🚨 🔴🎧 Fall in Airbnb Listings Revenues Sparks Housing . 🦅 🌎 ⚓️

- Homes for sale NEAR APPLE CAMPUS

- AirBnBust Update: "Zero Reasons" For Optimism | Amy Nixon

- The Airbnb Crash Is A Bigger Problem Than Think

- 🚨 🔴🎧 Fall in Airbnb Listings Revenues Sparks Housing State of the Market SAN JOSE 40DOM. 🦅 🌎 ⚓️

- #REWTF of the Week

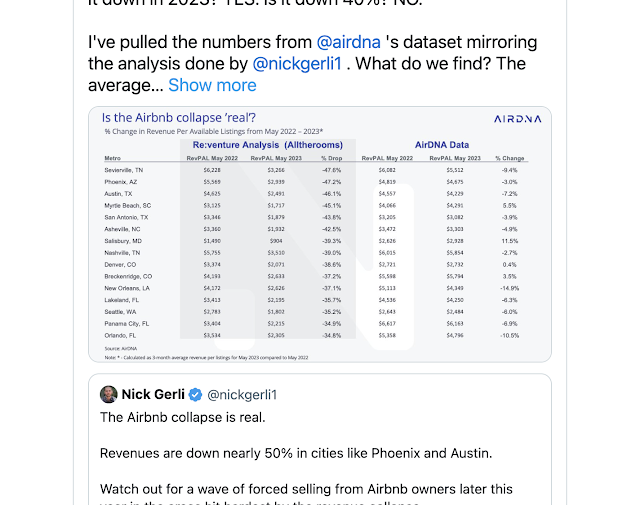

- Curbed Airbnb

- https://www.curbed.com/2023/09/airbnb...

Today, we're talking about three things you need to know. Airbnb style. Today, all we're talking about is Airbnb. There's a bunch of articles. So there are three things you need to know about Airbnb. If you're thinking about buying or investing or making that your arbitrage or side gig or side hustle, Airbnb might not be the castle you can.

Dig your moat around. Let's get into this. We're also talking about San Jose real estate's 40 days on the market report, which is just the basic numbers on what's going on. All right, so let's get into this. I'm reading a ton of articles here and that all kind of fall into the whole idea of what the hell's going on with Airbnb.

The Airbnb Crash Is A Bigger Problem Than Think

why is it such a big problem? There's a couple of things, right? And we'll get into it a little bit more as we describe what's going on. There are hundreds of gurus on Facebook advertising or TikTok or wherever. And they're, Still telling you that buying Airbnb or Airbnb arbitrage or Airbnb is a great little side hustle you can make a ton of money on.

Yeah, it is. It absolutely is. If it's not passive though, it's not passive, you just can't passively Airbnb, it's just, that it doesn't work that way. You have to be a hotelier of sorts for it to make sense for you to do this cost-effectively. Now, what's going on is everybody's buying into lots of people are buying into the whole idea of creating my next, legacy through Airbnb, which granted you're allowed to write.

Who am I to tell you what to do? I just rather play this one a little bit more conservatively and be more like Chicken Little and tell you that the sky could fall. Will it fall? I don't know. Don't listen. But look, these are signs. And you can read into the science. These are facts. These are things that are coming in.

