🔴[LIVE] Is Housing UNHEALTHY?

- Sales volume over 25000!

- Bel Air estate with ties to Sackler scion sells

- Fraud on the rise

- Fall in Airbnb Listings Revenues Sparks Housing Market

- Why Airbnb owners are about to Sell

- Homebuyer Workshop https://event.webinarjam.com/register/6/8oz4kcg

Pod https://podcasters.spotify.com/pod/show/siliconvalleyliving/episodes/LIVE-Is-Housing-UNHEALTHY-e296dh1

X https://twitter.com/VitoScarnecchia/status/1701255482030293095?s=20

Listen to "🔴[LIVE] Is Housing UNHEALTHY?" by Silicon Valley Living. https://t.co/Fxiy1DsrJF

— Vito@Abitano (@VitoScarnecchia) September 11, 2023

Three things we have to talk about, living in Silicon Valley real estate.

Let's get started. Today we're talking about: TITLE THEFT is on the rise. I keep talking about this because actually, I have a little story for you. I'm going to talk about this towards the end. Just stay tuned. AIRBNB could be a trigger to our Real Estate market collapsing, not us. We have a home buyer's workshop coming up and Sackler if you know Scion - The drug addiction. Gurus. They sold a property down in LA and it made the news. So we'll talk about that too. Let's get started.

Bel Air estate with ties to Sackler Scion sells

I did some searching on this. And it's true. This Dolcetto investment group is tied to the Sackler family. Sacklers is the family who created Scion and they're the ones who are in Netflix. They did that six-part series with Ferris Bueller guy.

This has two pieces to it. Shame on the Sackler family for preying on that addictive compound. But two Luxury real estate is slowing considerably. And that might be one sign of what's going on in our market. This is going to be tied all over now.

There are mega, mega-millionaire billionaires that will never ever feel any kind of. Problem with any kind of recession. That's not the problem.

But there are markets and company owners and hedge fund owners that might not do well in this recession. This is where you could take advantage of it. Now, are you going to buy a $17 million house? No, but I did some research.

I thought this was it, but it was actually sold in 1998 for $5 million. But they. 2018. They did buy it for 2 to 22.5 million. The Dolcetto LLC. And then they sold it. Just this last month and August for $17 million. So they took a big hit. Mostly because they probably not doing well financially. Sackler. Insider trading. I don't know. Just a little piece of information you should know.

Homebuyer Workshop

home buyer workshop. This is free to look at. Come and take a look at it. There's another one that'll be popping up here pretty quick.

But it talks about if you're in the market to buy a house. If you've done it one time, if you've never done it before, if you've done it 100 times, this will give you kind of a refresher as to where we are right now.

Fall in Airbnb Listings Revenues Sparks Housing Market

Airbnb, I keep picking on Airbnb and I keep finding articles on Airbnb. And the reason why is I think it could be a tipping point to a crash in the market. Now, is the market going to crash down to 50% or $0.50 on the dollar? Probably not, especially in the Silicon Valley.

Probably won't see anything crazy like that. Maybe on the east side where, there are more blue-collar workers and if they get unemployed, then they'll have to sell their house. We don't have a ton of Airbnbs here, maybe around downtown, maybe or around, you know, Levi Stadium. But I don't think we have a huge supply of AIRBNBs here in Santa Clara County.

Where we're seeing it, though, is in different areas, such as, you know, travel areas like Lake Havasu, Fort Collins, Phoenix, Arizona, Colorado, place destination, places for people to go and spend some time together with the family. And that's really the demographic that people buy or rent Airbnb.

Keep an eye on Phoenix, because some people seem to think that. That might be. That's one of the canaries that we're keeping an eye on, right? We look at Las Vegas, we look at Saint Louis, we look at Tampa. We look at. D.C.. New York, San Francisco, Las Vegas. Did I say that? And obviously Phoenix. It's one of the canaries that we're looking at for this market to possibly be an indicator of the trigger of a possible crash. Right. Now the last couple. Tomorrow we'll talk about loan volumes why they're down and how more and more people are seeing unemployment. More people are using their credit cards to make ends meet and that's dangerous. A little bit.

Why Airbnb Owners Are About to Sell

That's Phoenix. Scottsdale. Remember a few months ago when I talked about this? And the whole idea behind it was when you have an oversupply and demand stays steady, prices need to fall. And when you overpay for a property or a business asset and all of a sudden that business asset gets saturated with competition and the demand stays constant, that means supply goes up, supply goes up, demand stays the same, and prices fall. And that's things that we're talking about. That's why we're looking at possibilities, right? There's a ton of gurus out there that talk about Airbnb and how you can make $1 billion and la la la la la. Um, I've always been kind of hesitant about buying into the Airbnb gig because. It just seemed like everybody wanted to do it. Now what's going to happen?

Prices will fall and then equalize or find an equilibrium of prices. But a lot of people who are Airbnb hosts right now will exit that market and either go long-term rent their houses or their properties to long-term renters or sell them. And when they sell it, they put more properties on the market. And there you go. So. Other things that.

You have to look out for it on Airbnb. I'm not saying it's not a bad deal for you if you're still thinking about doing it. I'm just saying be very cautious and be very aware of it. What you do. Where you do, and how much you pay for that property.

