🔴[LIVE] Sales Volume Still DOWN- Values Holding Steady NAR President Kenny Parcell Steps Down

- Sales volume over 26000!

- Parcell Resigns; Kasper Vows Urgent Change at NAR

- Fraud on the rise

- Fall in Airbnb Listings Revenues Sparks Housing Market

- Why Airbnb Owners Are About to Sell

- Home buyers course

Homebuyer Workshop

https://event.webinarjam.com/register/6/8oz4kcg

http://blog.abitano.com/

https://www.onereal.com/vito-scarnecchia-1

Some photos source: https://blog.reventure.app/blog/airbnb-owners-are-being-forced-to-sell/

Three things you need to know. Hang on a second. Hi.

Here we go. Three things you need to know. Silicon Valley, real estate. Here we go. Kenny Persall, NAR president, National Association of Realtors, president steps down to Airbnb. It's starting to fail. I've been talking about it for a while now. And Homebuyers Workshop. All right, let's get going into this real quick.

Parcell Resigns; Kasper Vows Urgent Change at NAR

Kenny Purcell, a president of the National Association of Realtors. He resigns. There are a lot of sexual harassment claims and other corruption happening at the highest levels of one of the largest lobbyists, and lobbyist associations in the country, second to the National Association of Rifles, National Rifle NRA.

If you don't know anything about the politics behind it, I tend to stay away, mostly because it's one of those things where I just don't deal with politics. I think there's a lot of corruption, a lot of backhandedness, and a lot of stuff. And this just tends to prove the point, right? I try to stay away from it as long, arm's length as much as possible.

And the reason why I'm bringing this up isn't to shame this person because nobody's perfect. I understand. And I'm not protecting him at all. This has been news for a couple of weeks. If you haven't noticed, I missed last week mostly because I took a shingle shot that knocked me down, I'm still grilling from it.

Anyway, the problem is that NAR is a union and I'm not against unions at all. I think it's one of the strongest things that keeps this economy afloat. Especially what's going on in the automotive industry right now. You need to have unions to help with negotiation, right? As long as you don't protect the ones that stay out or that venture out of the purview of values that the union comes up with.

We pride ourselves on integrity and ethics. Every year we have to have an ethics class. And then this guy turns around and allegedly harasses people and it's a toxic thing. And I understand it's a simple thing when you're in a position of power. We have that in the military. We have that in multiple unions.

We have that in politics. We have that in the government going on all the time. Sexual harassment, power plays, toxic leadership. It needs to stop. It needs to be nipped in the bud right now. The reason why it's important to us especially now that we're coming into a recession, you're going to see our numbers dwindle.

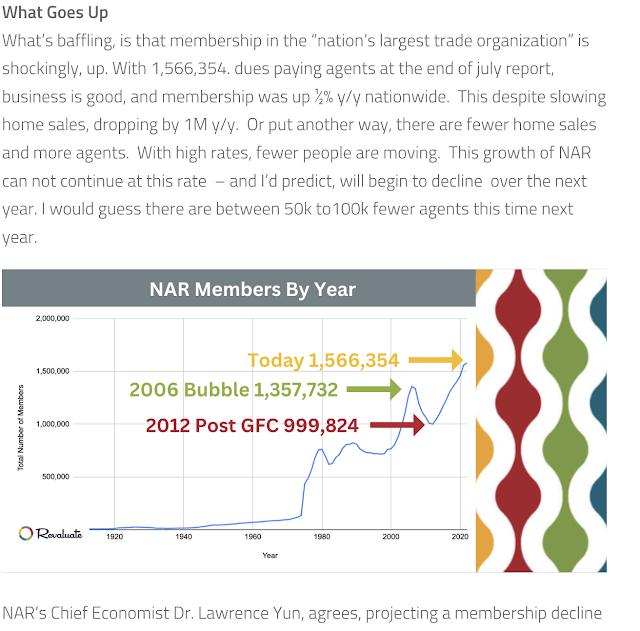

We've already lost 60, 000 Realtors, which is only 3 percent of the entire United States thing population of Realtors. We're expected to lose another. 60, 000. And the reason why this is important for you to know is because perhaps your aunt Emma might be time for her to retire. Or those people that you happen to know who just got into it might not be financially stable enough to stick around.

