🚨 RATES at 7.51% !!! Days away from a Real Estate Crash? How Low will prices GO?

🚨 RATES at 7.51% !!! Days away from a Real Estate Crash? How Low will prices GO?

- Hi's and Lows

- RE/MAX Settles Claims in Compensation Lawsuits

- Video on settlement https://fb.watch/nctthbMBPz/

- Warren Buffett: "A Storm is Brewing" in the Real Estate Market https://www.youtube.com/watch?v=Jq_6RKHJIIA

- RE/MAX makes $55 million deal to settle commission lawsuits https://www.nar.realtor/magazine/real-estate-news/remax-settles-claims-in-compensation-lawsuits

- AirBnBust Update: "Zero Reasons" For Optimism

- HOME SEARCH

- TITLE THEFT IS ON THE RISE WHAT IS IT, HOW DO YOU PROTECT YOURSELF AND WIRE FRAUD http://blog.abitano.com/2023/08/title...

Good morning. Had to miss yesterday, but that's okay. Not a whole lot going on as far as everything else is concerned. No hockey stick things to realize. But today we're talking about three things you need to know about real estate in Silicon Valley. Today we're talking about REMAX settling with compensation lawsuits.

RE/MAX makes $55 million deal to settle commission lawsuits

I'm sure you've seen it. If you know anything about what's going on in real estate right now. We have a little bit of video on it. Warren Buffett says a storm is brewing and yeah. And then we'll talk about rates. Let's get moving. All right. Just real quick rates at 7. 5. One. I think this is going to stall the market a little bit, which is good.

We need to stall the market. We still have headstrong buyers entering into the market. However, I see houses sitting a little bit longer on the market.

It's nothing to worry about just yet, but I just need you to be aware of it because really what's happening is the numbers that we're talking about are incremental right now. We're not in a full-fledged recession or contraction. It's just, I think this is where we're at the precipice of the market.

Chilling out a little bit, slowing down. We're seeing inventory go up a little bit, but not enough to really mention anything to worry about. As a matter of fact, I did the numbers yesterday. I just didn't record it. So you can see we're still really healthy as far as the volume of the number is down, but that's because there are fewer listings.

How's this? They're still selling. As a matter of fact, if you look at these numbers, 74 percent of the houses that closed last. week, the last seven days closed over the list price. That's healthy. Who was inverted where we had 60, 70 percent of the houses going under market. Then it's a little something to worry about.

Gas is still crazy high. It's going to continue to get higher. I think until next year, once we start the political election cycle along with this, and I think this is just remnants of what's going on.

Hi's and LowsQuickly, let's talk about highs and lows. So if you look, Foley made it twice. It's the lowest list price to sales price, and the lowest list price to sales price ratio, by 109%. Which isn't actually that, it was actually... Let's see that real quick. Oh, poop. Actually, no, it sold over the list price. Yeah, so let's do this real quick for all photos.

So Foley, a standard little house, looks like it's a single garage. Standard bungalow slash ranch, with nothing fancy to it. This is in, it's

right by the freeway, right by 101.

The problem is it was right by a freeway. So that close to the freeway, you're going to hear the freeway, right? Let's see, it's the most affordable three-bedroom, single-family house in the heart of San Jose for 850, 000. Isn't that crazy? Let's take a look at the next one. The highest list price ratio is a little backward.

This is Martell, 148%, 48 percent list price. Purposely thought though, this is probably homes that are selling in this area, which is Campbell. No. Where is this? 17. Yeah, this is Campbell, Crestmont area houses are selling for about one and a half million. So when you put it on the market for 1 million, you're going to get a lot of houses.

You're going to get a lot of them. Offers you're going to get a lot of buyers coming through but the true matter is that's where the market sits That's where the market sits and that's where it's going to sell. I mean look it's not a Fantastic mansion or anything. It's just a standard row house ranch maintained house that looks like they painted it before they did it They did some updating new floors new lights new paint new kitchen.

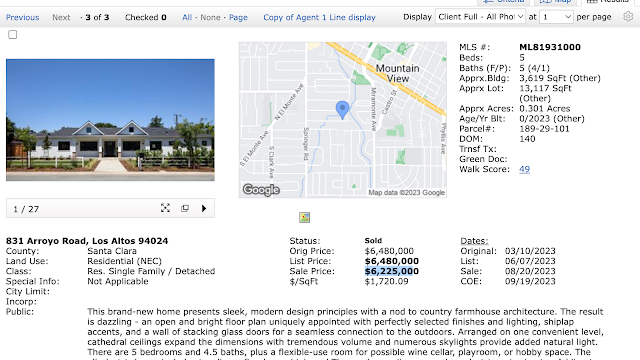

This might be a fix Flipper too. And then the highest sales price was in Los Altos, a Royal road. Nice, beautiful ranch house. This thing is 3, 600 square feet on a third of an acre, has five bedrooms, and four and a half baths took 148 days to sell. And 96%, 96 percent is where it came in after the original list price.