Because even though interest rates are still sky high, a majority of properties are still being snatched up pretty quickly, which, you know, goes against affordability. And this real deal, the real deal.com is a great place to check this stuff out. Okay, enough of that. I know I keep beating up on Airbnb and I apologize.

Fraud on the rise

One of my friends from high school and the client came to me the other day, and said, I have a friend that I think maybe she watched this, this, you know, my video and I appreciate this. She knows of an elder who had four properties and somebody either a housekeeper or a caretaker or somebody that's a licensed real estate agent came in and preyed on them. You know, this is all supposition.

This isn't exactly what's happening. Right. But we'll find out more later on. So I did some research on it and found out a little bit more about who owns the property, introduced them to lawyers, and got them all this. And guys, it's happening. It's happening.

Check on your parents and. If you. If you're quasi-suspicious, let me know. I'm happy to help you out with this. I just did a quick title search on your house. Send it to you. Don't bother you again. That's it, right? I'm happy to help you out with this because it's important to know about it and know what processes to take care of in case it happens.

If you do anything today, sit there for 5 or 10 minutes and learn about title theft. It's happening and it's on the rise. And it's I mean, it's it's everywhere and it's it's prevailing.

People people are preying on elders and it's got to be aware of it. All right. So if you want to know, send me an email, or DM me. I'm happy to do the research for you. I'm not going to charge you for it and It'll help protect you and your parents and your loved ones and your family and friends,

I'm here to help. And this is something that we have to do together.

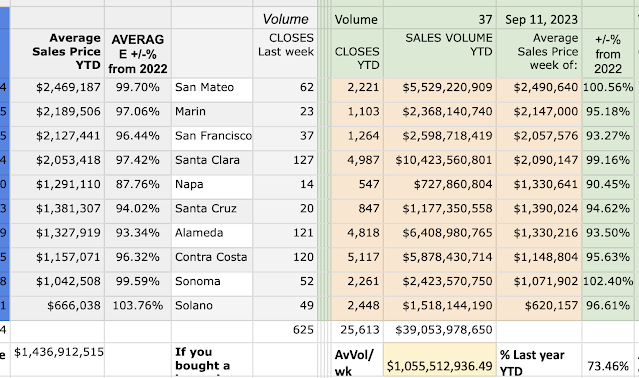

Sales volume over 25000!

Okay. Let's take a look at the numbers. We have over 25,000 units sold so far this year, and we're on the 37th week. It's crazy. We're averaging $1 billion of sales every week, every week. We're averaging $1 billion in sales every week.

The 10 Bay Area Counties sold 625 single-family homes this last week.

These are just single-family homes. I'm not including Monterey because it's a little further out. But everything that every county pretty much touches except for Santa Cruz, that touches the Bay Area, the bay. The bay is added to this. Just so you can take a look at what's going on now. These are the weekly numbers, right? $39 billion.

That sales volume year to date. Crazy. I guess that's. Over $1 billion a week.

That's really healthy, right? Last year, our sales volume was 1.4 billion. This year. 30% or 60% of that. 66% ish. No 73%. I'm wrong, but we're still very healthy. We're catching up as far as last year's peak pricing. Average pricing. Right. So we're seeing numbers just. We're seeing numbers grow and that's awesome.

So I'm really happy to see this happen. Nothing too crazy out of the realm. San Mateo again is healthy. San Mateo has some luxury properties, but there are still a lot of higher-end houses that are out there. And for an average house, you're going to pay a lot more $2.5 million for an average house in San Mateo. Then you are even in Santa Clara. Right. So even though they sold 62 homes versus 127. They sell for more, mostly because that's where the VC money is. That's where high-tech money is.

That's where a lot of old money is. And average homes cost a lot more over there than they do here in Santa Clara, even in San Francisco. And it's still a healthy market. Santa Clara is still a very, very healthy market. Mostly because we have a lot of high-end engineers working and making a lot of money. It makes it very affordable, unaffordable for the rest of us. Only 16% of California residents can afford to buy a house where they live. 16%. So it's like one out of eight, right? So that's it.

Is the housing market unhealthy? I don't think it is here in the Bay Area. I think it is in other parts of the world. And there are certain trigger points that you have to be aware of. And that's why I do this every day. So you can see where we are, what we're doing and. Strategically what you can do if you want to buy or sell a house here in Santa Clara County or elsewhere. All right. Three things you need to know in Silicon Valley. I'm Vito Scarnecchia with Abitano. We'll see you out there.

Short

25000 Single Family homes Sold to date.

#fyp #best time of the year to #buyrealestate , #housingmarketcrash #prediction , #housingmarket projections, #Should I Buy A House Now Or Wait?, #should I buy a house now or wait until 2023, #Why You'll Regret Buying A House in 2023, Housing Market 2023: 5 Options If You Regret Buying a Home #SanMateo , #Marin, #SanFrancisco , #SantaClara , #Napa , #SantaCruz , #Alameda , #ContraCosta , #Sonoma , #Solano

#best time of the year to buy a house, #next housing crash prediction, #housing market projections, #Should I Buy A House Now Or Wait?, #should I buy a house now or wait until 2023, #Why You'll Regret Buying A House in 2023, Housing Market 2023: 5 Options If You Regret Buying a Home San Mateo, Marin, San Francisco, Santa Clara, Napa, Santa Cruz, Alameda, Contra Costa, Sonoma, Solano

25000 Single Family homes Sold to date.

Comments

Post a Comment