So just keep an eye on them, make sure that they're doing okay. If they decide to take on, that three-letter word called a J O B, I understand it's not for everyone. I've been doing this for almost 20 years now. It's tough. There are good times and bad times and you have to put away for the tough times.

We're going to see our numbers dwindle. It's normal when a recession happens, when times get tough, people in real estate tend to bail out and it's not a bad thing. It's not a, it's not a good thing. It's just, it is what it is, right? So

when you have, an associate, the way the NAR works is its power comes from its people, right? And one of the things that I tend to always do. Lambast on Realtors is it becomes an easy thing for other people in different industries to come into because it's simple. I just sent out a post today that 20 years ago, I remember two things from two questions from my question, my, my exam, I was the second guy out.

I passed. I didn't pass a second time. I didn't fail. I was the second guy out, not saying anything about that because the test was simple. All you have to do is apply yourself, practice it, and you'll pass it. And to my daughter, it's just like your driver's license test. You apply yourself, take the math, and the practice exams, and you'll be prepared for it.

You understand the material. The period does not prepare you to be a real estate agent. It doesn't teach you. It teaches you ethics, but it doesn't teach you ethics. It doesn't teach you. It teaches. It teaches you Marketing, but it doesn't teach you marketing. It doesn't teach you all the things you need to know to be successful in real estate it tells you the mechanics of real estate, not how to be successful in real estate, how to have a long life, long-lived career in real estate.

And that's what's sad about the exams. That's California. I can't speak to other states cause I've never taken those tests. What do I know? But there you go. Their power is in growing their population. Their power is in collecting dues, and I wanna say, look right here. 15% over a year, the next couple of years, $156 per year, plus a $45 marketing fee.

Advertising collects $315 million in dues every year. And some would say that it's not. I'm not in it. I don't know the day-to-day, I don't know what's going on with it. But I do know that a lot of that money goes towards lobbying. Keeping regulations done and supposedly policing our own. And here's the problem from the top up and the bottom down.

We have to do better. We have to do better for our clients. We have to do better for the industry. We have to do better. We just have to do better, period. And doing something like this, while it might seem like a negative thing, it's actually a positive thing because it's a step in the right direction.

Enough said.

Fall in Airbnb Listings Revenues Sparks Housing Market

Airbnb talked about this last week or the week before it's going to be a problem. You're going to see, and I understand that in Florida and other destination places, Airbnb's hosts have given up a lot of Aaron, a lot of Airbnb hosts have given up a lot and given out. A lot of revenue. And the problem with this is there are so many gurus still on the fricking advertising wagon trail swearing up and down.

You can retire from your job and be an Airbnb host. It's not as easy as you think. A couple of things. Their fees have gone up considerably. I talk about this. I went sailing a couple of weeks ago and I talked about this for about 20 minutes. Airbnb. It's a great concept. And it started off with Y Combinator and I'm a massive fan of Y Combinator and startup companies.

They set out to disrupt the industry. And that's great. But here's the thing. VRBO was already around for 20, or 30 years before that. And they came in and now they're the Wall Street darling. It was the Wall Street Darling for a long time. Now that things are changing, they need to show a profit.

They're still not showing a profit or maybe they're showing a small profit, but they're increasing their fees. It's costly for you to rent an Airbnb unit. It doesn't matter if it's a house, an apartment whatever. It's expensive because you have to do the nightly. The nightly fee, but there's also a cleaning fee and then you have to spend 20 minutes to 45 minutes cleaning up, getting things up ready for the host to come in and clean up, whether they bring in a professional cleaner or whatever, that's up to them.

On top of that, there's a little loophole within the system that you can stay the entire time and then you call up Airbnb and say, I wasn't satisfied and they'll pull that revenue and give it back to the guest and the host winds up losing revenue and they lose possible. Revenue for paying for that house, that unit, that condo, that apartment is devastating.

