more next week Maybe at the end of the week, we'll see, but we're at almost the high that we saw last year.

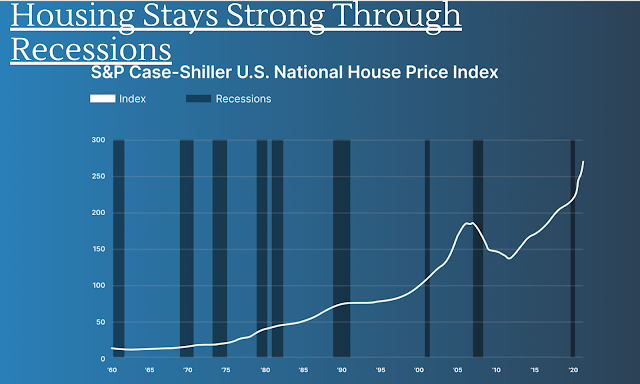

If you look at prices historically, where is that? Oh, I know where it is. I can show this to you real quick.

Probability of a Recession

Housing prices. There we go. See, look at that. See how resilient I am. They tend to go up over time, right? And right now we believe that we're artificially high because if you look at the strike, If you look at the line where that, so how low were prices go? I don't think we're going to see pre-pandemic prices in some areas.

You absolutely will. Don't think that we're not going to see prices bottom out here in different areas. We are going to see prices go down, but guys, we live in Silicon Valley, right? We have one of the strongest economies in the world. And yes, there are going to be places here in Silicon Valley that get hurt.

For example, Napa. Castro Valley, Contra Costa Marin, those areas, not Marin, yeah, you could say, Marin, you could say Sonoma, you could say there's, you don't know where it's going to hit, Monterey could get hit, Santa Cruz could get hit, it doesn't, but overall, on the average, prices are going to continue to go up.

Which is, when you look at the stories, it's a, it's grim, but it's not grim because we're going to have massive layoffs, probably not going to be here. There are going to be some layoffs here, but not to the extent that you see right across the nation. We're going to see massive layoffs coming here pretty quick.

Which is a full 5%. If you think about it, it could be another 5 percent of unemployment coming. What happened to those people that just bought a house and they get unemployed, they have to sell their house or they have to turn around and sell it. Just like the Airbnb people. We talked about that yesterday, and we'll talk about that a little bit more tomorrow.

There's a certain equilibrium to what people can afford to pay when they can pay it. When the market's going great everybody's making money and you have stock. The stock market is going crazy high and you have day traders making millions of dollars. That's great But when the market comes down you lose your ass and then the next thing, it's it drops So, how does that change?

I've been telling people for a very long time to hold off on buying houses If you have to buy right now buy right now, right? Divorce. You have to buy another house or you have to rent another place or whatever. You have to do it. If there's a death in the family and you need to down an empty nest, I understand.

It's actually a good time to sell. And I have always said this. It's actually better to sell your house and move when the market is down. Not for a few reasons. One, you don't have to pay me as much to you're not paying taxes or as high taxes. Because if you can buy a house at five hundred thousand dollars versus a million dollars That's a whole lot better in property taxes.

And two you have a lot more equity to gain over time Sure, you're going to lose money when you sell your house Money that really isn't yours until you actually sell the property. But let's say you have a house that's worth I don't know 1. 6 million dollars and the market collapses or contracts or crashes And it's worth 1.

3 now. So what? Yeah, it's a loss of three hundred thousand dollars, but that wasn't money in your pocket that was Air money until that gets cashed out and when you sell it gets cashed out and then you can convert it into another property or another investment or however, you want to use it.

So if you sell low, then you know, you can transfer that idea over to the next house you buy. And that means if your house is worth 600, 000 or your new house is worth 600, 000, you can drop it down to 500, 000. Everybody wins. It's just the part of the market that you're working in when you're in a hot market.