AirBnBust Update: "Zero Reasons" For Optimism | Amy Nixon

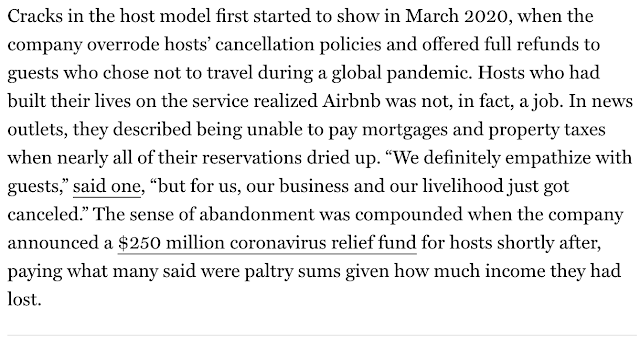

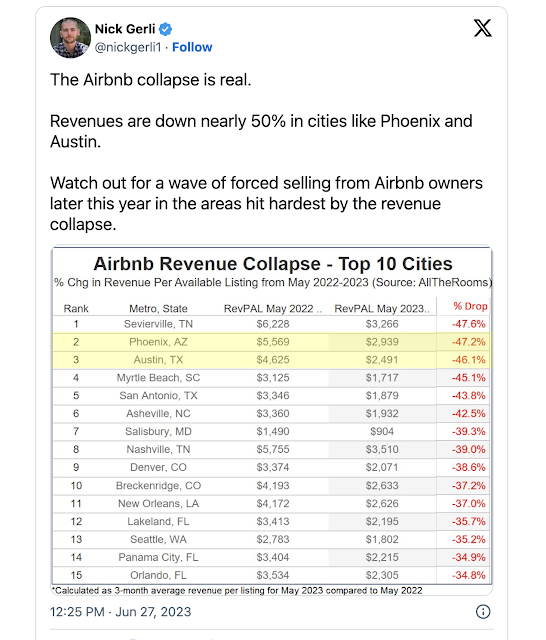

Yesterday we talked about this a little bit, or the day before we talked about this a little bit. Certain areas are falling in revenue. What does that mean to you? If you're thinking about, or you own an Airbnb supply and demand, right? And I don't know if this one has it or not.

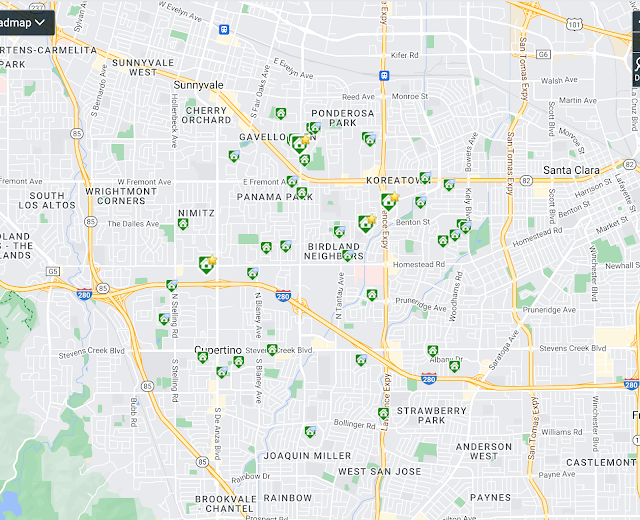

There's a heat set, right? A saturation map tells you that there are so many units available in a certain area. And look, there's a natural equilibrium in every market. Doesn't matter if you're in gold, in computers, in earphones, whatever, or in short-term rental, Airbnb, or V R B O.

The problem is that these numbers here have been oversupplied, and when there's oversupply, that means a few things. Your unit will stay empty for 50% of the time, or your revenues will go down 50% or about. Based on what the market demands or commands. When we were in the COVID lockdown, you couldn't travel outside of the United States.

You were pretty much locked in here, but you could travel so you could go to Sedona, you can go to Phoenix, you can go to Cape Coral, you can go all over the place, which we did, right? We were still locked down here in California and I took my family to Cape Coral, Fort Myers, last year of the year before.

And what we noticed is And there are a lot of Airbnb, and we don't Airbnb, we do VRBO, it's the same thing, right?

There's this oversaturation of that. So during the lockdown, it made sense. You can go and travel yourself from San Jose to Florida or to Georgia or wherever, and spend a day or a couple of weeks at somebody else's place. Totally makes sense. Now everybody's locked opening up travel is going to outside the United States and we're more outside of the United States than in time inside than was before and These places are hurting not hurting, but they're just seeing a lower growth of Revenue, right

Now, on top of that, New York and other big metropolitan areas are cracking down on Airbnb because every metropolitan area has a government and every government wants their little vague. They want their peace. And there's they're coming back and saying, no, you need to do this. You need to charge more money and we need to regulate it.