The original list price was 6. 5 sold for 6. 2, 140 days to sell. And this is in Los Altos. Where things are. And if you think about life as an epicenter or the real estate market as an epicenter, you'll see this area right here is the epicenter. I've mentioned this a few times, right? This is the epicenter of the real estate market.

This is where the VC money is. This is where people who have a ton of money throw their money. They live here. They are VC venture capital startups, and they have. They work for LinkedIn. They're very high-paid jobs. Million-plus salaries are pretty standard here unless you're retired and you got into it luckily.

So if you look at it as you go out, more affordable housing happens the further out you go. Livermore, Pleasanton Tracy Gilroy, Watsonville, Santa Cruz, even though Santa Cruz right now, you're looking at about a one-and-a-half million dollar house for a standard house. So anyway, it's a beautiful house.

Look at this thing. Just gorgeous,

impeccably updated, just like that last ranch house. We're just talking about location now, right? And size, this is a lot larger. It's probably three times larger, three times larger than a kitchen.

Everything's tastefully decorated. That was like a 600, 000 lamp right there. The staging's done well. You have a friendly little office, a walk-in shower, and a nice tub. Walking closet stuff. You're not really afforded when you're on a smaller ranch. That's 1100 square feet. It's a laundry room,

not much to say about the backyard there, but there it is. And, with six million for a house in Los Altos, you're giving up something. And I can tell you for certain that what you're giving up is the yard, because most of this house is, most of this property is built out. So when you look at houses that sell in Palo Alto, you're looking anywhere from four for an original house all the way up to 16, So it's a very well-priced house for Los Altos in Santa Clara.

So there you go. Okay. Let's talk about Remax Settles. Compensation claim. Now everybody knows that real estate commissions are negotiable. When you have experience, you know that you're, you can ask for more, right? I tend to not ask for a ton. I try to be where I try to work with people. I understand that there's, it's a lot, but I also know that I have pride in my workmanship and I have my experience and I'm a negotiating.

Pitbull. And when it comes to marketing, I've been doing this for, 20 years. So I tend to not fully discount myself. I do work with,, my clients. I add a massive amount of value to my clients. On top of that, traditionally what we've always done is you pay me say 6 percent, and then I give the other agent, the buyer's agent, half of that money.

There's a lawsuit saying that's, Not fair for the sellers to be overcharged or what have you and what's happening is it's going deeper and deeper into The seller feels like they're getting ripped off what's gonna happen though And if this takes root is if you buy a house And you use an agent, doesn't matter if soliciting agent or a buyer's representative agent or an exclusive buyer's agent, you're going to have to come out of pocket to pay them commission or some kind of fee to make it worth their while to represent you good or bad.

It's changed. I'm completely okay with the change, right? Cause if you're going to work with me, I'm going to get paid one way or another. The problem is on the financing side. I can just roll it into the financing. You can, but you can't.

Lenders can't do that just yet. It hasn't been allowed yet. So there's a lot of gray area as to how people are going to be compensated, how you're going to compensate me if I represent you as a buyer's agent. So be careful what's going on. I typically do not use, I typically do not work with people that don't work with a buyer broker agreement with me, meaning I'm going to be compensated for the work that I do.

As a buyer, period. I don't really go back and forth. I don't play. I'm, I work hard for you. I get the deal done. I make sure that we do it and make it as smooth a transaction as possible. But what's going to happen is Remax laid down on their belly and said, okay, I just don't want to go through the thing.

We're just going to settle out and 70 percent of this 55 And the people that were inside this class action lawsuit are going to get 0. 25 on the dollar of this 55, 000, 000. Hundreds and thousands of people do it, so expect to get back maybe 400, 000 or 500, 000. Good for you, right? Class action lawsuits are horrible.

I would never participate in them. Didn't know before that I did, but apparently, I've given, I've given a couple hundred dollars for a class action lawsuit. What am I supposed to do? It's a waste of time and energy everybody's fault. If there's going to come out, what's going to happen is we're going to come out with a new disclosure because lawsuits beget disclosures,

lawsuits. We get revelations right now, before you sign anything with a real estate agent, you have to sign a disclosure of agency and an SPSA or some kind of new agency to tell you that there are three different types of agency. And sometimes within the agency, there might be some internal chattering about the best deal and there might be some, whatever, but it's all to the benefit of the seller.