It's different because you're selling high, but then, you have to just take that extra money and throw it into the next house. And it happens over and over again. People just, I get it, but hubris takes over instead of logic. So smart people sell when it's right. If you can afford to hold on to two houses at the same time, maybe rent one out and then buy the next house.

There you go. But Vito, what about the houses that are at 3%? Again, it doesn't matter because if you don't have a job and you can't pay for that, you're going to walk away from it. Or you're going to, if it's an Airbnb, you're going to convert it into a long-term rental if you can afford it. But it would be foolhardy for you to take money out of your pocket every month and throw it into a rental.

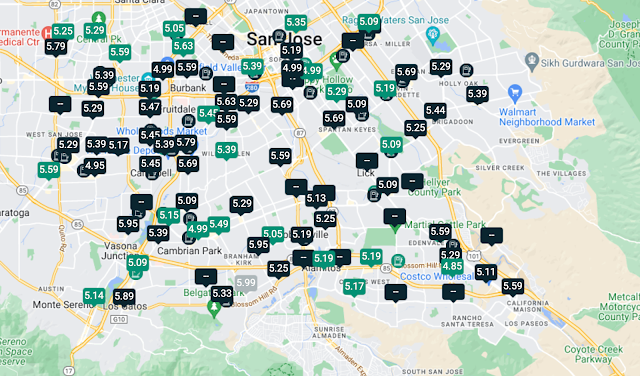

That's not the idea of being a landlord. The idea of being a landlord is so you get income from it, not have to make it an albatross. Just be careful about what you're doing. And talk it out if you have to if you want to talk it out and talk out a few different scenarios Give me a call and I'll be happy to work with you on that So again, these links are here for you so you can take a look at where we are Okay, mortgage rates again are still pretty high.

We're talking about eight percent. Somebody even said ten percent I don't think it's going to go that high but who knows we're talking about possibly eight percent in the next month or so Which would stop the market or slow the market considerably. This is slowing the market considerably as well. The lowest I saw was 4.

GAS

79, 4. 87. I didn't see it here today, but I can tell you at Safeway, right down the street at Villa Jokes, it's 4. 85. Crazy, right? I paid 5. 11 yesterday at Costco. If I had known, I would have gone to Safeway. It is what it is. All right, highs and lows. Look at this beautiful rolling hills road These are not my listings By the way If you need to have these listings or take a look at these listings the MLS numbers Are in the blog and they're in most of the platforms that I put them on

this one sold for 96. 4 percent of the original. This price took 13 days to sell. It's four bedrooms, five and a half baths, 5, 600, 5, 465 square feet and 2. 2 acres built in 2009 let's take a look at this beauty. This thing's gorgeous. The only thing that scares me about this is to take a look at the drone shot.

When it looks at the vineyard, this is gorgeous. Just look at that view worth it. My mom used to say it's a million-dollar view, but now it's like a 10-million view. That's just the way it is. Everything about this is opulent, pure luxury. Old Italian Tuscany style with a little bit of Asian flair with that bottle there.

This is the kind of house that I would imagine a mansion would be like this is just gorgeous. Everything is just pure rich and feels nice. They're ready to move there. You can tell they're ready to move their wine is gone yeah, let's get this over here so you can see that let's go over to the vineyard real quick. Look at that view as beautiful. So This doesn't show the picture as much. Let's back it up a little bit. You can see that all of this dirt around here was built out. So it was almost like they built out a pyramid of dirt.

And unless this house has piers that go all the way down to bedrock, a couple hundred feet down, a bad earthquake could shake that up pretty well. Unless it was compacted or engineered correctly. That's something to be aware of. So anyway, that's my only negative of that thing for 7. 7 million dollars Gilroy, this is 62 and a half years or older Complex This development is a nice senior community that Has a pool clubhouse nice home home pretty standard.