We need to be habitable. And mostly because there's probably a hotel lobby saying, Hey, this is not fair to us. They're taking money away from us. Who's licensed we follow all the rules and these people don't have to do that. Curbed if you look through Curbed, you're going to see an article about Airbnb every week, every month, right?

So they're always talking about what's going on with Airbnb and there's positives and negatives to it. I'm personally not a fan of Airbnb and I'll tell you because they don't treat their hosts right. They charge excessively high and their fees are excessively high and some loopholes screw over the hosts.

And I don't, I'm not a big fan of that. And just like Uber, the wall streets coming down on them saying you need to show more revenue, you need to show more revenue, which means the hosts have to pay. And the hosts have to pay. That means the guests have to pay. And then it just becomes a nonfun thing. Can you travel with your dog?

In your pets. Yes. Other hotels cater to pets. I've always felt that going to a hotel is just a better thing for me. It's clean. I don't know if it's cleaner but mostly it feels cleaner. There are more amenities right at my beck and call. Yes, it's more expensive, but you're paying for the convenience.

Again, nothing against Airbnb or VRBO. We use them when we go on big family vacations and we want to have a house and a pool to ourselves, right? Cause we have teenagers and teenagers like to sleep until noon on their vacation, which is whatever, I get it. I guess I was a teenager a while ago. So this guy goes through it as well.

I would suggest if you want to listen to this guy, the link is in the, in all my platforms and all the content, he makes a pretty good argument for what's going on. Now will Airbnb crash the real estate market? It could be a catalyst. Absolutely. It could be the spark that lit the fuse that lit the cannon that started the collapse.

Curbed Airbnb https://www.curbed.com/2023/09/airbnb-host-meltdown-new-york-september-regulations.html

It absolutely could be, but it won't. It's not going to be the reason why. We have an economic crash or a real estate crash. It could, again, it could trigger it, but it's one of those things that are, it's part of a domino that could come into a lot of different things. So let's quickly go into

my little house of cards. Let me find it real quick and explain it to you. And I hadn't had this, I didn't have this plan. I just want to bring this over here. Remember tipping points. We are looking at all of this, right? We see an automotive tipping point right now. We have the automotive union. Strike they want to be paid more money I get it.

I get it But what's that's going to what that's going to do is it's going to force the manufacturers to push more manufacturing offshore It's because of inflation. I understand that I'm not against or for Unions, I know that they have a purpose. I belong to unions I actually belong to the second largest.

The largest union in the United States, which is the National Association of Realtors, is not a big fan of them either. And if you see the last couple of episodes, you'll see why energy's getting crazy expensive. Commercial real estate is losing billions of dollars in value every day. I think this is going to be the black hole.

That is ignited by whatever chain reaction we see that's where I'm seeing it right now health care is there. It's just overburdening. I think we have to go through a lot of reform and change their credit cards We're all maxed out as Americans Because we're either overpaying or we have to feed our families.

We understand right that could be a tipping point I don't think it is right now. And I think this won't be a catalyst. I think Airbnb could be a catalyst for the housing market that would tip everything else out. But honestly, I think where we're going to see the big vacuum rip is here and the automotive, but that's where I've been saying automotive since 2008.