A lot of people, and there's not a lot of people talking about that right now. Is it a huge population of Airbnb hosts? No, it's probably five or 10 percent of people getting a little frustrated right now, but it's happening. You're going to see a lot of it. Destination places like. Phoenix, and Scottsdale Florida, are places where people go, they want to stay at a house.

That's great. I don't see it as a positive. The last thing I'm going to talk about is oversaturation. I told you before that there are Airbnb gurus out there training people how to become hosts, right? One, you pay 10, 000. 500, a thousand bucks to learn how to take a course on how to become a host.

And then you go through their system and become a whole, you buy a place and then you decorate it and you're spending all this money and you base it on a specific revenue that is supposed to come in. Now, when you have. You have way more supply than you have demand. You have units sitting empty, which hurts the Airbnb host.

It doesn't hurt Airbnb one bit. They don't care. Airbnb started off where if you were leaving on vacation and you want for 10 days, 15 days, you want to rent out your house. You can make some money off of, letting people stay at your house. Not something I want to do. So naturally it evolved into this thing where you can buy a unit.

Decorate it and make it your little pet project or your side hustle. And people have made millions of dollars doing that. There's nothing wrong with that. However, when you're in a place, it's a destination and there's oversupply. You buy a house at a certain price point. And then you pay for it and you have monthly costs on that.

And if you're not making those monthly costs, you're pulling money out of your wallet every month to make that unit flow. And it's not a side hustle anymore. It becomes an albatross. And that's when we're going to see a lot of people come through and sell their units. Is this an opportunity for us? Yes, but it's not what you think it is.

The amount of homes that are out there right now is negligible. It's I understand it's 40, 000 units that are out there. Actually a million Airbnb units on beer, BRBO. But let's just say that 5 percent of that goes, that's 50, 000 units that go away. That's not going to start anything. Let's say it's 20%.

That's well, it's 200, 000 across the United States. It's not going to do anything in a specific location. It might hurt like Cape Coral, Fort Myers, not pointing that out, Neil, just saying that's just one thing that came up in my head. Their revenues have dropped. Now this isn't across the board.

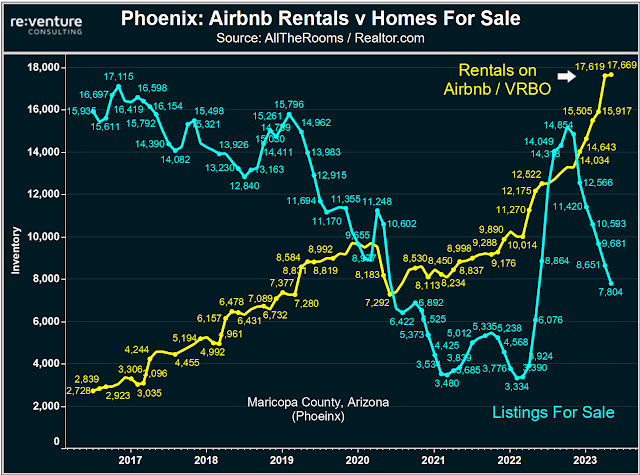

This is in certain areas, right? You buy in a certain area, Phoenix, Arizona, 48 percent drop, right? Let's see, Fort Collins, San Antonio, Texas, Seattle, Washington. These are all destination areas. They've seen a massive drop in revenue that's going to hurt people overall

supply ratio right here. This is where you need to be and it's oversupply. Oh, here we go. Let me break this down here again. See,

okay. The Phoenix, Arizona, 48 percent drop. And revenue for Collins, Colorado, 43 percent top San Antonio, Gulfport, Mississippi, and Phoenix, Arizona. So what are these people to do? This is the supply versus demand, right? This is the assumption, right? It ebbs and flows. This line isn't really straight, but if you're up here, you have two and a half times the supply for the demand units sitting empty.

Or you have to lower your price.

That's Phoenix, Scottsdale, Phoenix, Scottsdale Tempe. It's oversaturated. That's the point that I'm trying to make. So if you're thinking about buying an Airbnb, I suggest you do a little bit more research. All right. Vacant units are surging. Here's that demand line that we were talking about.