So low is the lowest price sold in Santa Clara county and it's Kind of a ringer because you should put an asterisk next to this because This is a retirement community. So it really falls out of the purview of that. But let's see How much is the hoa? 253 guys. This is awesome. That's an awesome prize for somebody who's retired

Okay, the highest sales price to list price ratio is Hammond's A in Saratoga. Seven days to sell. Listed at 2.8, sold for $4 million, 141.3%, three bedroom, two and a half bath, 21.44 square feet. It's smaller than my house, a quarter acre, built in 1964. The only difference between that house and my except for on the two stories.

This is Saratoga, period. That's the only reason why. They did a fantastic job marketing this thing. Guys, when you sell your house, you want to understand marketing. Staging is a huge part of it, but it's marketing. It's position and placement. And price is all you have to remember, right? There are five P's in marketing, but this house is completely redone.

It was remodeled over time. Manicured, and maintained. It's a beautiful home and it's worth 4 million. All right. The lowest list price to sales price ratio, which came in at 83. 2 percent was in San Jose's four seasons court, right next to, let's say on one. Yeah,

East side, San Jose took 418 days to sell. Why

hubris, ego. My house is worth 1. 8 million because the house is down the street, which is half a mile further away from the freeway. So for 1. 8 million, okay let's talk about what your value is. What's designed obsolescence. When you look at a house that's right next to the freeway, I don't care if you're a quarter mile away or right next to it, boarded up on it, people would rather spend more money on a house here than here.

They would rather spend more money over here. And if you look at it when we look at Houses to comp out. We look at a one-mile radius. If you're looking at houses over here and they're selling for 1. 8 million and your house is right next to the freeway, your house is not going to sell for 1. 8 million.

I don't care what you think. So this agent bought what we call the listing. They bought the listing, the over-promised and under-delivered price placement, right? All that others, the five P's. Positioning promotion.

So three bedrooms, two and a half baths, 1, 668 square feet, 5, 000 square feet. It's a standard home built in 1984, 400. It took over a year to sell because the seller said my house was worth this. And the agent reluctantly agreed. They just wanted the listing. They finally got it. They finally convinced the seller to lower the price.

I don't know if I can see, I can't really see on this version. But that's where you get deals, right? But understand this is 1. 5. This is worth 300, 000 less than the house that sold half a mile away. Even over here, people will pay more for it because you don't hear. The freeway

enough said

I know I went long with the whole Grim market thing guys understand that Silicon Valley is resilient. We're strong Yes, there's going to be houses that lose money lose value. It happens what you have to remember is anything on the west side of 17 or 880 tends to do a lot better than the houses that That are situated on the east side of 880, but we're still going to come back.

We're still going to come back strong. Blossom Valley over the last dip, April from April 22 to now, we saw a dip of 250, 000. And now we're right back up. We're probably 60, 70, 000 on average from the peak, but we're coming back. The entire Bay area is coming back. The Bay area is resilient and don't be afraid to buy.

When we see a collapse in value or contraction in value, it will come back. We can go into, Mad Max World where it goes into Armageddon and that's totally different. But at the same time, that's probably not going to happen. We need to have a reset. Warren Buffett knows.

We need to have a reset. So we'll come back. We'll come back stronger. We'll come back better and we'll come back richer. So look at buying a house. Now we'll look at buying a house later. If you're looking at buying your first house, now's the time to do it. And tomorrow we'll talk more about first-time buyer programs.

All right. I'm Beto with Avatano. We'll see you out there.

http://blog.abitano.com/2023/09/live-days-away-from-real-estate-crash.html

https://podcasters.spotify.com/pod/show/siliconvalleyliving/episodes/LIVE--Days-away-from-a-Real-Estate-Crash--How-Low-will-prices-GO-e29gtvf

real estate news, stock market, Silicon Valley real estate, real estate crash, Bond yields, Wealthion, Airbnb, Blackstone real estate, MLS listings, Zillow, redfin, Santa Clara homes for sale, MLS listings san Jose, AI

Comments

Post a Comment