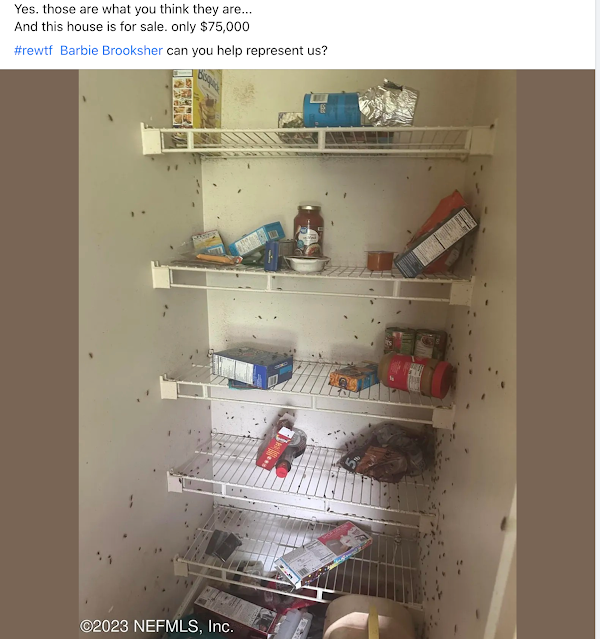

Okay, let's see. REWTF of the week. Let me expand on that for you. That is a clean-out. That's not my listing. That's in Jacksonville. And those are, yeah. They are what you think they are.

Homes for sale NEAR APPLE CAMPUS

Alright let's see. Quick daily. These are homes in Apple. You can get a nice little excuse me, two bedroom, two baths, 1200 square foot condo for a mere 939, 000. Isn't that awesome? Isn't that just amazing? Holy cow. Norwalk drive. It's a little further away.

It's only 850, 000 and you get three bedrooms, three baths,

another condo, 1. 2, two bedrooms, three baths, probably two half baths upstairs, downstairs. We'll see. Albany. I sold one in Albany. Wow.

All right. Let's see these list price decreases. You're going to, we're going to start seeing a whole lot more of these mostly because rates are still continuing to go up less affordable and people are seeing layoffs on the horizon, which means they're less likely to buy property. However, if you look at the pendings from last week, our pendings are actually up or equalizing at 74.

We had 65 closings last week. We have 500 houses, single-family homes over. 40 days on the market. Those are the properties that you want to find to make offers on the ones that are 90 days on the market probably have something wrong with them, structurally overpriced location, or the seller's just not willing to bend.

So not saying not to go for those, but take a look at that. If you're going to buy a house, that's where you'll find your deals. Because 73%. Where is it? Where's my number?

76 points net 77 percent of the houses that sold last week. So for an over-list price, that's a normal thing. Look at this over the last couple of weeks, we're averaging about 76, 77%. Don't believe me. Take a look, right? Look at all these. That was last week. 127, 134, 107, 53 out of the 65 that sold. So for an over-list price one, as opposed to last year, not a whole lot.

We already saw the contraction coming in. The max was 117, but that was an outlier. Because if you look at those numbers here and you have to stare really close, most of them are 100 to 103, if not below. Okay. And cancellations are still standard. TFT is back on the market. That's pretty nominal. Nothing's out of the ordinary.

So we're still seeing things go average. The average Soul price went up. We're at 1. 7 last year 2000 no, that was that last year San Jose single-family homes topped around 1. 9 Million. So we're still about 200, 000 away from where we should be.

And the median price is 1. 5. We're still in a healthy market here. Just keep an eye out for what's going on outside. We live in a little vacuum and that's understood. That's just the way things are. All right. Tomorrow we're talking about inventory Airbnb, probably we'll see. I'm Vito with Abitano. We'll see you out there.

Links\

http://blog.abitano.com/2023/09/fall-in-airbnb-listings-revenues-sparks.html

Fraud on the rise http://blog.abitano.com/2023/08/title...

- Financial Intelligence https://bit.ly/AbitanoHomeValuation

- https://bit.ly/AbitanoHomeValuation

- NAR.Realtor Stats. https://www.nar.realtor/research-and-...

- https://www.onereal.com/vito-scarnecc...

- Campbell, San Jose, Silicon Valley, retirement, empty nest, Financial Intelligence, Best Realtor Santa Clara County, Google Jobs, apple careers, Apple Jobs, meta jobs, Hewlett Packard, Oracle, Intel, Cisco, Facebook, Broadcom, Adobe, eBay, Willow Glen's five most expensive homes Willow Glen's five most expensive homes

Comments

Post a Comment