Why Airbnb Owners Are About to Sell

And those numbers are up back when this is just Nashville. Again, these are all just Metro areas, right? You can't, you have to look at it specifically to different things, right? Vacant houses for rent. Wow. Found in my monthly calculations, these are vacant houses for rent. Those could be corporations that buy into the property.

They just rather rent it or leave it vacant and rent it out.

And it doesn't mean that different areas are doing or performing. Either I mean we have different areas that are doing well. So the bottom line is just be careful, right? I'm, not going to tell you not to I'm just going to tell you to be careful about buying into that lastly I said homebuyer workshop guys.

Homebuyer Workshop

https://event.webinarjam.com/register/6/8oz4kcg

We're getting a lot of people buying into this. This is great. This is an awesome little project that we did together. Scott Hill and I did a quick workshop. It's free. I don't call you bug you. If you want to take it and not use me, that's great. If you want to use me, that's great. I'm not here to tell you not to do anything, but if you're in the mode to buy a house.

Consider getting educated as soon as you can to buy a house, right? There are a lot of different facets I always say there are 742 different things that happen in a home-buying transaction There are a lot of things and use a sherpa use somebody who's been around for a while. So sign up for it. It's free Again, I won't bug you.

I'm here to answer questions and educate you. One last thing, beautiful day, October 7th and 8th. I'm doing Latimer, but 20 different projects are out there. 18, 19 different projects that are out there. Get involved in your community.

Sales volume over 26000!

Numbers by the numbers. We're at over 26, 000 units over the last year.

That's volume is down, right? We're supposed to be, as far as the numbers are concerned, I still need to actually do the numbers of units, but I can tell you. Average closes per week. We saw 916 in 2022. That was 2022 after we peaked in April, four months into the month, into the year. We're down to 774 on average.

Anyway, we have 694 versus 916. So we're a third of where we should be. Volume price-wise, we're at 73%. This is probably 70 percent as well. But look at the numbers are still staying strong. Now this is from a high right here. If you look at the average, I calculate this out from the average sales price, which is 2.

4 to 2. 4 over here. And that's where we are right now. Now. If you look at the average price year to date, we're still a little bit below, but it doesn't matter because we're coming back strong. The numbers are holding still. You don't see a ton. As a matter of fact, 67 percent of homes that are sold. I'm going to show that in the Thursday edition, we go 67 percent goes over the list price.

Now it could be like 1 percent over list price all the way up to 40 percent list of over list price. But we do have a third, a full third of houses that sit on the market over price for the condition, location, and market conditions. So there's a lot of opportunities to still buy. Are we looking at a crash?

Some people say yes, and some people say no, I'm not going to speculate. I think we're in for a long haul of mediocre sales increases over the next four years, five years. That's just my thought. Is a crystal ball. No nobody can tell the future, right? We can go into World War Three, China collapses, and all sorts of different things can happen.

I see all these reports all the time. I talked to economists. I see a lot of economists, podcasts, and videos of what's going on across the country, and across the world. And there's a lot of turmoil that's happening, but is it something that's going to crash the market? I don't know. I have the automotive industry going.

And going on strike, we have China slowing down its economy. We have shipping slowing down. We have multiple currencies losing their value. We have oil prices going sky-high. So I don't know. There are a lot of things that are in the rule thing. You can't buy for today. You have to buy for 5 to 10 years from now, right?

That's how it's always been. It's always been like that in the Silicon Valley. I'm still looking at buying property outside of California. And there's a lot of great deals that are happening out there. So if you have any questions, you want to run it by me. I actually have an appointment this week with a past client of mine.

And we're, it's just something that we're doing, right? We're getting ready to prepare for the next decade. The next 10 years. And that's the way you have to look at it. All right. I'm Vito with Abitano. We'll see you out there.

🔴[LIVE] 🚨 Junk Fees? Just say no!

#best time of the year to buy a house, next housing crash prediction, housing market projections, Should I Buy A House Now Or Wait?, should I buy a house now or wait until 2023, Why You'll Regret Buying A House in 2023, Housing Market 2023: 5 Options If You Regret Buying a Home San Mateo, Marin, San Francisco, Santa Clara, Napa, Santa Cruz, Alameda, Contra Costa, Sonoma, Solano

Comments

Post a Comment