That's the way it is a buyer. There's a buyer's agent, a dual agent, and a seller's agent. A dual agent represents both the buyer and seller and you're absolutely allowed to do that in California. I tend to hate doing that. It just intermingles things and confuses things, but at the same time it's allowed and a lot of people do that.

So if you take a discount broker, typically what they'll do is they'll push offers off unethically and they will wait until they find a buyer and represent both the buyer and the seller. Is that the best trade? Is that a best trade practice for a real estate agent? No, gives us a bad name, and it. dupes the seller into thinking that they got the best deal possible where you don't know if you don't, because you don't, as many offers on the table as possible.

So it's something you have to be aware of. You have to be really careful with what you're doing. That's part and parcel of why I do these videos I want to educate you to let you know how to work with real estate agents. You might not decide to work with me, hurts my feelings, but whatever.

At the end of the day, Educate yourself on all the processes, right? Everybody says, Oh, it's so easy to sell real estate until the market gets hard. Now that the market's hard, we're still doing really well. We just had a closing this week, right? So don't think that we're not doing business. We are continuously doing business and we've been around a long time.

And my agents and the team are consistently getting out of business. We're doing the right thing. And sometimes. If it's a detriment to our clients, we come out of pocket, out of our commission to make sure things smooth over. That's how things work. If you discount us, don't expect us to dig deeper into our pocket to help smooth things over when things go awry.

And oftentimes it's not our fault. 90 percent of the time, I'm not perfect, I make mistakes, but 90 percent of the problems that happen that I smooth out are not my problem, I make it go away with my commission because I can and I do, and I'm a professional and that's what we do, right? So be careful what you're looking for in this.

Is it a good thing? It is what it is. I don't have a problem with buyers paying their agents a fee. I don't have a problem with new agents coming in and saying, you just give me 2, 000 and I'll do it. I know that there are inexperienced agents that are dying to do business, right? The problem is you have inexperience there.

When you have somebody that's been in business for 20 years, the business, the contracts, the negotiation tactics, the market, you talk about the market every day. So there's that difference. And some people buy a Corolla, My son has a Corolla and some people buy Mercedes.

There's a different level of service that is expected of you as a consumer. That's it. So be aware of what's going on. There's another video right here. This is more from the lender to the agent mindset. It's there's a link down below in the copy and the content. and understand that mindset a little bit just to be educated.

And then there's another. Our buddy Warren Buffett and his buddy are talking about what's going on in the market. And it's really about the commercial market starting to dwindle. I'm watching right now. I'm not going to buy commercial strip malls, which actually is a great opportunity for people because that business will come back.

I'm looking at apartments all across the United States and I'm looking to buy apartments right now. If you're interested in learning about that, please let me know. I'd be happy to work with you on this, but they're saying that there's a tide of commercial property that is losing value by the trillions.

And we're seeing what's happening is the rates the mortgages that The loans that are put on commercial property are temporary. They're five-year interest-only typically, and they're bought by REITs or real estate investment trusts or syndications or some other investment corporation.

And they put in 200, 000, 2 million, 20 million, depending on the size of the commercial property. And then they take that as their down payment. People jump in as a down payment provider for this REIT or the service. And they go in and. Get a commercial loan. These commercial loans are only good for five years and they're based on, again, that we did the 2%, 3%, 4%.

When they make good, now we're looking at seven and a half percent. I'm quoting myself. When I do my research, I'm quoting 8 percent because I don't know where we're at. When I look at the numbers, I'm looking at the income and the value and the potential rent and all the other costs, the property tax insurance, and all this other stuff.

It's coming down to where that market is going to stall. And that's what he's talking about right here. This might be a trigger to the House of Cards. Ooh, come on, load me, boy. There you go. The house of cards that we talk about here every week. That's commercial real estate, right? And it was 1. 1 back a year ago when we put this slide together.

AirBnBust Update: "Zero Reasons" For OptimismNow it's 1. 4 trillions of dollars are going to be lost in commercial real estate. Be on the lookout for that. Why does it matter? Because it could be a tipping point to the entire economy you have to be aware of it. Airbnb, if the economy tot tipples, that means people are going to become unemployed.

Fewer people are going to travel and fewer people when they travel, they don't travel. It's going to hurt Airbnb. That means they have the potential to turn those into long-term rentals and sell them right now before the market contracts. which would push the supply in or they move into them or they let them go back to the banks.

So those are the options that are happening. So there you go. Those are your three things for living in real estate and in Silicon Valley for real estate and living in Silicon Valley. I'm Vito Scardecchio with Abitano. We'll see you out there.

Comments

Post a Comment